| *past 24-hour performance |

| | PepsiCo raises outlook: PepsiCo (PEP) reported Q3 earnings and revenue that exceeded expectations, prompting the company to raise its full-year earnings outlook. (CNBC)

IMF inflation forecast: The International Monetary Fund has raised its global inflation forecast for next year to 5.8%, advising central banks to maintain tight monetary policies. (Bloomberg)

LuluLemon rival IPO: Activewear brand Vuori is talking to investment banks about an IPO as soon as 2024. The apparel company would seek an IPO to top its $4 billion valuation from 2021. (Business of Fashion)

Huawei not impacted by sanctions: After stockpiling components for months, Huawei aims to ship 60M to 70M phones in 2024, doubling shipments from 2023 and 2022, despite the US crackdown. (Nikkei)

BIRK IPO: Birkenstock has priced tomorrow’s IPO at $46 per share, a price near the middle of the targeted range, as the company chooses to play it safe given the choppy market. (WSJ)

Major oil deal rumors: Exxon Mobil (XOM.N) is in talks to pay more than $250 per share by Wednesday for Pioneer Natural Resources (PXD), according to a person familiar with the matter. (Reuters)

Samsung is hurting: Samsung Electronics expects its Q3 operating profit to fall 78% from a year earlier as its flagship semiconductor business is still struggling to exit an industry downturn. (Marketwatch)

Crisis at Country Garden: Chinese property giant Country Garden failed to repay a $7.74M loan and is expected to default on its U.S. dollar bonds and other offshore debt obligations (WSJ)

| | | Oaktree: Why danger of a hard landing still lurks: For more than a year, investors have been hopeful that the Fed will be able to bring inflation down, and guide the economy toward a soft landing. Oaktree Capital’s incoming co-CEO Armen Panossian is skeptical about investors’ rosy expectations, though. Read more » | Why don't you just sell all your stocks and buy ETFs, you'll probably have better performance?: There is no denying the appeal of the stock market. It promises untold riches for everyday Joes that happens to stumble across the next hundred-bagger. Nevertheless, the odds are not in your favor. Read more » | These stocks are screaming recession. It’s almost time to buy them: However magnificent the “Magnificent Seven” tech titans might be, it is probably time for investors to look past them—way past. Of the 3,000 companies that make up virtually all of America’s stock market, an index representing the most valuable one-third, the Russell 1000, is looking healthy again. Read more » |

|

| | New York’s Airbnb ban Is descending into pure chaos (Wired) Trump’s team is quietly preparing to go on offense against RFK Jr. (Semafor) Disney+ censoring classic Disney cartoons to reflect modern sensibilities (Boing Boing) EV buyers can get $7,500 tax credit starting in 2024 (WSJ) Early tech adopters are investing in a new toy: solar-powered electric yachts (CNBC)

| | | | | If you're concerned about the direction of the US economy… | You need to see this guide on how to diversify and protect your retirement savings. In it, you’ll learn how to protect yourself from surging National Debt... a weakening U.S. Dollar... stock market downturns... and much more. Get your guide here. | SPONSOR |

| |

| | |

| |  | Will Manidis @WillManidis |  |

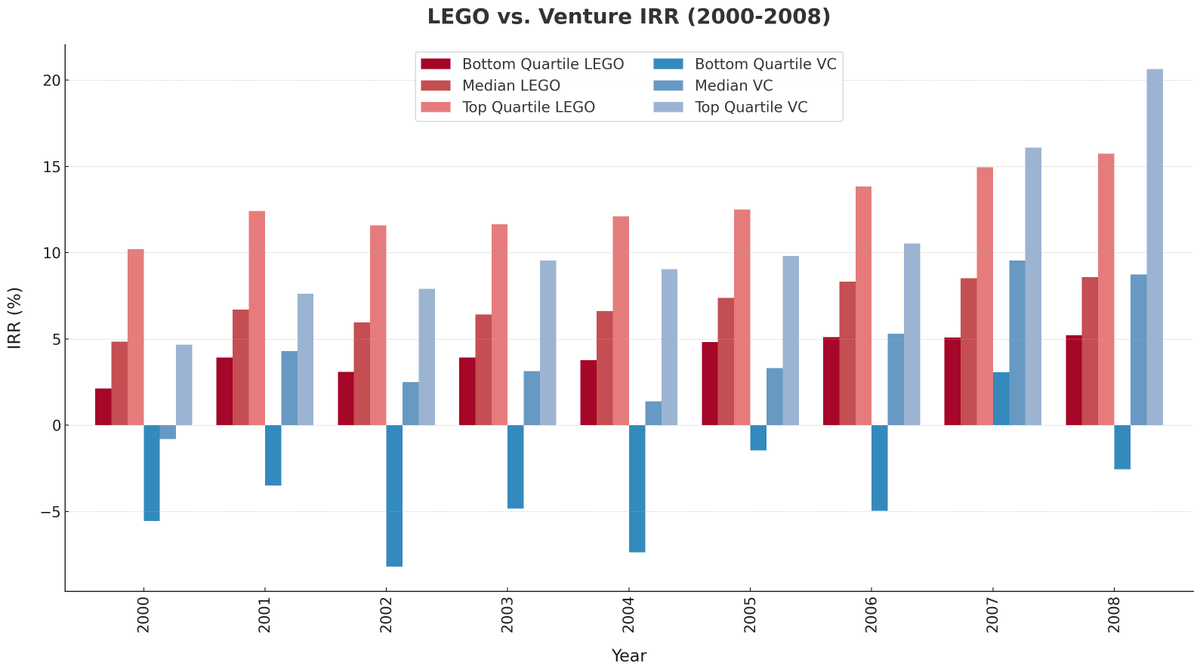

| You can outperform most venture funds by buying LEGO. I analyzed the last 20 years of secondhand LEGO pricing data, and found randomly purchasing sets will match most VC's returns if you're somewhat intentional about what you buy-- you massively outperform even the best firms |  | | | Oct 3, 2023 | | |  | | | 11K Likes 1.32K Retweets 255 Replies |

|

| | | Thunderclap Research is a professional investment research firm focused on understanding and profiting from market anomalies. | We take both a quantitative and qualitative approach to research and focus extensively on strategies for established money managers and everyday retail investors. | We are a small, self-funded team of real humans going up against the hype-filled, sensational news outlets in the world. You can check out a selection of our other publications below. | | CoinSnacks Digestible crypto news. | | Subscribe |

| | Gold Playbook All your gold investing news in a single daily email. | | Subscribe |

| |

|