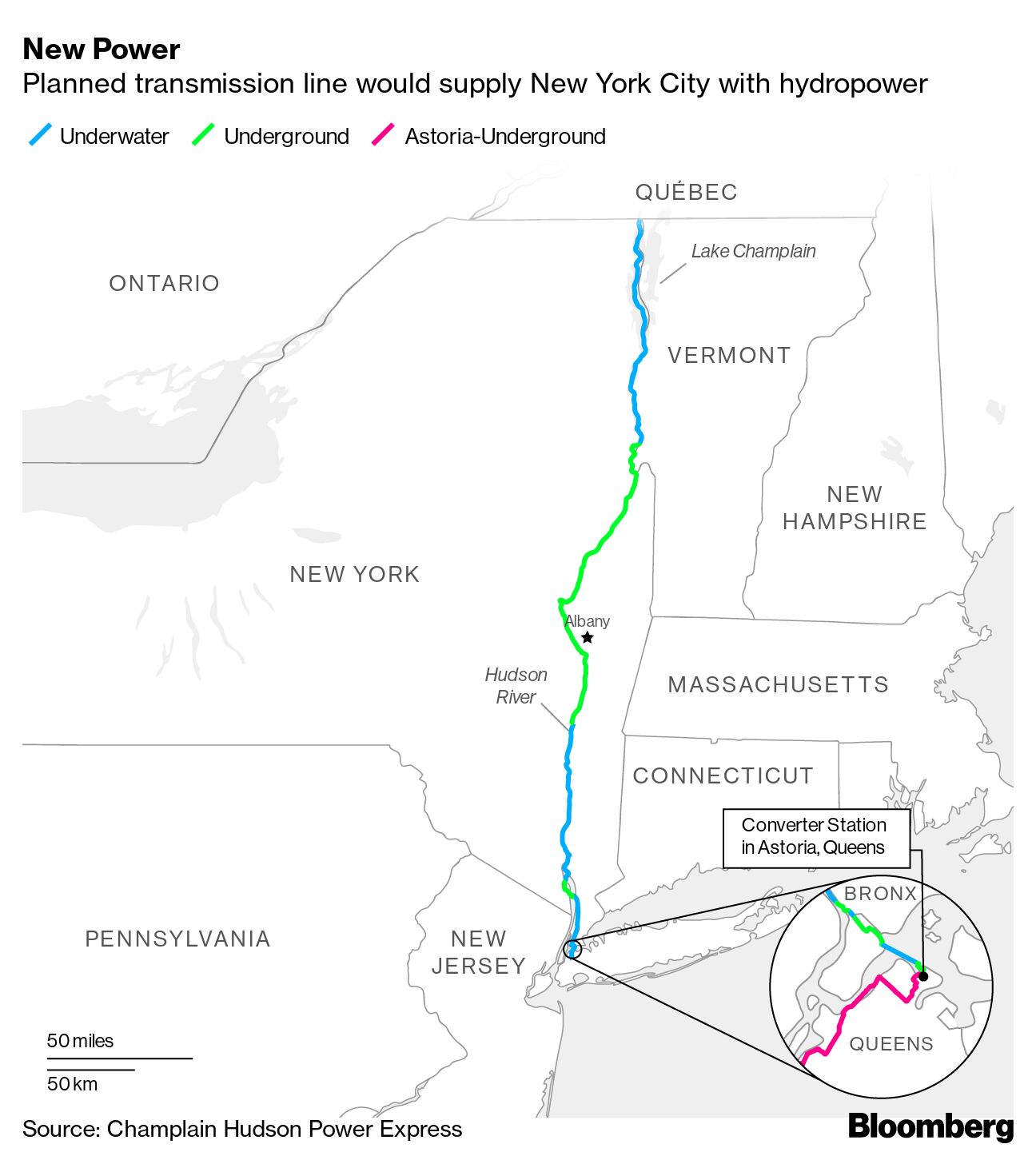

| The potential for a major escalation in Vladimir Putin’s war on Ukraine is being telegraphed by a rush to hold what NATO and Kyiv officials call sham referendums in occupied areas of the east and south. As Putin’s forces have been pushed back, aides have urged him to claim parts of Ukraine as Russian territory, like he did with Crimea. Announcements of votes in the coming days were made just as measures unveiled in Moscow point to a potential mass mobilization that could follow. Experts warn that Putin may label future efforts by Ukraine to recapture annexed territory as war on Russia itself, helping boost Russian public support for a call-up to supplement his battered forces. It would also free him, under Russia’s own rules, to consider the use of nuclear weapons, a level of brinkmanship that could lead to negotiations—or confrontation. For now, NATO Secretary General Jens Stoltenberg said at the United Nations General Assembly in New York that “such sham votes, referendums, do not have any legitimacy, and therefore they do not change the nature of the conflict.” NATO and its partner countries “have to support Ukraine for as long as it takes, because the alternative is much more dangerous for all of us. As for using weapons of mass destruction, US President Joe Biden warned of a “consequential” response should Putin take such a grave step. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. Federal Reserve officials are about to put numbers on the “pain” they’ve been warning of in recent weeks when they publish new projections for the US economy. The central bank will release its latest quarterly projections Wednesday following a two-day policy meeting where officials are expected to raise their benchmark rate by three-quarters of a percentage point for the third time in a row. The world’s youngest leader sounded the alarm on social unrest, warning that discontent that explodes in one place can be repeated anywhere. In a passionate speech calling for more government accountability, Chilean President Gabriel Boric told the UN General Assembly that demonstrations in 2019 which led to dozens of deaths and destroyed infrastructure were triggered by years of injustice. Outrage over inequality and poor basic services, he warned, can lead to uprisings in other countries.  