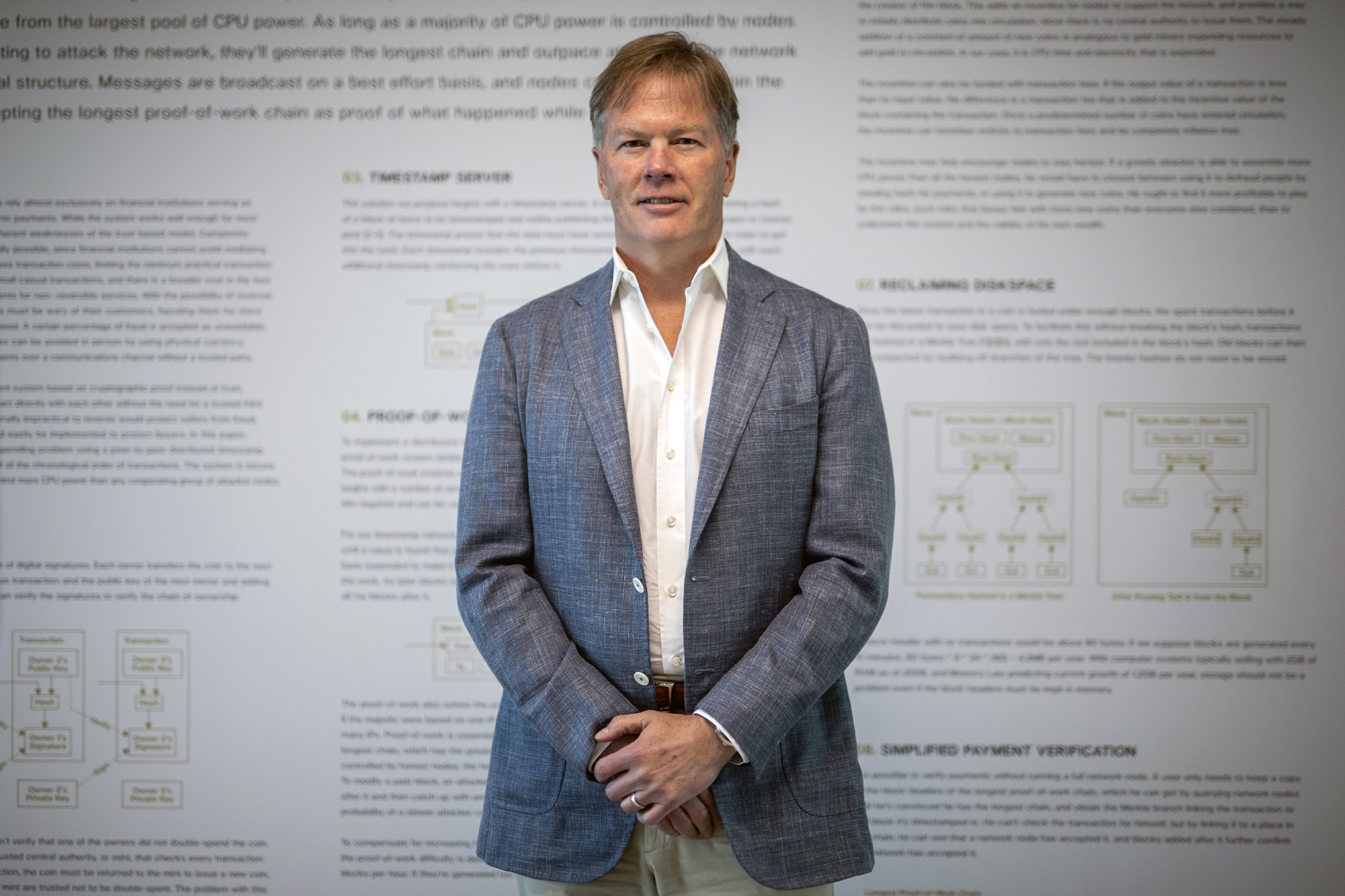

| The era of historically low interest rates is coming to an end, and not just in America. As early as next week, the Bank of Canada will start a campaign of tighter monetary policy that will test the country’s debt-laden consumers and reveal whether its economic recovery has staying power. In the U.S., volatility that’s gripped markets of late shows no sign of letting up, as the S&P 500 notched its worst week since March 2020. Option expirations of more than $3 trillion are adding to the turbulence. Here’s your markets wrap. —David E. Rovella and Natasha Solo-Lyons Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. For Bitcoin, there only seems to be one constant these days: losses. With the Fed looking to withdraw financial support from the market, riskier assets have suffered. Bitcoin lost as much as 8.7% Friday and dropped below $38,000 to its lowest level in six months. Since its peak in November, it’s lost 40% of its value. Other digital currencies have been smacked around as well, with Ether and meme coins mired in similar drawdowns. While crypto evangelists with lots of skin in the game continue to predict six-figure values, Bitcoin is in meltdown mode. Still, that doesn’t mean everyone is hurting. Former Goldman Sachs bond trader Dan Morehead’s Pantera Bitcoin Fund has returned more than 65,000% since 2013, and Pantera Capital Management, once a traditional hedge fund that wagered on macroeconomic trends, oversees $5.6 billion of crypto assets. That’s on top of the $6 billion it’s returned to investors.  