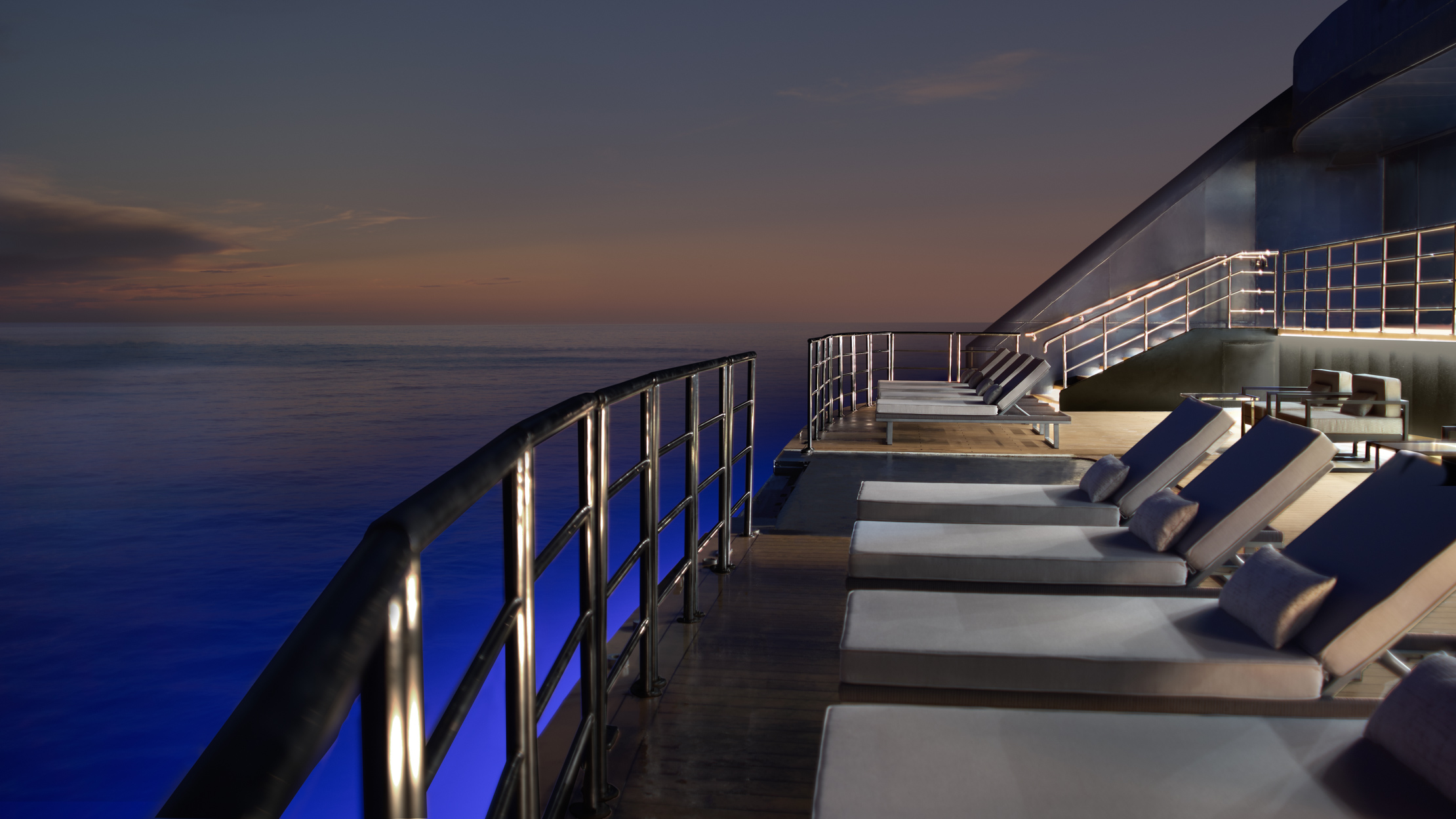

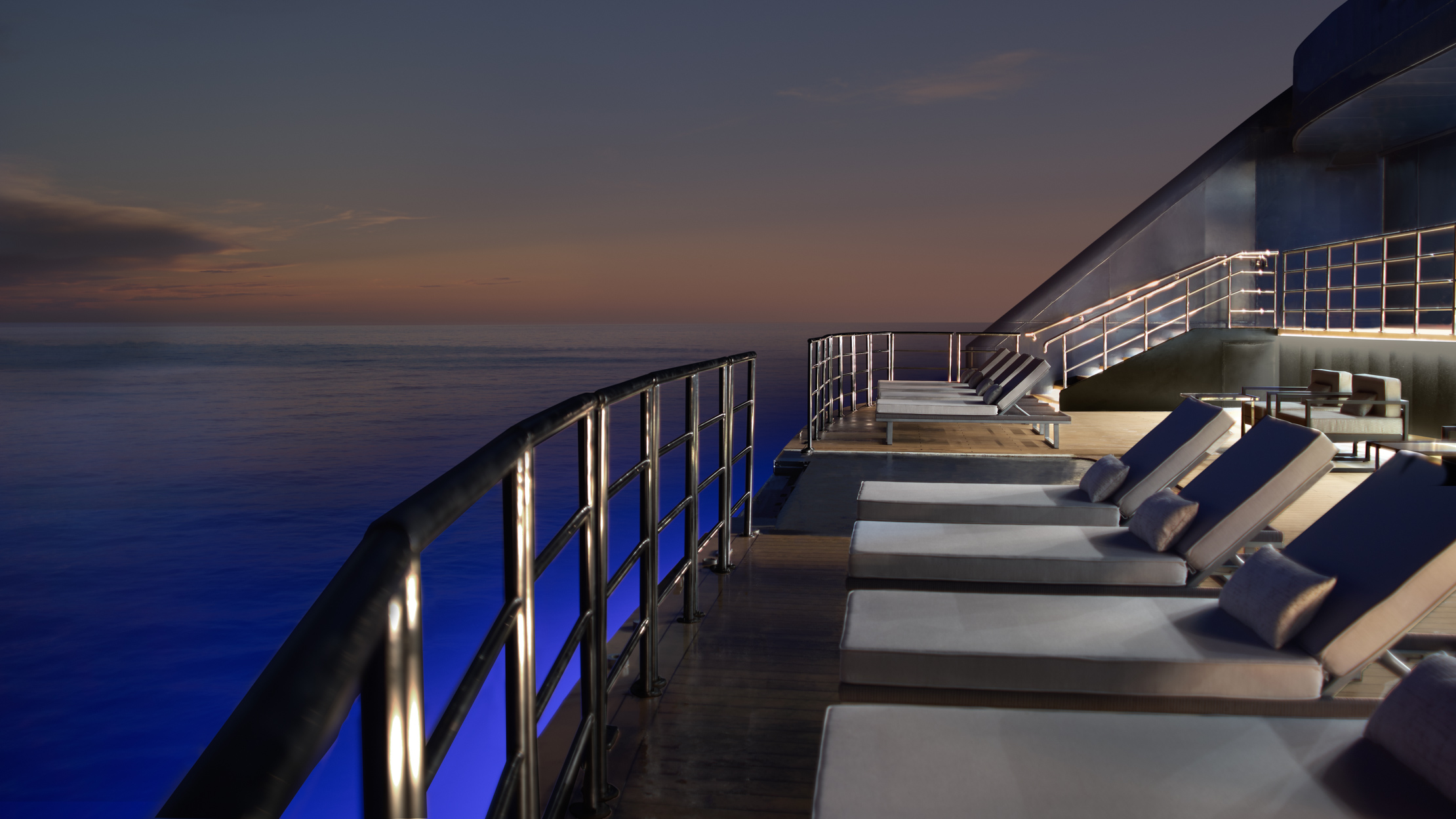

| For Credit Suisse, the hits just keep on coming. Already battered and bruised as it tries to move past a long series of scandals and losses, the Swiss bank got some more bad news: Goldman Sachs estimates it faces a capital shortfall of as much as $8 billion in 2024. Best case is the bank is short only half that given the need to restructure investment banking operations at a time of “minimal” capital generation, Goldman analysts contend. Credit Suisse is exploring radical cuts to its volatile investment bank, including spinning off large parts while hiving off a securitized products group. But this latest reorganization is going to cost a lot of money, and just two weeks before Chief Executive Officer Ulrich Koerner is due to present his plan, it remains unclear where the cash is coming from. While raising capital is one option under consideration, Credit Suisse executives would strongly prefer not to issue equity, given that its share price has been hovering near record lows. —David E. Rovella The pandemic will forever change how consumers shop, everyone said. Having turbocharged e-commerce’s ongoing destruction of brick-and-mortar, all shoppers would inevitably embrace the online experience, and continue to do so after Covid-19 faded away. That answer seemed obvious when the pandemic first struck, with retailers shuttered and millions home in their pajamas surfing the internet. After experiencing the ease of online shopping, why would consumers return to stores? Well, the pandemic hasn’t even ended yet, and return they have. For the past five quarters, online growth has trailed the sales gains of the overall retail industry. And in some categories—such as clothing—the percentage of sales made online is back to where it was before anyone had heard of the