|

| |

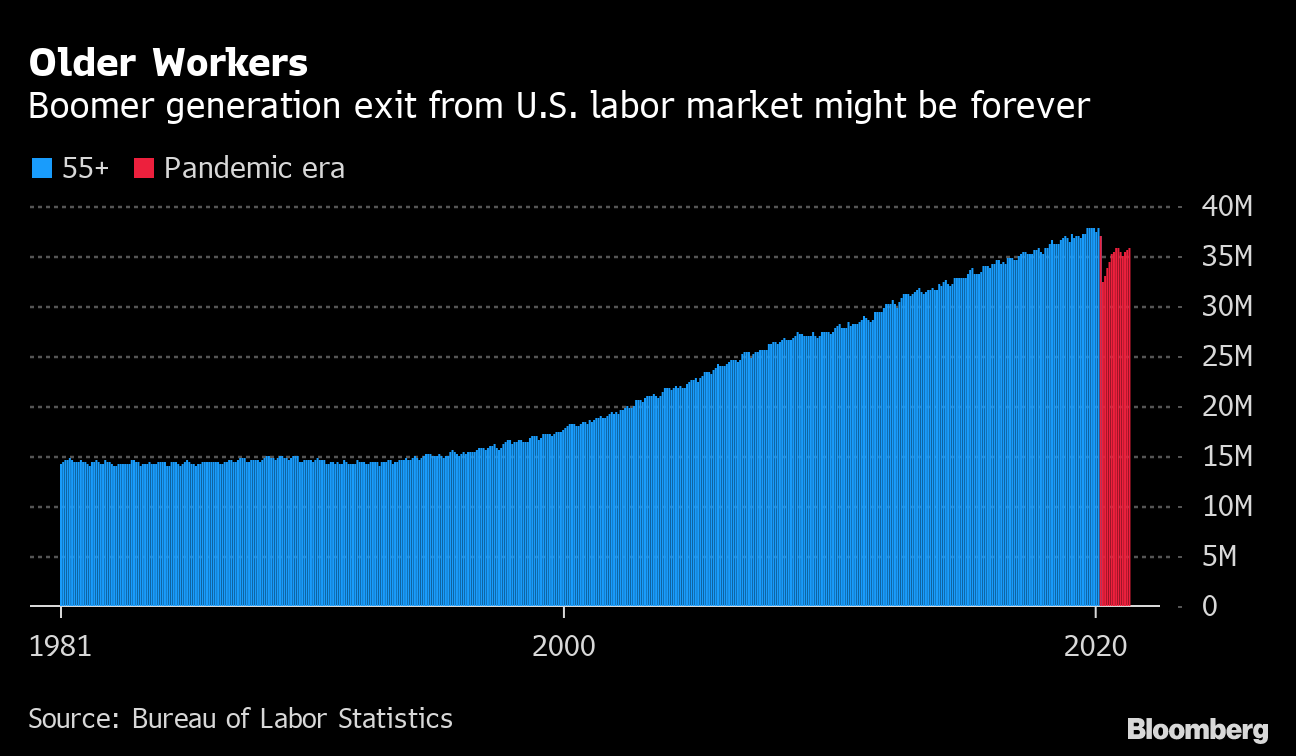

| Companies thin on bullish fundamentals but which still enjoy a devoted, vocal base of shareholders have long been known as “cult stocks.” Amid a social-media-fueled frenzy to pump up a stock like AMC Entertainment, it can be almost impossible to know what’s genuine, organic enthusiasm for a company, and what’s bought and paid for by newly enriched day traders. Some of these groups of investors are starting to look more and more like, well, actual cults. —David E. Rovella Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic globally and across America. Here are today’s top storiesThe U.S. Federal Reserve is showing little concern about inflation even though its preferred measure, the core price index for personal consumption expenditures, has increased 3.1% over the past year, far exceeding the central bank’s longer-term 2% target. Bill Dudley writes in Bloomberg Opinion that while the current spike in prices will likely pass, the long-term threat remains very real. India, the current focal point of the coronavirus pandemic, added 134,154 new cases in just one day. While stratospheric, it’s nevertheless close to the lowest number of daily infections the hard-hit country has seen since April 8, according to government data. India’s reported death toll climbed by 2,887 to 337,989, though the true number could be more than ten times that. Meanwhile, the U.S. government said it will send 25 million vaccine doses to countries across Asia, Africa and Latin America, the first time President Joe Biden’s administration has shared shots it could have used at home. Recipients include India, the Palestinian territories and Kosovo. While much of the world is still scrambling to obtain vaccines, the global number of doses administered has now surpassed 2 billion. Here’s the latest on the pandemic.  People wait to receive meals distributed by humanitarian groups in Chennai, India, on May 25. Photographer: Arun Sankar/AFP The White House has pitched Republicans the idea of a 15% minimum tax on U.S. corporations (along with strengthened IRS enforcement efforts) as a way to fund a bipartisan infrastructure package. The proposal sets aside the Biden administration’s proposal to raise the headline corporate income rate to 28% from 21%. Also on Thursday, Biden signed a widely anticipated order amending a ban on U.S. investment in Chinese companies, naming 59 firms with ties to China’s military or in the surveillance industry. Biden’s retreat on corporate taxes wasn’t enough to prop up U.S. equities, which fell Thursday as Wall Street worried that good employment news would spur the Fed to stop throwing its weight around. A report showed payrolls at U.S. firms gained by the most in almost a year, while additional figures on the economic health of the services sector rose to the highest on record. Here’s your markets wrap. Beijing’s crackdown on homegrown tech giants may be coming to an end, according to a portfolio manger at Fidelity International. While probes of billionaire Jack Ma’s Alibaba and Ant Group took three to four months, a second batch of investigations into firms such as Tencent and Meituan may proceed more quickly, indicating the cycle could be wrapping up. The surge in early retirements triggered by the pandemic is increasing inequality among U.S. Baby Boomers.  What you’ll need to know tomorrow

United Airlines Bets Orders Supersonic AircraftIt took a few decades, but faster-than-sound commercial flight is almost all the way back. United Airlines is jumping into the potential market for supersonic travel with the first firm order for Boom Technology’s Overture aircraft, wagering that business flyers will pay top dollar for speedier trips across oceans. The airline will buy 15 of the supersonic jets.  Rendering of the United branded Boom Technology Overture. Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Sign up for Bloomberg CityLab’s most popular newsletter, a weekly digest of what’s trending in the future of cities. |

|

|

|