To investors,

I was talking to a friend recently about the various investment opportunities in the crypto industry. He kept explaining how much exposure he had to publicly traded stocks, so I asked my friends at Bitwise to do an analysis on that piece of the market. Below is their write-up. Really fascinating stuff.

Crypto assets are the best returning asset class over the past one, three, and five years. And yet, many traditional investors remain on the sidelines.

Why? Among other reasons, because crypto assets are just different. You don’t buy them in traditional brokerage accounts. You can’t value them like stocks. There are no spot crypto ETFs. They can be intimidating to many investors.

Fortunately, investors have a new choice: Publicly traded crypto equities.

Over the past two years, dozens of crypto equities have listed on public markets, and you can now build a portfolio of companies across crypto mining, brokerage, asset management, and more.

The best thing? These “picks and shovels” plays are among the fastest-growing and most-profitable companies in the world. They’re also being overlooked in certain ways by Wall Street.

The Crypto Combo: High Growth and High Profitability

Crypto equities today combine two characteristics rarely found together: Exceptional top-line growth with very high levels of profitability.

Take Coinbase, the premier crypto exchange.

At a market capitalization above $50 billion, it is already ranked in the top 200 largest U.S. public companies. And yet, 2021 median estimates project astounding revenue growth of 426.9%, with a net profit margin of 43.6%.

Usually, when companies are growing that fast, they are unprofitable; think Facebook (now Meta) in its earliest days. But thanks to massive growth in the crypto ecosystem, with aggregate crypto exchange trading volumes surpassing $10 trillion through August (more than 5x all of 2020), Coinbase has been able to pair that growth with significant profits.

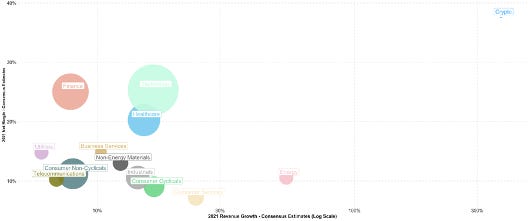

It’s not alone. The chart below compares the median top-line growth and net margins for pure-play crypto equities, as captured by the Bitwise Crypto Innovators 30 Index, with other industries in the S&P 500.

Crypto equities are expected to deliver top-line growth and net margins of 371.0% and 37.5%, respectively, for 2021. That is higher than any other industry in the S&P 500, and significantly above the average company, which is scheduled to deliver 11.9% growth and 14.9% profit margins.

CRYPTO EQUITIES STAND OUT IN TERMS OF THE PROFITABILITY GENERATED FROM THEIR TOP-LINE GROWTH

2021 median estimates of revenue growth versus profitability levels for crypto equities and S&P 500 industries. (Area of each circle is proportional to the total market capitalization of each industry).

Crypto stocks shine even compared to other fast-growing businesses. For instance, the median company in the disruptive technology oriented ARK Innovation ETF (ticker: ARKK) is expected to grow revenues by 40.4% while having a negative net profit margin of -9.4%.

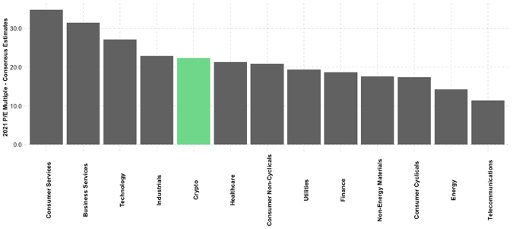

What’s even more interesting about crypto equities is that they are largely flying under the radar. Despite superior fundamentals, they currently trade at a median 2021 P/E ratio of 22.3x, just marginally higher than the S&P’s average of 21.2x.

FAVORABLE GROWTH AND PROFITABILITY DYNAMICS ARE NOT REFLECTED IN 2021 P/E MULTIPLES

2021 P/E multiples of crypto equities versus the industries of the S&P 500 Index

There are many reasons for this unique combination.

