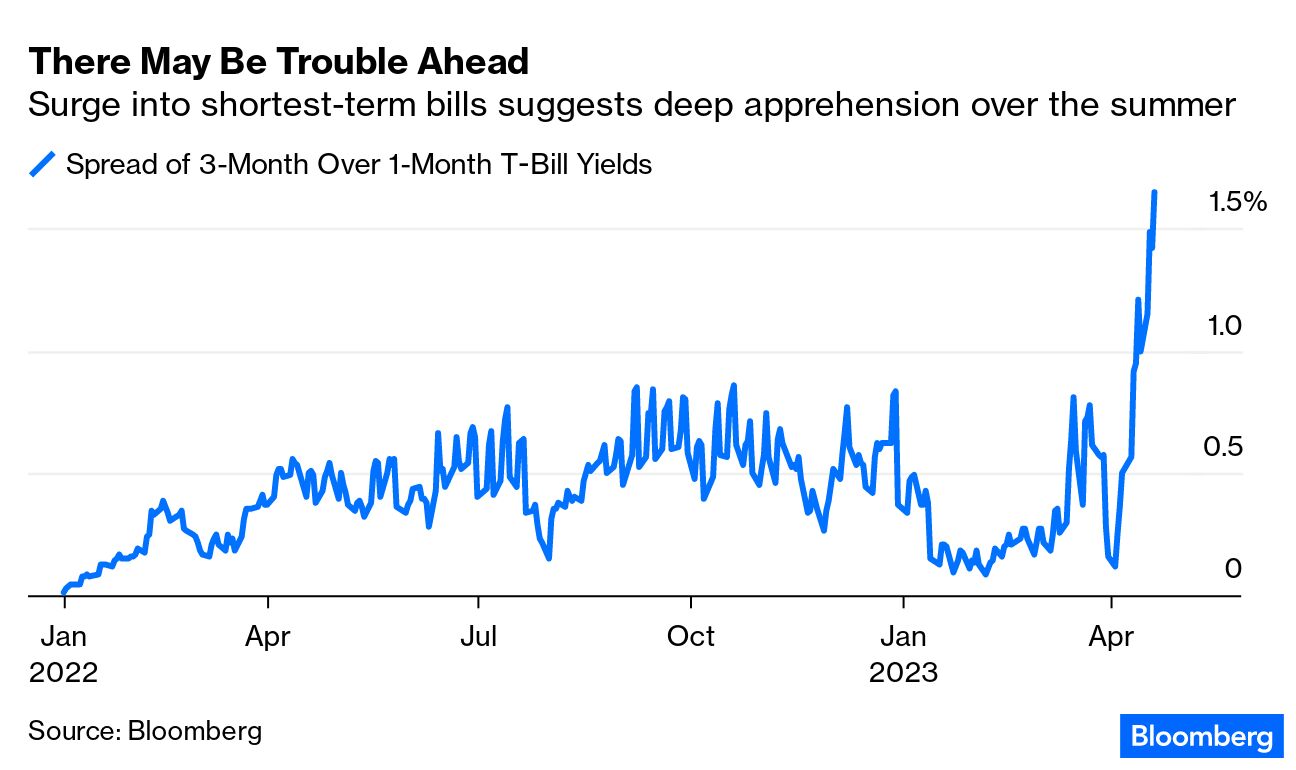

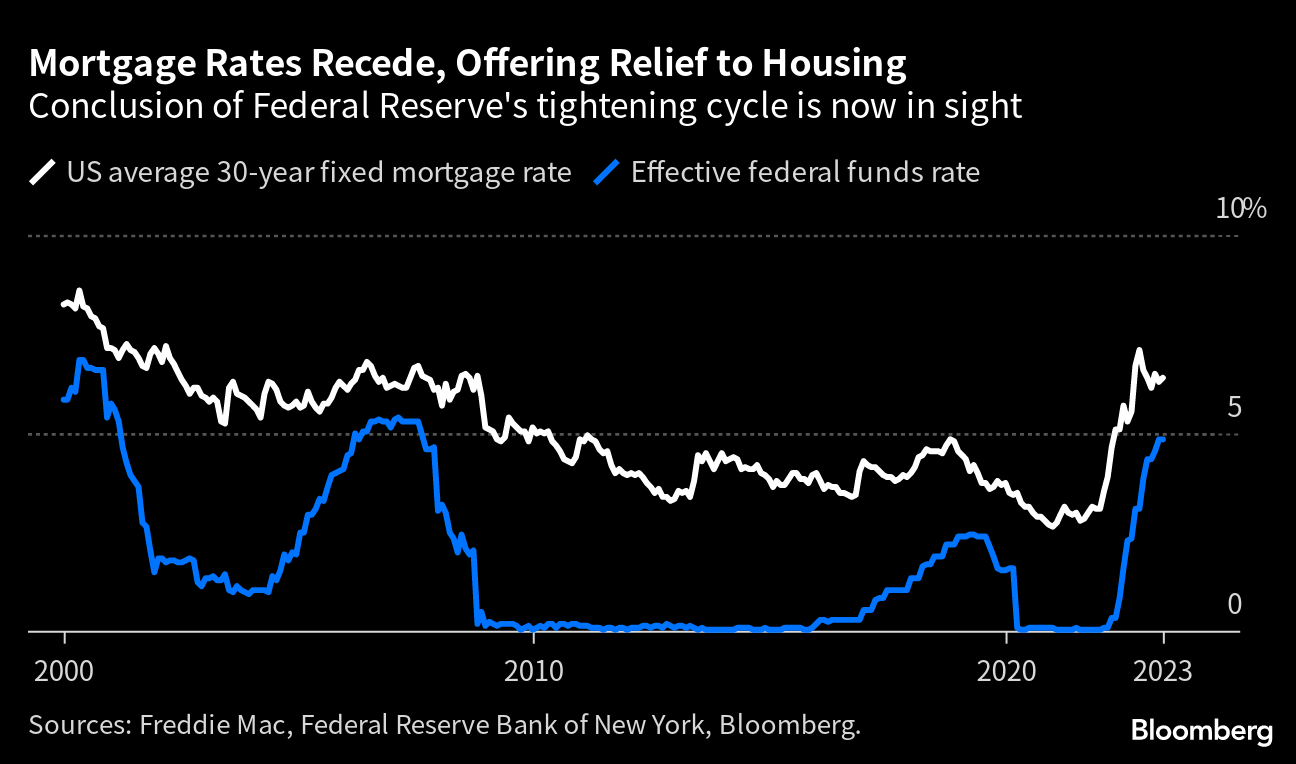

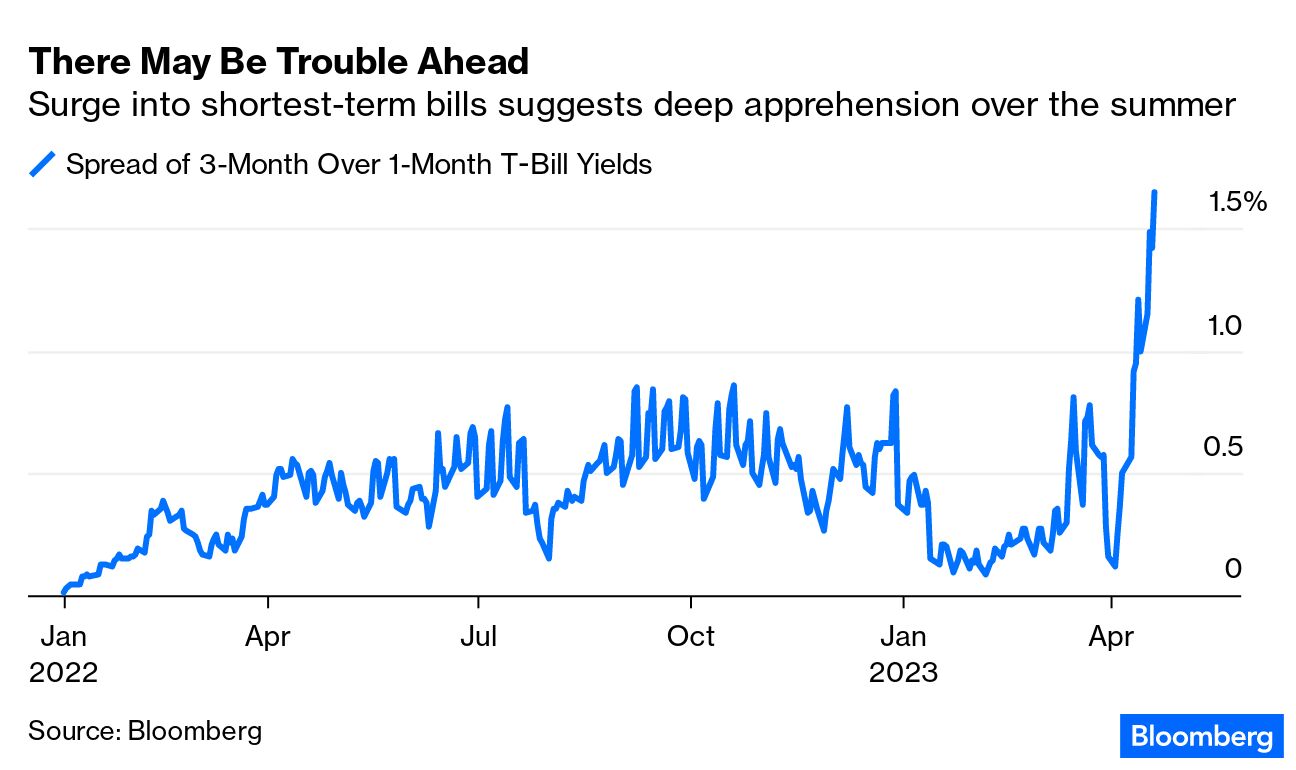

| It’s still April, and by most measures there’s at least a few months left. But the threat of a US default at the hands of a Republican-controlled House of Representatives, and the political war brewing with the White House over the majority’s list of demands, is beginning to manifest itself in markets. House Speaker Kevin McCarthy has linked raising the debt ceiling to major budget cuts Democrats uniformly oppose. First, in a critical vote set for Wednesday, he must face down dissidents in his own party who oppose his bid to slash green tax credits, and others who oppose any compromise at all. The bill would also kill the administration’s student debt cancelation effort and significantly defund education, the White House has warned. The Education Department estimated the GOP bill would cut $4 billion for low-income students, resulting in some 60,000 fewer teachers, and that 7.5 million children with disabilities would lose funding, the equivalent of 48,000 fewer teachers. Some 80,000 fewer college students would receive Pell Grants while the 6.6 million who do would get $1,000 less annually, the administration says.  McCarthy’s bill, given Democratic control of the Senate and White House, is arguably performance art—a first salvo in his bid to get the White House to deal. But regardless of who blinks first, there’s damage being done already. “The debt ceiling offers a classic example of a ‘black swan’ event—extreme but very low-probability,” John Authers writes in Bloomberg Opinion. “Markets are notoriously bad at pricing them, and for most of this year the attitude seems to have been that it’s not worth the effort of even trying.” But last week, that began to change. In the Treasury-bill market, bonds with less than a year to go before they mature are among the safest investments. But the spread of the yield on three-month bills compared to one-month notes has suddenly shot up, Authers says. This only makes sense if investors are worried that something bad might happen to the government’s ability to pay up at some point between one and three months from now. That’s exactly when the debt-ceiling muck is likely to hit the