|

|

Today’s letter is brought to you by Trust & Will!

Trust & Will is the most trusted name in online estate planning and settlement.

The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy.

Their mission is to make estate planning simple, affordable, and inclusive.

All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements.

To investors,

Most of the investor interest in cryptocurrencies has historically been concentrated in the digital tokens. Retail investors were first to the party, followed by family offices, corporations, and financial institutions. The big hope from many is that nation states will be the next big shoe to drop in the adoption curve.

At the same time that adoption was sequentially moving from small accounts to large accounts, capital allocators were also moving horizontally through the market as well. First, investors were buying bitcoin, then Ether, and now a plethora of other crypto assets that push them further out on the risk curve.

These are all digital tokens though. One of the areas that “crypto investors” seem to always leave as an afterthought is the public equities involved in the crypto market. For example, Alyssa Choo from Bitwise pointed out this week that 2023 continues to be a good year for crypto equities:

Coinbase $COIN: +263% YTD

Riot Platforms $RIOT: +274% YTD

Marathon Digital $MARA: +260% YTD

Galaxy Digital $GLXY: +114% YTD

The first three companies on this list have more than doubled the return of bitcoin year-to-date. While true, these results are not necessarily reflected in the public narrative at the moment.

But the recent past results are not necessarily indicative of future performance. Some investors are bearish on the ability for a crypto-native firm like Coinbase to succeed against a litany of traditional financial firms competing for customers and assets. Maybe these bears are right, maybe they aren’t. Predicting the future is hard.

Put that debate aside for a second though. A narrative that is forming around Coinbase specifically is that the company’s stock price will hit $1,000 during the bull market. If you search Twitter/X for “$COIN $1000” you will see many different accounts all but predicting this milestone as an eventuality. Again, I have no clue what will happen, and predicting the future is very hard, but let’s take a look at what it would take for that milestone to be achieved.

2023 Net Revenue Estimate: $2.6B

2025 Net Revenue Estimate: $14.5B

2023 Monthly Transacting Users Estimate: 8.5M

2025 Monthly Transacting Users Estimate: 32M

2023 Assets on Platform Estimate: $130B

2025 Assets on Platform Estimate: $500B

This means that Juan’s analysis concludes that Coinbase’s stock would reach $1,000 if the company hit $14.5 billion in net revenue, 32 million monthly transacting users, and $500 billion of assets on the platform.

Those are a significant increase from the current position, but a strong capital inflow during a bull market is the perfect tailwind to help a company like Coinbase achieve stunning potential growth like this.

As many of you know, I have had financial exposure to Coinbase through the Morgan Creek Digital Assets fund for a number of years. The thesis ~ 5 years ago in the private market was that Coinbase would serve as the best US-based, regulated exchange. They had great brand awareness, the team continued to innovate on the product in an impressive way, and the institutional offerings were starting to serve as the default for large capital allocators as they came into the market.

Each of these components of the thesis still remains true today. Additionally, Coinbase appears to have transitioned a big part of their business into a crypto-native format. According to Qiao Wang, “the most impressive thing about Coinbase is they transformed themselves from a CEX to a crypto-native organization: wallet, L2, onchain identity, payment, and more.”

