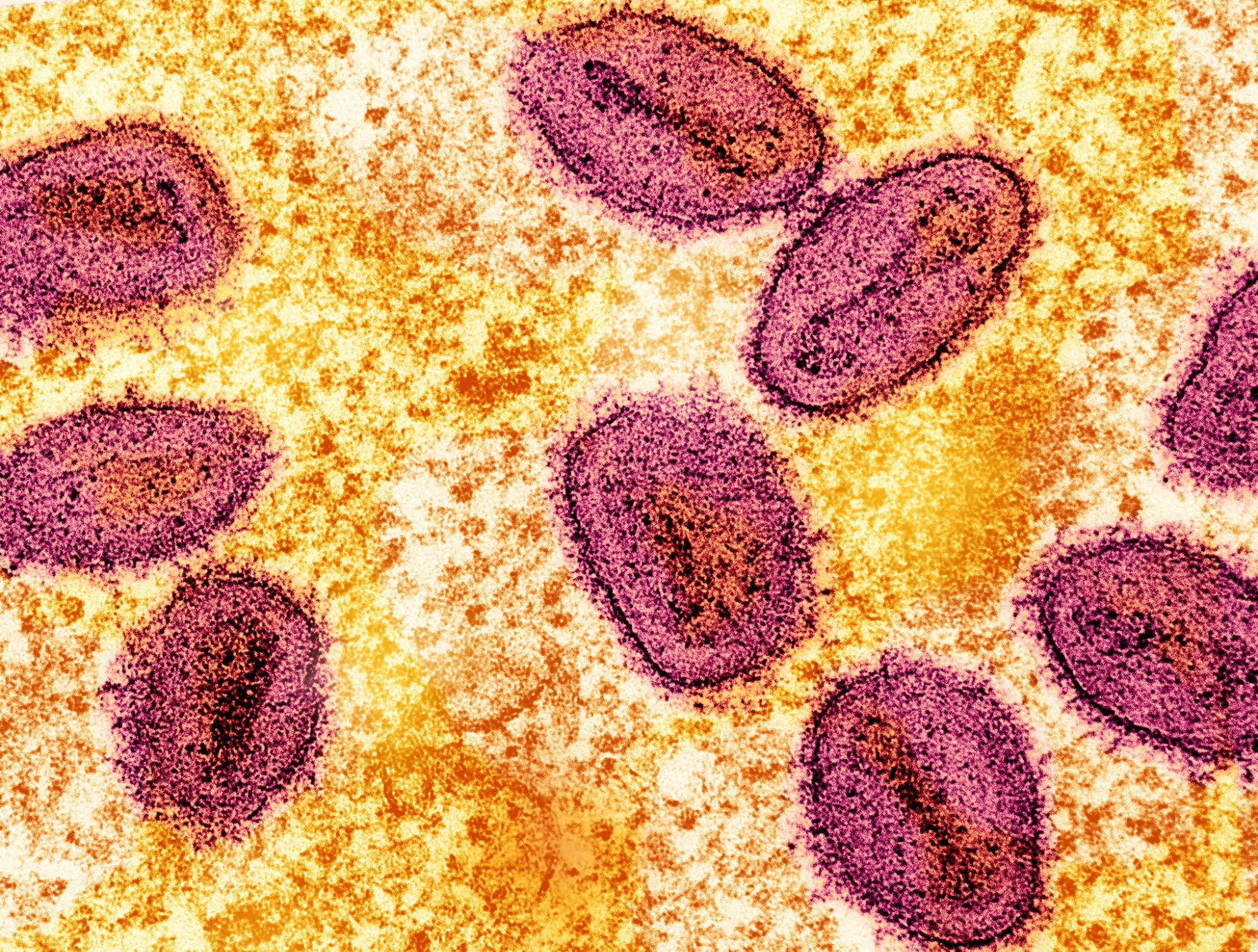

| US inflation fell below a crucial threshold as it nears the end of a long trip back from the catastrophic coronavirus pandemic and its economic aftermath. Wall Street dutifully rejoiced. Stocks rose after an inflation report further solidified bets the Federal Reserve will start cutting rates in September. The S&P 500 extended its advance into a fifth straight day, the longest winning streak in more than month. Most of its major groups gained, with financial, energy and tech shares leading the way. Wednesday’s consumer price index data reinforced the trend of disinflation and brought a degree of relief to markets still reeling after last week’s meltdown. Combined with a softening job market, the Fed is widely expected to start lowering rates next month, while the size of the cut will likely be determined by incoming data. The dollar remained at a four-month low. Here’s your markets wrap. —David E. Rovella The World Health Organization has declared a fast-spreading mpox outbreak in Africa a global health emergency. The spread of a new strain of the potentially deadly virus in the Democratic Republic of Congo, “its detection in neighboring countries that had not previously reported and the potential for further spread within Africa and beyond is very worrying,” WHO Director-General Tedros Adhanom Ghebreyesus said in a briefing Wednesday. The mutated strain of mpox—a virus that causes unsightly, painful rashes and lesions—has spread to at least six African countries, infecting about 15,000 people and killing more than 500 in the DRC this year alone.  Colorized transmission electron micrograph of mpox virus particles. Source: NIAID Japanese Prime Minister Fumio Kishida said Wednesday he will not run for a second term as president of the Liberal Democratic Party to take responsibility for scandals that have dogged it throughout his nearly three-year term. Kishida has also taken a hit from recent market chaos, including the biggest falls in the main stock indexes in decades. Japan’s next prime minister will face challenges from inflation, volatile financial markets, a worsening security environment and the transition to a new president in the US, Tokyo’s most important ally. It’s shaping up to be one of the most uncertain races in years. Michael Burry, the hedge fund manager famous for his 2008 bet against the US housing market and subsequent depiction in The Big Short, further increased his stake in Alibaba Group Holding while slashing his overall equity portfolio in half. Scion Asset Management, Burry’s investment firm, reported an $11.2 million position in Alibaba in the quarter, up from $9 million in the first quarter after adding 30,000 shares. Shift4 Payments was the firm’s second-biggest holding. Amid plans to fire more than 6,000 of its employees, Cisco gave a cheery business forecast that arguably shows its business situation isn’t as sobering as once thought. The biggest maker of computer networking equipment gave a bullish revenue outlook for the current period thanks to a rebound in orders. Sales will be $13.65 billion to $13.85 billion in the fiscal first quarter, which ends in October, the company said Wednesday. The upbeat outlook suggests Cisco has more of a cushion to overhaul its business as planned.  