Click here for full report and disclosures

â Virus hits Europe: With the worsening spread of the coronavirus, governments are rightly imposing ever tighter restrictions on economic activity in ever more European countries. The extreme uncertainty about the medical outlook and, to a lesser extent, the sell-off in equity markets exacerbate the big fall in confidence. Against this backdrop, the improving news out of China where the number of active COVID-19 cases has fallen by more than two-thirds from its peak of 58k on 18 February to 15k on 12 March is no consolation. The domestic disruptions in Europe, severely affecting many services even more so than manufacturing, overshadow the likely easing of original supply-chain disruptions linked to China.

â Tough months ahead: As European citizens and governments take steps to slow the spread of the virus, including a partial shutdown of the whole of Italy, retail and services activity is tanking badly even as spending rises in some sub-sectors such as healthcare and supermarkets. Global demand for, and the supply of, manufactured goods will likely slump through the whole of spring as the pandemic-related disruptions take a toll on major parts of the global economy. This will badly hurt trade-orientated Europe. Other countries may have to follow the Italian lockdown example at least to some extent with a lag of a week or two weeks. This will take a heavy near-term toll on activity.

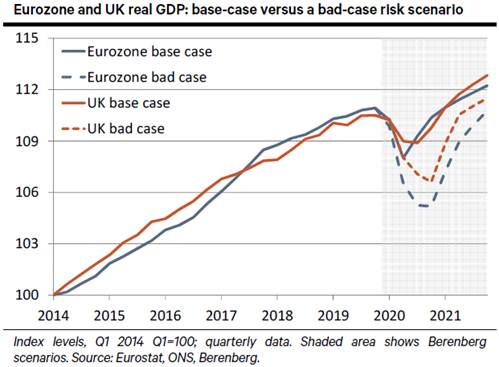

â Base case – the worst is over by June: We expect a broad-based sharp decline in output in March that will likely worsen in April and May as authorities take ever more restrictive steps to contain the spread of COVID-19. As our base case, we now assume drops in quarterly GDP by 2.0% qoq in the Eurozone and by 1.1% in the UK. The recovery could begin in June as the spread of the virus slows down and a surge in government spending enables health systems to cope better than before. But even with a rebound in H2 2020, annual GDP for the year as a whole would decline by 1% in the Eurozone and 0.7% in the UK. Previously, we had expected -0.1% yoy for the Eurozone and 0.9% yoy for the UK as our base case. From such a low level, GDP could rebound by 2.0% in the Eurozone and by 2.3% in the UK in 2021. This is our base case.

â Bad case – the worst is over only by the end of 2020: In a tail-risk bad-case scenario, a further spread of the virus and severe restrictions on normal activities would prolong the recession through the second half of 2020 before a rebound starts in early 2021 – see chart. That scenario would entail a 3.5% contraction in 2020 GDP in the Eurozone and a 2.0% fall for the UK before a solid rebound in 2021. The rebound would carry on with above-trend gains in GDP from a still low level in 2022. Ultimately, however, the impact of COVID-19 will be temporary. Increasingly, policymakers are showing that they are ready to do what it takes to avoid a 2008/09-style scenario. The bigger the near-term hit, the stronger the rebound thereafter from a very low level. Even a bad-case scenario would not warrant a permanently lower valuation for equities anywhere close to what markets are currently pricing in. Unfortunately, even the huge monetary, fiscal and regulatory policy response on the way across the western world is no obvious circuit breaker in a medical emergency. We need more clarity about the course of the pandemic first.

Chief Economist

+44 20 3207 7889

holger.schmieding@berenberg.com

Senior Economist

+44 20 3465 2672

kallum.pickering@berenberg.com

European Economist

+4420 3207 7859

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659