fan. And there are other signs, too. —David E. Rovella The sledding for First Republic is still pretty rough. A day after the regional lender reported earnings that fell far short of analysts’ estimates, there was more troubling news about how the bank plans to dig itself out of the ditch that swallowed three other banks. First Republic is exploring divesting $50 billion to $100 billion of assets, which include long-dated mortgages and securities, in a bid to reduce the mismatch between assets and liabilities. Still, the bank’s shares fell Tuesday by as much as 50%. A selloff in Chinese equities is deepening as a barrage of economic and geopolitical risks stack up, with global funds accelerating their exodus. The MSCI China Index lost as much as 2.6% Tuesday. Foreign investors were net sellers of onshore China shares for a third straight session, while bond yields have dropped. Traders continued to cite geopolitical tensions as a key deterrent even as a consumption-driven recovery takes hold. But even that recovery may come with risks. Chinese leader Xi Jinping had been on a campaign to win hearts and minds across Europe, or at the very least to put some daylight between the continent and their ally across the Atlantics. Then an envoy in France, with just a few words, blew it all up.  Ambassador Lu Shaye Photographer: Martin Bureau/AFP/Getty Images Users put off by Elon Musk’s seemingly haphazard Twitter decisions (among other things) have sought a credible alternative for months, including more staid services like Mastodon. Now some are gravitating to a rival app backed by the Twitter original himself—Jack Dorsey. His invite-only Bluesky app has been downloaded by iPhone users 245,000 times, of which more than half came this month. This year, the app started inviting users from its waiting list—which numbered more than a million people when Musk bought Twitter in October. The severe contraction in the US housing market over the past year looks like it may be coming to an end, and the bottoming-out is raising hopes on Wall Street that the country could avoid a recession altogether. That’s because historically, housing has been a critical driver of the broader business cycle. And with the Federal Reserve expected in most quarters to pause hikes