Cisco Systems headquarters in San Jose, California Photographer: David Paul Morris/Bloomberg Last August, Casey Harrell spoke the first clear words his five-year-old daughter could remember hearing him say—a repeat of his wedding vows to her mother, Levana Saxon. The adults in the room cried. The moment was possible thanks to a wave of innovation in one of the most challenging areas of medicine: reconnecting the brain to the body after something—an accident or an illness like ALS—has severed the ties. Apparently cat videos are more important than sanity. American teens are generally against the idea of regulations that would place restrictions on their use of social media platforms, despite knowing the potential harms to mental and physical health, according to a survey of 430 first-time voters. A study designed by nonprofit Helena found more than 60% of new voters oppose requiring kids under age 16 to seek parental consent to use social media. More than 85% of young people think there should be no time limits on when they can receive social media notifications, such as at night or during school hours. Apple will begin letting third parties use the iPhone’s payment chip to handle transactions, a move that allows banks and other services to compete with the Apple Pay platform. The move follows years of pressure from regulators, including those in the European Union. Apple said it will allow developers to use the component starting in iOS 18.1, an upcoming software update for the iPhone. The payment chip relies on a technology called NFC, or near-field communication, to share information when the phone is near another device. In and around Fort Worth, Texas, there was a folksy former securities broker named William “Doc” Gallagher who plied the AM airwaves selling god and solid returns. Drawn to his Christian bona fides and swayed by his supposed investing acumen, elderly couples eagerly handed over hundreds of thousands of dollars—sometimes their entire life savings. At first, many received statements indicating consistently high returns. Then later the truth—and the financial devastation—became clear. On the Bloomberg Investigates documentary The Money Doctor, we show how Gallagher skillfully hid an elaborate Ponzi scheme under the cloak of piety, fleecing his clients of $38 million while destroying the lives of the vulnerable in their sunset years.  Watch The Money Doctor by Bloomberg Investigates Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. Bloomberg Power Players: Join us in New York on Sept. 5 during the US Open Tennis Championships and hear from leaders working to identify the next wave of disruption that could hit the multibillion-dollar global sports industry. With us will be A-Rod Corp founder Alex Rodriguez, Boston Celtics co-owner Steve Pagliuca, Carlyle Executive Chairman and Baltimore Orioles owner David Rubenstein and US Women's National Team forward Midge Purce. Learn more. |