For one, reputational, regulatory and other concerns have prevented traditional companies from entering the crypto market in significant ways, shielding early movers from well-funded competitors for long periods of time. Additionally, crypto equities still have scant market coverage, depriving them of significant analyst coverage and institutional awareness.

There are of course also significant risks. Crypto equities are exposed to crypto asset prices, which can be volatile and have historically demonstrated elements of cyclicality. The exceptional historical returns in crypto have been accompanied by sharp and sometimes prolonged corrections, and those drawdowns could happen again. Additionally, risks related to regulation, market infrastructure, technical developments, and user adoption can also affect these markets.

Still, as a fast-growing and often overlooked sector, these companies bear real consideration, both from investors locked out of the traditional crypto market and from investors looking to augment their crypto exposure.

Are Cryptoasset Correlated With Crypto Equities?

A common question investors have about crypto assets is whether their returns are correlated with crypto assets. In other words, can you get crypto-like exposure with crypto equities?

The chart below shows that the answer is yes … mostly.

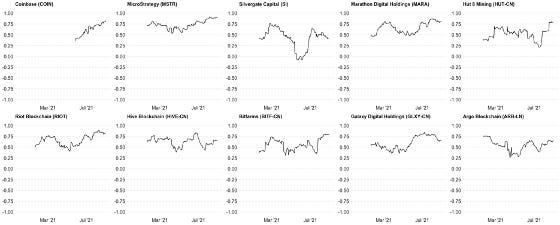

CORRELATIONS BETWEEN CRYPTO EQUITIES AND CRYPTO ASSETS TYPICALLY RANGE BETWEN 0.50 AND 0.75

30-Day rolling correlations of daily returns between the top 10 constituents of the Bitwise Crypto Innovators 30 Index and the Bitwise 10 Large Cap Crypto Index. Data from December 1, 2020 to September 30, 2021 for all companies except for Coinbase, for which data is available from April 14, 2021 to September 30, 2021.

The chart looks at the correlation between the 10 largest pure play crypto equities and the broader crypto market. It finds that crypto equities offer material exposure to cryptoassets, with correlations typically ranging between moderate (0.50) and significant (0.75). While not a perfect proxy, this is a robust connection.

Another important angle is whether these stocks are leveraged or de-leveraged to cryptoasset price action. Commodity stocks tend to be leveraged plays on the commodity cycle, as their profits tend to go up more than the price of the underlying commodity during bull markets and vice versa in bear markets.

Our analysis suggests crypto equities share this relationship with the underlying cryptoasset prices, although again to different degrees.

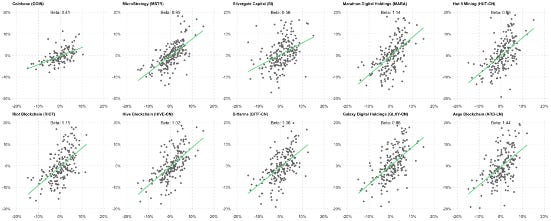

CRYPTO EQUITIES ARE LEVERAGED TO CRYPTOASSET PRICES TO DIFFERENT DEGREES

Betas of the top 10 constituents of the Bitwise Crypto Innovators 30 Index (vertical axis) to the Bitwise 10 Large Cap Crypto Index (horizontal axis). Data from December 1, 2020 to September 30, 2021 for all companies except for Coinbase, for which data is available from April 14, 2021 to September 30, 2021.

The chart shows that crypto equities’ betas to cryptoassets range from 0.41 for Coinbase to 1.52 for Argo Blockchain. This range is intuitive considering that the subsectors within crypto equities are exposed to cryptoasset price cycles in different ways. Crypto miners tend to have significant operating leverage to crypto prices and therefore their share prices tend to exacerbate the crypto price cycles. Other industry players, however, have valuation drivers that may not be entirely influenced by crypto prices. Exchanges, for example, derive their revenues from trading volume, which may not always move in tandem with crypto prices (and can even spike during short pullbacks), and from additional services that they can add on top of trading fees such as custody, staking, and lending.