coronavirus. The US Securities and Exchange Commission is investigating Yuga Labs, the creator of the popular Bored Ape Yacht Club collection of NFTs, over whether sales of its digital assets violate federal law. The SEC is examining whether certain nonfungible tokens from the Miami-based company are more akin to stocks and should follow the same disclosure rules.  Bored Ape Yacht Club digital artwork from the collection of Ovie Faruq and Mike Anderson Source: Ovie Faruq Bank of England Governor Andrew Bailey urged investors to finish winding up positions that they can’t maintain, saying the central bank will halt intervention in the market as planned at the end of this week. “My message to the funds involved and all the firms is you’ve got three days left now,” Bailey said Tuesday. “You’ve got to get this done.” After an abrupt end to the US housing boom, home flippers who were winning big just months ago are now racing to stem losses. The doubling of mortgage rates since January crushed buyer demand and depressed values in investors’ most favored locations. It’s also caused mortgage firms to start firing employees. Everywhere you turn, the biggest players in the $23.7 trillion US Treasuries market are in retreat. From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have backed off. And then there’s the Federal Reserve, which has accelerated the pace of offloading Treasuries from its balance sheet to $60 billion a month. The US is speeding up shipment of two advanced air defense systems to Ukraine in response to pleas by President Volodymyr Zelenskiy for the West to supply more—and more advanced—weaponry in the fight against Russia. French President Emmanuel Macron responded to Russia’s latest attacks with a decision to strengthen his nation’s military presence in Eastern Europe. On Tuesday, Vladimir Putin launched another round of missile