Click here for full report and disclosures

â Worsening outbreak raises recession fears: Equities sold off sharply this week on rising fears of an economic downturn triggered by the increasing risk that parts of the European continent may have to go into a partial shutdown to contain the spread of COVID-19. Economists cannot predict the severity and duration of the potential medical emergency ahead. But we can assess the ability of the economy to recover once the worst is over. Even in case of a big hit to economic output in the near term that extends beyond just one quarter, the economic logic does not point to a protracted downturn. A sustained bear market in equities still seems unlikely, in our view.

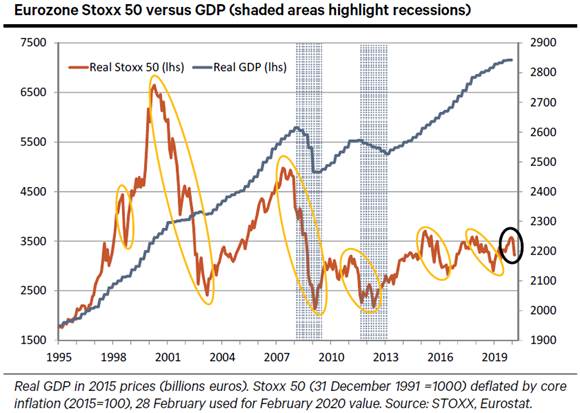

â The lesson of history: Are corrections in equity markets a good predictor of recessions? Not usually. Financial markets are prone to sharp swings in sentiment and herd behaviour as they react to risks that emerge and fade. This is normal. As our chart shows, two of the six drops in the Eurostoxx 50 of 20% of more since 1995 (not including the current correction) coincided with or foreshadowed a recession in the Eurozone (2007/8 and 2011/12).

â Remember the fundamentals: Faced with an acute and highly disruptive shock, we must ask the following question: is the global economy primed for a downturn? The answer is no. There are situations when it only takes a trigger to topple a vulnerable economy. For instance, the US real estate correction that started in 2007 was the pin that pricked an unsustainable subprime debt bubble – a misguided policy reaction to Lehman turned it into a genuine disaster. Today, the world is far less vulnerable to such an outcome. We see no serious excesses in the advanced world that could require a cleansing recession. As long as policymakers help to ease the pain of any temporary disruptions, economic activity and confidence should gradually recover once the virus is contained.

â Practical implications: The tentative evidence out of east Asia suggests that, if the breakout in Europe worsens, it could take authorities around three weeks to contain the virus once temporary measures such as travel limitations and the closure of schools, factories, etc, are taken, while suppliers of essentials like medicine and food continue to operate. Such measures will need to remain in place for a few weeks even after the virus is contained. For companies that need a full year of revenues to make profit or break even, the prospect of more than a month of lost revenue while they continue to pay out wages and other such costs is a serious problem. Even healthy firms will come under temporary pressure due to a drop in demand and disruptions to supply chains.

â The role of policymakers: Neither central banks nor governments have the tools to fully offset the potential costs from COVID-19. The best response remains quickly to bring the epidemic under control – even if that entails a big short-term cost – to pave the way for a rebound thereafter. Beyond extra spending on healthcare and the like and letting automatic fiscal stabilisers do their job, the following policy responses could also help markets and economies weather the worst: 1) liquidity injections into markets to contain a financial panic; 2) cheap loans for firms suffering temporary cash-flow problems; and 3) fiscal subsidies to firms to prevent layoffs along the lines of the German Kurzarbeitergeld scheme.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659