Conclusion

Cryptasset adoption accelerated in 2021, with the global crypto population more than doubling from 100 million in January to 221 million in June. Through the disruption of existing paradigms, the creation of new opportunities for different segments of society, and shifting of consumer behaviors, crypto is reshaping the world.

Crypto equities are capitalizing on this as the fastest growing segment of the public markets, providing an opportunity for investors to participate in this exciting megatrend.

Hope this was informative for each of you. I’ll be looking to do more analysis like this in the coming weeks. Thanks to the team at Bitwise for being so helpful and putting context around the data as well. Talk to everyone tomorrow.

-Pomp

THE RUNDOWN:

Michael Saylor Says MicroStrategy Will Continue to Keep Adding to Its Trove of Bitcoin: MicroStrategy will continue stockpiling bitcoin for years to come, and while the cryptocurrency's price is volatile, "it's going up forever," CEO Michael Saylor told CNBC on Monday. The bitcoin bull outlined his bullish outlook on the digital asset after a MicroStrategy regulatory filing last week showed the company bought 9,000 bitcoin in the quarter ended Sept. 30. The data analytics company's bitcoin count stood at 114,042, and the stash was worth nearly $7 billion on Monday as bitcoin traded around $61,220.Read more.

NFL Star Aaron Rodgers Gives Ringing Endorsement of Bitcoin: NFL superstar Aaron Rodgers offered a resounding endorsement of bitcoin on Monday, tweeting that “I believe in Bitcoin & the future is bright.” The longtime Green Bay Packers quarterback and three-time MVP revealed that he’s working with Square’s Cash app to receive an undisclosed amount of his salary in bitcoin for the first time. New York Giants star running back Saquon Barkley said in July he would be receiving all his future endorsement money in bitcoin, while several other NFL players have also said they would get part of their salaries in cryptocurrency.Read more.

Coinbase Revenues Could Hit Nearly $50B by 2025: Coinbase is the best-positioned cryptocurrency-related company to benefit from the industry’s soaring growth, Hayden Capital said on Monday in a memo on the crypto exchange. Coinbase could reach $49.2 billion in revenue exiting 2025 under a bullish outlook of mass crypto adoption, rising interest among institutional investors and the sector growing to $6.8 trillion in total size. Under a more conservative crypto market cap estimate of $3.4 trillion, the firm would more than double revenues to $21.3 billion by 2025.Read more.

Biden Administration to Congress: Put Stablecoins Under Federal Supervision – Or We Will: A group of U.S. regulators urged lawmakers to subject stablecoin issuers to the same strict federal oversight as banks, in a highly anticipated report released Monday. Congress should also require custodial wallet providers to be regulated by a federal agency and limit stablecoin issuers’ interactions with non-financial companies such as tech or telecom providers, the President’s Working Group for Financial Markets said. The latter recommendation appeared to be aimed squarely at Diem, formerly Libra, the controversial stablecoin project created by Meta, the social media giant previously known as Facebook.Read more.

Pension Funds Wade Into Crypto Investments: The Houston Firefighters’ Relief and Retirement Fund made news recently when it announced it was investing $25 million in bitcoin and ether, marking what was believed to be the first time a U.S. pension fund had put cryptocurrencies directly on its balance sheet. Of course, $25 million is only a drop in the bucket compared to the $5.5 billion in total assets held by the fund – more precisely, it represents just 0.5% of its portfolio. But it still was a notable first step by the historically conservative investment fund. Read more.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Rich Antoniello is the Founder & CEO of Complex (now Complex Networks). They recently sold the business for approximately $300 million to BuzzFeed.

In this conversation, we discuss media, entrepreneurship, capital markets, bitcoin, NFTs, and some of the CRAZY stories from over the years.

LISTEN TO THIS EPISODE OF THE POMP PODCAST HERE

Podcast Sponsors

These companies make the podcast possible, so go check them out and thank them for their support!