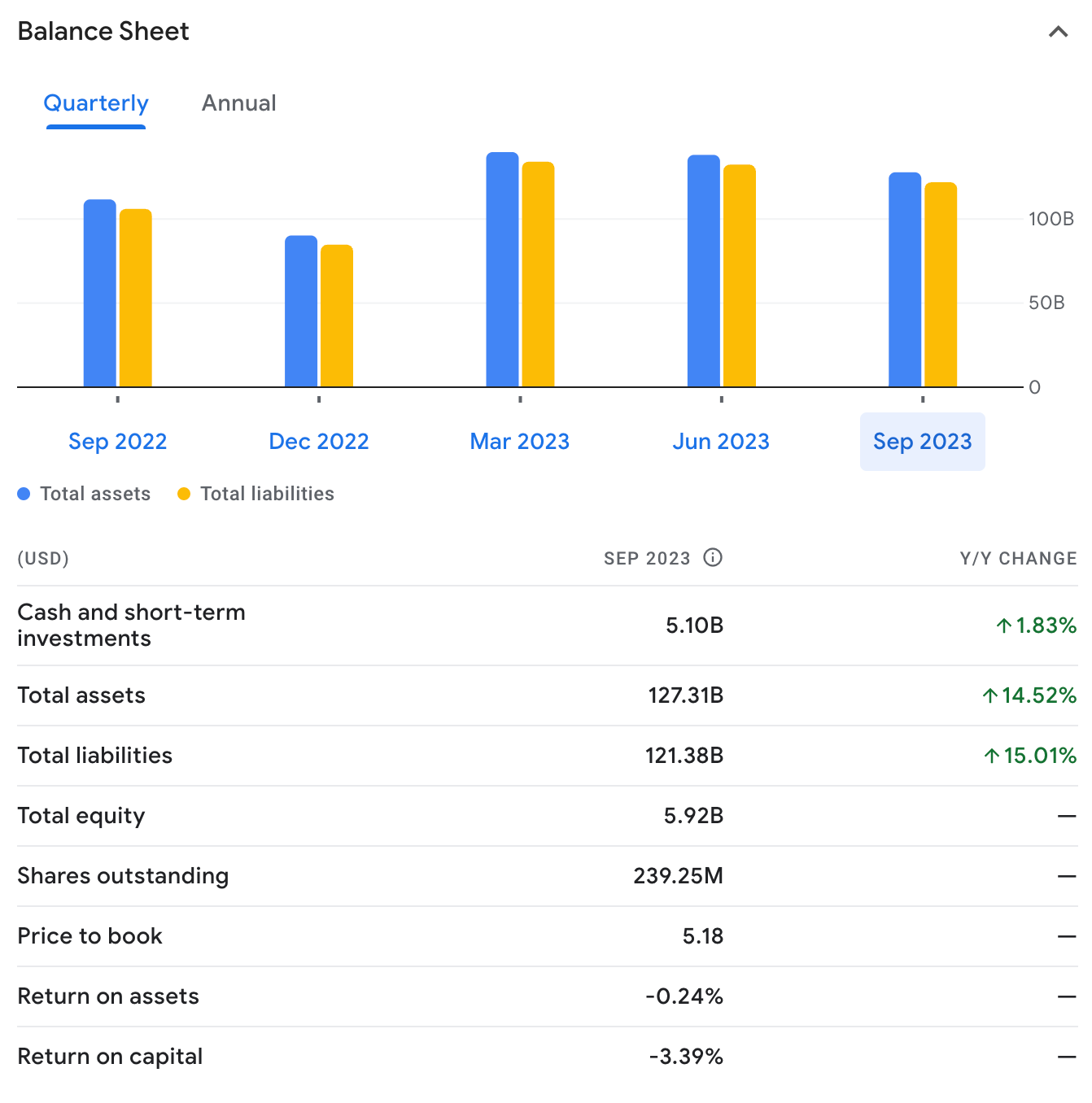

It is not every day that you see a public company rebuild the plane while in flight with such ease. I have no plans to change my personal portfolio based on these recent public comments from various analysts, nor do I ever recommend selling anything in crypto pre-halving, but I am curious to hear what each of you thinks about Coinbase. Here are the income statement, balance sheet, and cash-flow statement.

Leave a comment or reply to this email with your thoughts. There is great debate in the market around this company, and the market will be the ultimate referee of who is right and wrong, but that doesn’t prevent the rest of us from discussing our personal opinions.

I look forward to learning from each of you. Hope you have a great day. I’ll talk to you tomorrow.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Oliver Rust is the Head of Product at Truflation.

In this conversation, we talk about outdated process used for calculating CPI, what Truflation is doing with new data collection, how good data would change Fed’s response & lead to better decision making, why Truflation believes inflation will be sticky in 2024, and what success looks like for Truflation.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Here Is Proof That Inflation Data Is Wrong…

Podcast Sponsors

Cal.com - Changing the calendar management game. Use code “POMP” for $500 off when you sign up.

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.