|

Latest Luxembourg News Corporate, Funds Promoters and Family office January 2020

Real Estate Tokenization

Real estate is the largest asset class in the world. Globally, in the professionally managed industry, the size of the total real estate market reached $8.9 trillion in 2018, up from $8.5 trillion in 2017. That being said, the industry still suffers from significant barriers to entry. New technology, specifically tokenization, can alleviate many problems that currently exist in the industry today. But what is tokenization? Tokenization is the process of converting an asset into a digital form that lives on a blockchain infrastructure. It can turn challenges that are seen in the industry into opportunities: -

Illiquid → Liquid: Real estate suffers from low liquidity because it is expensive for investors to buy and sell their stakes. Tokenization greatly improves processes and reduces the cost of liquidating shares. This encourages more trading on secondary markets. -

Fragmented → Connected: Today’s global real estate market revolves around many fragmented systems. Using the blockchain, market participants can access relevant information on a real-time basis, allowing for more informed and timely decisions.

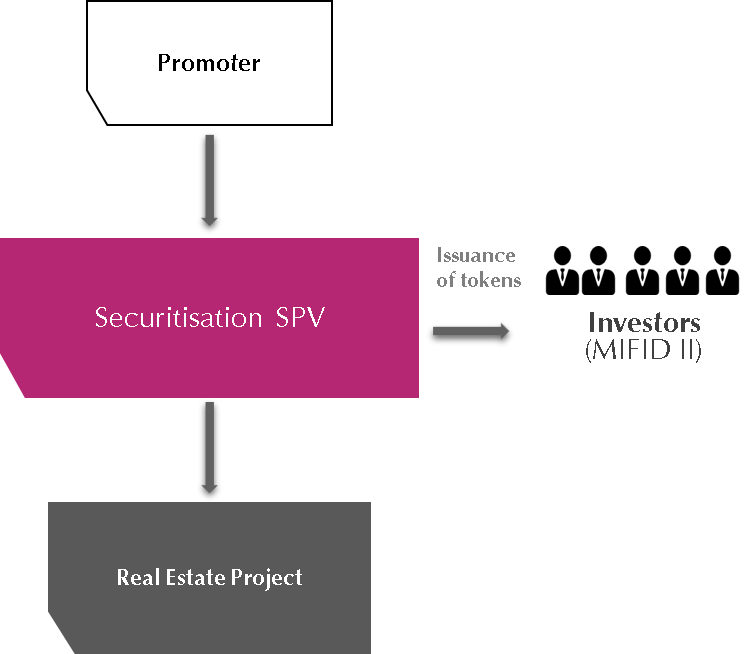

To find out more on Real Estate tokenization, you can download Tokeny Solutions’ case study here. Example of Real Estate tokenization through a Securitisation SPV:  Creatrust also offers advisory services on:

Credit/Debt Fund

A credit/debt fund is an investment pool, such as a mutual fund or exchange-traded fund, in which the main holdings include fixed income investments. A debt fund may invest in short-term or long-term bonds, securitized products, corporate debt, mezzanine debt, other debt instrument, direct lending, facility agreement, etc. Creatrust provides different solutions in terms of Credit/debt fund structuring such as the Special limited Partnership, the Reserved Alternative Investment Fund or the Special Investment Fund. Securitisation undertakings are often the preferred choices of the promoters Discover here why these solutions are advantageous and Creatrust new Fund Platform for regulated and unregulated fund/managers… Creatrust services :

Sustainability Responsible and Impact Investing via Luxembourg

Sustainable, Responsible and Impact investing (SRI) is the most popular strategy of the year 2019.

Investments that considers environmental, social and corporate governance (ESG) criteria to generate long-term competitive financial returns and positive societal impact have been huge this year 2019 and will continue to be the topics of the year 2020.

Investment Manager and Promoter have pilling cash into the strategies and the most common structures were : 1) SLP : a Special Limited Partnership can be setup as a co-investment vehicle or as an Alternative Investment Fund, the Manager which remains non regulated up to 100 Mio Eur - It does not need to appoint a custodian nor a regulated asset manager nor an auditor, No prior approval from the regulator

This allows the promoter to setup such entity very fast and for a fraction of the costs of a normal investment fund 2) RAIF, SICAR, SIF are also available as lightly regulated Alternative Investment Fund who can be used to invest in such investments. Reserved Alternative Investment Fund were the most wanted. It can be setup very quickly and does not need pre approval of the regulator. It can be managed by a foreign based manager. 3) The Securitisation or Bond Issuance Solution : Discover all findings of this study and the various forms of fund available in Luxembourg. Creatrust services :

Contact us - More on Creatrust - Creatrust News BP 027 - West Side Village - 89 E, Parc d'Activités | L-8308 Capellen | G.D. Luxembourg

T +352 277 297 40 | F +352 277 29911 | www.creatrust.com | creacom@creatrust.com

As part of the recent changes to the General Data Protection Regulation, we want to inform you about the possibility to opt-out of our Newsletter. This email results in prior information request related to our services. Do not hesitate to contact us at the following address in order to remove you from our mailing list.Info@creatrust.com |