Coin Cloud has been serving customers since 2014 and has established itself as the world's leading digital currency machine (DCM) operator. More than just a Bitcoin ATM, Coin Cloud machines make it easy to buy and sell Bitcoin and 30+ other digital assets with cash. To get your $50 in free Bitcoin, visit www.Coin.Cloud/Pomp

Compass Mining is the world's first online marketplace for bitcoin mining hardware and hosting. Compass was founded with the goal of making it easy for everyone to mine bitcoin. Visit compassmining.io to start mining bitcoin today!

Choice is rebuilding the way bitcoiners approach retirement by making it possible to invest in bitcoin and 19 other digital assets inside your IRA. Choice enables you to trade real bitcoin, other crypto, and stocks without having to pay a dime in capital gains. Join me and the 20,000 other bitcoiners who have started their tax-efficient stack, and open your Choice Account today. Search ‘stack sats’ in the app store or visit www.choiceapp.io/pomp

BlockFi provides financial products for crypto investors. Products include high-yield interest accounts, USD loans, and no fee trading. To start earning today visit: http://www.blockfi.com/Pomp

Gemini is a leading regulated cryptocurrency exchange, wallet, and custodian that makes it simple and secure to buy, sell, store, and earn bitcoin, ether, and over 40 other cryptocurrencies. Open a free account in under 3 minutes at gemini.com/pomp and get $20 of bitcoin after you trade $100 or more within 30 days.

CityCoins are programmable tokens that allow citizens to become stakeholders in their favourite cities. MiamiCoin was the first CityCoin launched and within it’s first two months it has already raised over $10 million USD in donations for the City of Miami. Join the CityCoins Discord to become part of the community, and help us build towards a crypto civilization.

Crypto.com allows you to buy, sell, store, earn, loan, and invest various cryptocurrencies in an user-friendly mobile app. Join over one million users today. You can download and earn $50 USD with my code “pomp” when you sign up for one of their metal cards today.

Circle is a global financial technology firm that enables businesses of all sizes to harness the power of stablecoins and public blockchains for payments, commerce and financial applications worldwide. Circle is also a principal developer of USD Coin (USDC), the fastest growing, fully reserved and regulated dollar stablecoin in the world. The free Circle Account and suite of platform API services bridge the gap between traditional payments and crypto for trading, DeFi, and NFT marketplaces. Create seamless, user-friendly, mainstream customer experiences with crypto-native infrastructure under the hood with Circle. Learn more at circle.com.

LMAX Digital is the market-leading solution for institutional crypto trading & custodial services - offering clients a regulated, transparent and secure trading environment, together with the deepest pool of crypto liquidity. LMAX Digital is also a primary price discovery venue, streaming real-time market data to the industry’s leading analytics platforms. LMAX Digital - secure, liquid, trusted. Learn more at LMAXdigital.com/pomp

Okcoin is one of the most popular licensed exchanges. Okcoin is the first to bring new cryptos to market, offering some of the lowest fees in the industry, an easy to use app, and Earn feature! It’s easier than ever to sign up, buy and trade crypto in just 2 minutes on Okcoin with credit & debit cards or just link your bank account to the best new crypto assets. So get started, and go to okcoin.com/pomp

Matrixport is Asia’s fastest growing digital asset platform with $10 billion in assets under management and custody. It offers one-stop crypto financial solutions including fixed income, DeFi in 1-click, structured products, Cactus Custody™, spot OTC and lending. Go download the Matrixport App and enjoy a welcome offer of 30% APY on USDC for new users.

Ethernity.io is the world’s first authenticated and licensed NFT platform, trusted by over 150,000 members. Visit Ethernity.io, where you can buy and sell authenticated NFTs from top notable figures, rights, license, and IP holders you can’t find anywhere else; the start of an entire ecosystem bringing utility to #NFTs.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable.

Nothing in this email is intended to serve as financial advice. Do your own research.

You’re on the free list for The Pomp Letter. For the full experience, become a paying subscriber.