Dan Morehead Photographer: Xavier Garcia/Bloomberg A controversial exchange-traded fund with a singular mission—to exploit weakness in Cathie Wood’s flagship fund—has now amassed $234 million in assets. Despite a low-key start, the Tuttle Capital Short Innovation ETF now boasts an impressive haul for a fund less than three months old, after returning around 50% since inception. Goldman Sachs is dangling new bonuses for a select few of its senior leaders. With pay already surging, about 30 of the firm’s top players will now be in line to unlock millions of dollars more. The incentive to stick around comes as Wall Street pay packages have spiked amid heightened competition for talent.

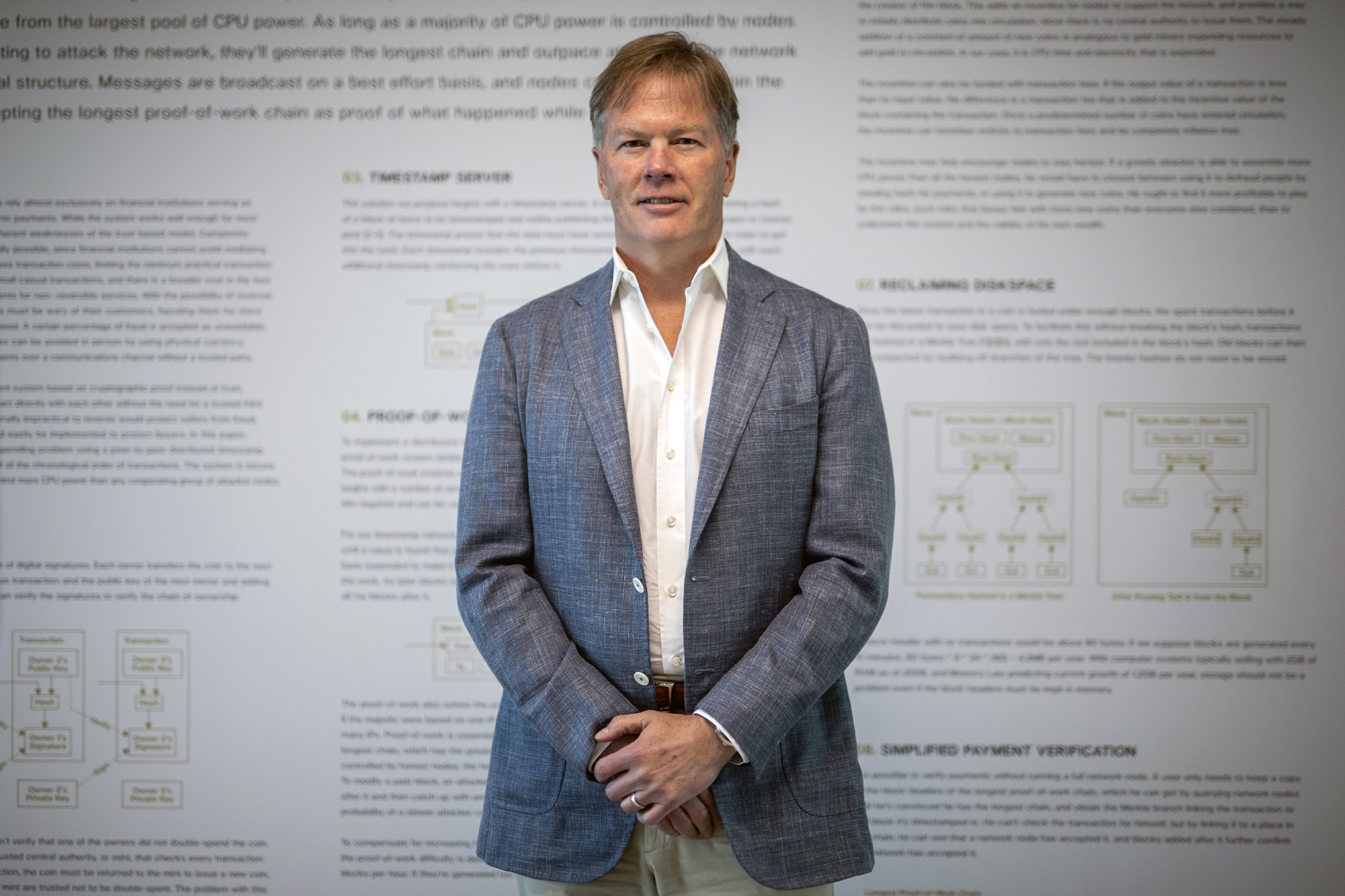

While Vladimir Putin surrounds Ukraine with troops and equipment and the world prepares for (what may be) another attack on his neighbor, the Russian president faces a growing domestic crisis. His constituents are falling victim to the coronavirus at an unprecedented rate. New infections are sky high with officials reporting 49,513 cases on Friday alone, though the actual number is likely much higher. Meanwhile, new research shows booster doses of vaccines significantly increase protection against both the delta and omicron variants. Here’s the latest on the pandemic. American women are staring down the barrel of the biggest attack on their rights in generations, Michael R. Bloomberg warns in Bloomberg Opinion. The future of the right to an abortion hasn’t been this imperiled since before the U.S. Supreme Court’s 1973 ruling in Roe v. Wade. As the high court now weighs efforts to curtail reproductive rights, Bloomberg says that its justices need