strikes on more than 20 localities across Ukraine, Kyiv said. Elon Musk has a Putin problem. He is denying a report that he spoke directly with the Kremlin leader about what he wants to end his war, one in which Russian forces are thought to have killed tens of thousands of Ukrainians. Ian Bremmer, head of political-risk consultancy Eurasia Group, told clients Monday that the world’s richest person told him he had recently spoken to Putin. Bremmer said that conversation came before a series of Musk tweets in which the Tesla co-founder triggered an uproar by urging Ukraine to agree to some terms Russia has been seeking. These include accepting a formal state of neutrality and recognizing Russia’s illegal annexation of Ukraine’s Crimea, Luhansk and Donetsk regions.  Elon Musk Photo illustration: 731; Photo: Getty Images Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. With sleek modern design, rich materials, plenty of lounge space, personalized service and a restaurant with menus designed by a Michelin three-star chef, the first ship of the Ritz-Carlton Yacht Collection is ready for its debut. The 298-passenger Evrima will carry its first guests on a seven-night cruise from Barcelona to Nice on Oct. 15. Have a look inside.  The ship’s Marina Terrace is both a lounging spot at water’s edge and a place to borrow water toys such as kayaks and paddleboards. Photographer: Christopher Cypert Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Invest: This year has seen the worst performance for equities and bonds since the 1970s. Aggressive rate hikes from the Fed, supply chain issues and geopolitical events have contributed to a challenging environment. Join us in New York or virtually Oct. 12-13 where we’ll hear from the most influential figures in investing and markets about how they’re navigating a rapidly changing economic landscape. |