after next month, that bodes well for a rebound. The highest-paying US internships are still in tech, despite the industry’s mass layoffs and shift to austerity in recent months. Fintech firm Stripe and video game developer Roblox topped the list with an average salary of more than $9,000 a month for the temporary, entry-level gigs, which mostly go to college students and recent graduates. That would translate to a wage of about $56 an hour or an annual salary of about $108,000. Harlan Crow doesn’t know why anyone would question his friendship with Associate Supreme Court Justice Clarence Thomas. The real estate mogul has said he’s never tried to influence Thomas and the Supreme Court hasn't directly taken up cases that affect Crow or his business. But that claim downplays the scope of Crow Holdings, the real estate empire where he serves as chairman and manages $29 billion, with assets spread across the US. It’s among the nation’s biggest apartment developers, a major player in the booming warehouse business, and the operator of an office park that caters to the richest, most powerful families in Dallas.  While Harlan Crow isn't a household name, in Texas and in the moneyed circles of Dallas, his family's influence runs deep. Photographer: Christopher Goodney/Bloomberg Mercedes-Benz Group AG unveiled a revamped version of its best-selling E-Class sedan in a crucial test for the German automaker’s push further upmarket. The new E-Class, the brand’s most popular model for decades, will hit showrooms this fall. The manufacturer wants to boost the average selling price of the mid-size vehicle that currently starts at around €50,000 ($55,140) by a full quarter as Chief Executive Officer Ola Källenius tries to fund a costly shift to electric cars.  Mercedes-Benz E-Class AMG line Source: Mercedes-Benz Group Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Transformation in a Time of Uncertainty: Join us in a city near you for Bloomberg’s Intelligent Automation briefing. Top business and IT executives are gathering to explore ways to offset economic pressures and help organizations thrive by enhancing operational efficiencies. Roadshow cities include New York on May 4; San Francisco on June 20; London on Sept. 20; and Toronto on Oct. 19. Register here. |