to hear loudly and clearly that rolling back the firmly established and widely supported legal protections that have been the law of the land since Roe would be a historically colossal mistake. Beef is destroying the Amazon. The world’s biggest beef producer claims that it has no tolerance for rainforest deforestation, but Bloomberg’s analysis shows that’s simply untrue—and Brazilian law isn’t helping.  Deforested land used for cattle grazing near Xinguara, Brazil, on Oct. 6. Six European retail groups are restricting Brazilian beef purchases due to new findings linking cattle production to deforestation in the Amazon. Photographer: Jonne Roriz/Bloomberg Retiring in 2022 could be challenging. Strong markets have swelled account balances, but changing conditions (like inflation running wild) are eating away at the modest returns of more conservative investments. It may be a good time to revisit your plan: Read Bloomberg’s guide to getting the best out of retirement right now. Gina Champion-Cain was a pillar of the San Diego business community. But her successful image and lavish lifestyle were fueled by fraud. Despite owning a real-estate company among other ventures, her interest in liquor license regulations would lead to her demise. In 2019, she was revealed to be the architect of an almost $400 million Ponzi scheme.  Gina Champion-Cain, center, at the opening of Luv Surf in 2012. Photographer: Andrew Oh Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Follow the money. Sign up for The Dose, a weekly newsletter that explores how once-illegal drugs like marijuana and psychedelics are becoming big business |