Gabriel Boric speaks during the United Nations General Assembly on Sept. 20. Photographer: Michael M. Santiago/Getty Images Private equity firms are supposedly masters of the business universe, spotting the hottest trends and giving survival tips to portfolio companies during downturns. But do they know how to manage their own cash flows? At a few firms, there’s a whiff of desperation. Fifty miles south of midtown Manhattan, in a red-brick building bounded by a railway track, sits the little-known brokerage behind some of the world’s wildest initial public offerings. It’s underwritten six US microcap IPOs this year that surged by an average 2,190% on their first day of trading. That’s more than 250 times the performance of offerings underwritten by Goldman Sachs, JPMorgan and Morgan Stanley. Blackstone is amassing $7 billion in new funding for a long-planned transmission line that will deliver Canadian hydropower to New York City. Italy’s right-wing coalition is trying to mollify nervous investors, pledging it wouldn’t seek an overhaul of the country’s plan for spending European Union recovery funds if it takes power. Hungary meanwhile contends it’s prepared to meet EU demands that it take action to curb fraud and corruption after the bloc threatened to freeze 7.5 billion euros ($7.5 billion) of funds earmarked for the country. Six years ago, a little-known textile maker called Shandong Ruyi Group embarked on a frantic, $3 billion buying spree with the goal of becoming China’s version of luxury powerhouse LVMH. It didn’t work out.  Qiu Yafu in Hong Kong in 2018. Photographer: Anthony Kwan/Bloomberg - Russian seaborne oil shipments are dropping, and part of it’s a mystery.

- Bloomberg Opinion: A new set of housing winners and losers emerges.

- Bloomberg Opinion: Regulators, don’t let crypto winter go to waste.

- “Dr. Doom” economist Nouriel Roubini just made a prediction.

- US builders shift to apartments as mortgage rates deter homebuyers.

- A Tesla battery fire shuts down California’s iconic coastal highway.

- Joe Manchin was the man at the center of it all. Now he’s in a vise.

One of the bigger hurdles to virtual reality going mainstream has been a lack of hit content. At the same time, its biggest proponent—Mark Zuckerberg of Facebook fame—has lost lots of face and a ton of money trying to promote his so-called Metaverse. There may be a solution though. While VR and sports have always seemed like polar opposites, companies in Silicon Valley and elsewhere are trying to change that, using virtual sports platforms to drive adoption of this new world. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Invest Summit NYC: Join us Oct. 12-13 in New York as we bring together the most innovative and influential figures to explore the rapidly changing financial landscape. Powered by Bloomberg’s unrivaled data, this annual event brings together global perspectives in a dynamic networking environment. Sign up today. |