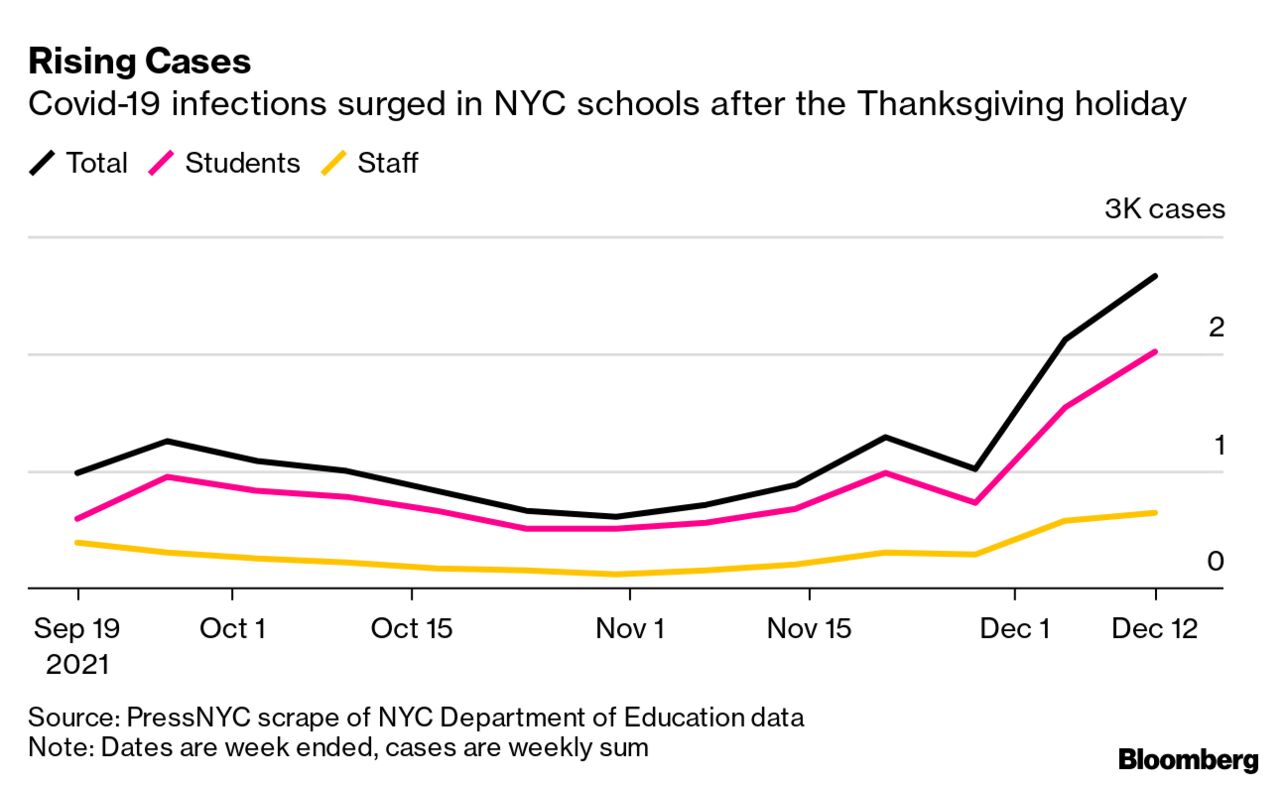

| It’s looking like chances that the holiday season would be different from last year are fading. Though booster vaccinations are still seen as a bulwark against serious illness from the latest mutation of the coronavirus, fears of an unprecedented wave continue to grow along with the global rate of infection, which now matches the height of the summer delta wave. The U.K., which has been overwhelmed by the new omicron strain, is seen as a harbinger of things to come everywhere else. On Thursday, France said it will ban tourists and almost all business travelers from Britain in a bid to slow the spread. The plan comes after the U.K. recorded its highest number of new cases since the beginning of the crisis. Here’s the latest on the pandemic. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. New York City appears to be no match for the convergence of the delta and omicron variants, despite some of the toughest Covid-19 restrictions and highest vaccination rates in the U.S. Indeed, it’s looking a bit like 2020 again. “We’ve never seen this before in NYC,” Jay Varma, public health adviser to Mayor Bill de Blasio, said Thursday on social media. “Test positivity doubling in three days.” Citadel, Blackstone and Millennium Management are among asset managers telling staff this week that they may once again work remotely. Citigroup is doing something similar. China Fortune Land Development said it’s been unable to get a hold of a money manager it gave $313 million to invest, yet another blow to the debt-laden developer. Fortune said it has “lost contact” with China Create Capital. Fired employees often want nothing more to do with their old job, but high earners in the U.K. should rethink that. For one JPMorgan trader in London, winning a court ruling that he should be rehired following a 2020 dismissal means millions of pounds of back pay. Bank of England Governor Andrew Bailey said an outlook for “more persistent” inflation was behind a surprise decision to raise interest rates for the first time in three years. “We’ve seen evidence of a very tight labor market and we’re seeing more persistent inflation pressures,” Bailey told BBC News on Thursday.  Andrew Bailey Photographer: Hollie Adams/Bloomberg U.S. Senator Joe Manchin, who along with fellow Democrat Kyrsten Sinema has been scooping up Republican cash as he finds new ways to block President Joe Biden’s economic agenda, may have forced the party to push consideration of the $2 trillion bill to next year. Senate Democrats are instead turning to a voting rights bill they see as critical to preserving American democracy, given the nationwide push by Republicans to restrict voting access and place GOP appointees in charge of election agencies. But again, Manchin and Sinema may stand in the way of their own party. Betting on flashy names like Shawn “Jay-Z” Carter, Shaquille O’Neal and Martha Stewart to boost blank-check companies this year left investors mostly in the red. Just about the nicest thing you could say about celebrity-backed special-purchase acquisition companies and the firms they brought public is that they’ve lost less for investors than benchmarks for the whole SPAC category. After that, things get ugly.  Shaquille O'Neal Photographer: David Paul Morris Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Get the latest on what’s moving markets in Asia. Sign up to get the rundown of the five things people in markets are talking about each morning, Hong Kong time. |