Click here for full report and disclosures

â Consumers are back: After a record plunge in economic activity in March and April, consumers are driving the rebound across much of Europe more than expected. Taking advantage of the early reopening of shops, German consumers opened their wallets like never before in May. The 13.9% mom surge in June that propelled German retail sales to 3.6% above their pre-pandemic level of February 2020 may well be an outlier. Germany is supporting its citizens more genereously than most other countries. But even in France, which started to ease lockdowns later, consumer spending rebounded in May to just 7.2% below the February level after a 32% shortfall in April.

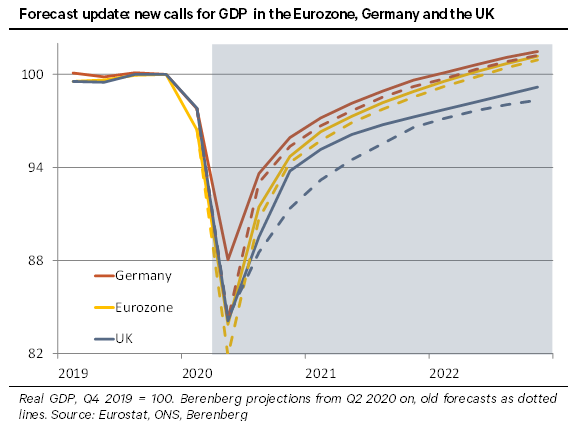

â Eurozone update – a less dramatic plunge in Q2: Two weeks ago, we raised our US GDP forecasts significantly for 2020 after a historic 17.7% mom surge in US retail sales in May. In the wake of the French and German data for May, we now raise our calls for Germany and, to a lesser extent, for other euro members and the Eurozone as a whole. For real GDP in Q2 2020, we now pencil in a plunge by 13% instead of 15.1% for the Eurozone and by 10% instead of 13.9% for Germany. As more of the rebound from the April trough is already happening in May and June, and thus in Q2, the qoq gain in Q3 will look less impressive than expected before. For Q3, we now look for a gain of 9.0% instead of 10.8% for the Eurozone and of 6.3% instead of 10.5% for Germany. Together with some smaller adjustments, this takes our annual GDP calls for the Eurozone from -9% to -8.2% for 2020 and from 6.9% to 6.6% for 2021. For Germany, we now project a contraction in real GDP of 6.2% instead of 7.4% in 2020, and a gain of 4.9% instead of 5.9% for 2021.

â UK forecasts: The stronger-than-expected start to the rebound in the Eurozone bodes well for the UK. In addition, UK and EU negotiators are making progress in the ongoing negotiations about their future relationship – containing the tail-risk of a disorderly hard exit from the Single Market at the end of 2020. Despite some small flare-ups, which can be controlled with local measures, the UK is continuing to contain the pandemic as it reopens its economy. Aggressive fiscal and monetary policies continue to support the recovery in confidence, investment and spending. We now expect real GDP to contract by 8.5% in 2020 from 9.0% previously, with a stronger rebound in H2 2020 (Q3 now +6.4% qoq from +5.0% and Q4 now 4.7% qoq from +3.2%). In 2021, we expect real GDP to expand by 5.5% versus 5% previously. In 2020, we project that growth will slow to 2.2% instead of 3.0%.

â Tick-shaped recovery: The changes leave our big-picture call intact. After an unprecedented plunge in activity in March and April, we look for a tick-shaped recovery with a rapid, but not V-shaped start in May and June that flattens off over time. For most of the Eurozone except structurally handicapped Italy, GDP should be back to its late-2019 level roughly two years after the trough. Due to Brexit, the UK may get there slightly later. While business investment, consumer spending on durable goods and exports will likely trail the overall recovery in real GDP, more government spending will fill the gap. For our calls, we assume that the advanced world is learning to live with the virus and will be able to contain new outbreaks with targeted regional measures that are far less disruptive than the previous national lockdowns. The current surge in new infections in the South and West of the US illustrates the key risk to our calls.

â For details of our new calls, see Forecasts at a Glance.

Holger Schmieding

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

Florian Hense

European Economist

+4420 3207 7859

florian.hense@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659