CPI Inflation in September ticks up to 13-year high

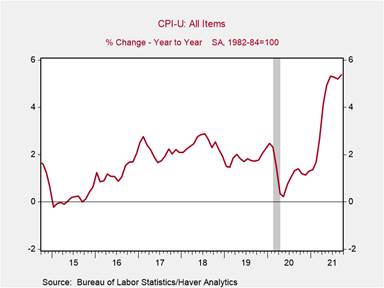

* The U.S. Consumer Price Index (CPI) increased by 0.4% m/m in September, lifting the yr/yr increase to 5.4%, its highest level since Aug 2008 (Chart 1). Increases in food and energy prices, which rose 0.9% and 1.4% m/m, contributed significantly to the rise in headline inflation in September. Core CPI (which excludes the volatile food and energy components) rose a more moderate 0.2% m/m, and 4% yr/yr. The relatively small monthly increases in the CPI in last fourth months of 2020 will likely lead to further increases in yr/yr inflation even if the monthly increases stabilize at around 0.3%, as seen in the September data.

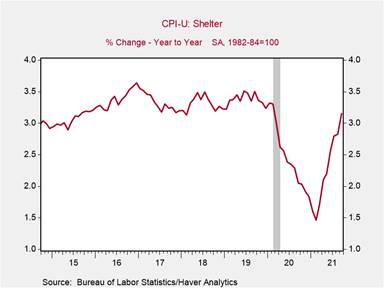

* Shelter costs which account for roughly one third of the CPI market basket have accelerated markedly, rising 0.4% m/m and 3.2% yr/yr, reflecting the surge in home prices during the pandemic and rising rental costs (Chart 2). Owner equivalent rent (OER) rose 0.4% m/m and 2.9% yr/yr, while rent of primary residences rose 0.5% m/m and 2.4% yr/yr. We expect the increase in shelter costs to continue through 2022 as lease renewals and higher home prices start to be reflected in the CPI. The Zillow rental cost index has accelerated to 11.5% yr/yr and the shelter component of the CPI will catch up.

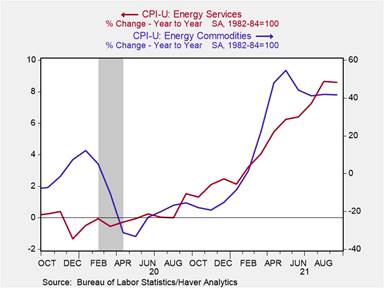

* Rising energy spot prices are affecting retail prices, with energy commodities prices rising 1.3%, and energy services prices rising 1.2%, its eighth consecutive monthly increase (Chart 3). Elevated natural gas and crude oil prices will exert further upwards pressure on headline CPI in the coming months, particularly if adverse winter weather spikes energy demand.

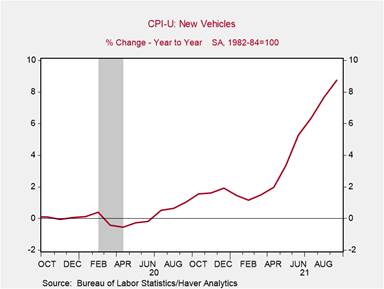

* Supply chain disruptions which were initially contained to certain sectors have broadened, with persistent delays across both production and transportation of goods. The semiconductor shortage continues to weigh on the auto-industry, the price of new vehicles rose 1.3%, the fifth consecutive monthly rise above 1%, while the yr/yr increase surged to 8.7% (Chart 4).

* The economy’s reopening spurt has raised consumer purchasing power and demand through rising employment, wages, and hours worked. Simultaneously, supply chain disruptions and bottlenecks have limited product supply, leading to broad based price pressures. Yr/yr prices have risen substantially across the major expenditure categories in the CPI: food (+4.6%), energy (+24.8%), apparel (+3.4%), transportation services (+4.4%), motor vehicle insurance (+4.8%), shelter (+3.2%). The argument that rising inflation is driven by specific sectors abnormally affected by the pandemic looks increasingly tenuous.

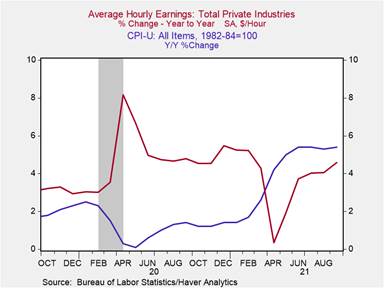

* CPI inflation has outpaced nominal wage growth, lowering real wages (Chart 5). Amid moderating payroll employment gains and widespread anecdotal and survey-based evidence of difficulties firms are experiencing sourcing labor, we expect nominal wage growth to catch up to the higher inflation and accelerate.

* Tomorrow’s PPI report for September will provide important information on production costs that have been accelerating. So far, businesses have had the flexibility to raise product prices in order to maintain margins. If aggregate demand growth remains solid, they will be able to continue to do so.

Chart 1: CPI All Items (year-over-year, %)

Chart 2: CPI Shelter (year-over-year, %)

Chart 3: CPI Energy Services & Energy Commodities (year-over-year, %)

Chart 4: CPI New Vehicles (year-over-year, %)

Chart 5: CPI yr/yr vs. Average Hourly Earnings yr/yr

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.