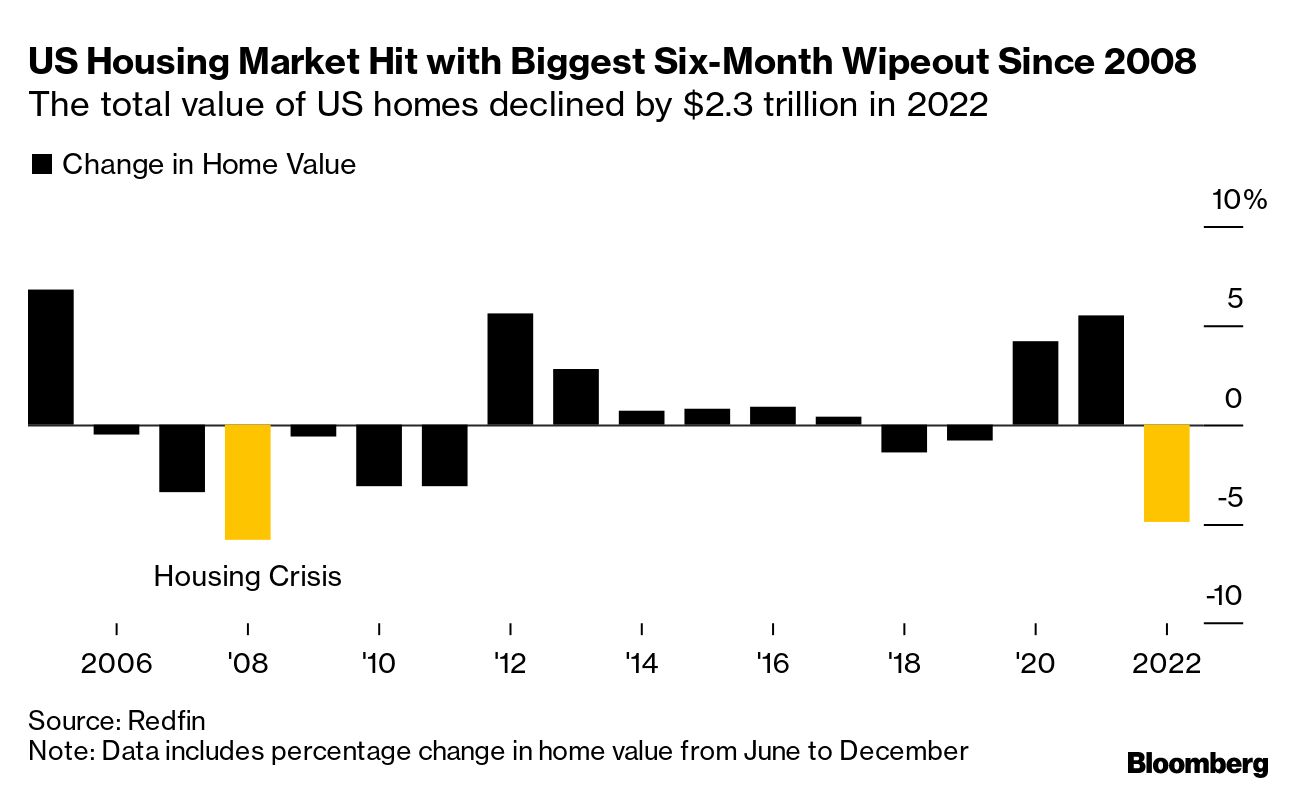

| Not a surprise but at least it’s on paper. Minutes of a recent meeting of US Federal Reserve officials show they foresee further rate hikes, with most—but not all—supporting a slower pace. What the Fed seems most worried about these days is less the vicissitudes of inflation and more the ticking time bomb of Congressional brinksmanship. Policymakers appear increasingly concerned about the potential for prolonged partisan warfare over the debt limit to disrupt the economy and financial markets. As the new Republican-controlled House of Representatives tries to muscle Joe Biden into spending concessions (the president in his State of the Union address called out now-walked back GOP proposals to sunset Social Security and Medicare), the Treasury Department is already applying special accounting measures to make payments. But time is slowly running out, and the central bank is getting a little nervous. Here’s your markets wrap. —David E. Rovella Apollo Global Management is said to be in talks to inject $750 million to support the leveraged-finance business of Credit Suisse Group’s investment-banking spinoff, First Boston. Apollo’s commitment may be matched by the Zurich-based lender, giving the unit roughly $1.5 billion in capital. The US housing market shrunk. By a lot. After peaking at $47.7 trillion in June, the total value of homes declined by $2.3 trillion, or 4.9%, in the second half of 2022. That’s the largest drop in percentage terms since the 2008 housing crisis. An investment firm that was once part of Microsoft co-founder Paul Allen’s family office is now targeting private credit. The firm formerly known as Vulcan Capital was spun out of the late billionaire’s family office in late 2021 as a standalone business catering to the world’s super-rich. Apple has a moonshot-style project underway that dates back to the Steve Jobs era: noninvasive and continuous blood glucose monitoring. The goal of this secret endeavor is to measure how much glucose is in someone’s body without needing to prick the skin for blood. Such a breakthrough would be a boon to diabetics around the world—and help cement Apple as a powerhouse in health care.  An Apple Watch Series 8. A new project could add glucose monitoring to the gadget’s capabilities. Photographer: Jeenah Moon/Bloomberg Scientists are making custom 3D-printed replicas of human hearts in an effort to improve replacement valve procedures, according to a study that holds promise to optimize the life-saving technology used in thousands of patients annually. Chinese authorities have urged state-owned companies to phase out using the four biggest international accounting firms, signaling Beijing’s worries about data security even after it reached a landmark deal to allow US audit inspections on hundreds of Chinese firms listed in New York. Despite Vladimir Putin’s proclamation Tuesday that it’s “impossible to defeat Russia on the battlefield,” there’s no question the last 12 months have been terrible for his country. In fact, Russia hasn’t just had a disastrous year, James Stavridis, former supreme allied commander of NATO, writes in Bloomberg Opinion. It’s had a few bad centuries.  Vladimir Putin, right, meets Wang Yi, China’s top diplomat, at the Kremlin on Feb. 22. Photographer: Anton Novoderezhkin/AFP Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. Watchfinder, the online pre-owned watch-selling platform, has dropped its prices by about 15% as valuations of used Rolexes and other top models decline. After an unprecedented surge in 2021 and early 2022, prices for the most desired Rolex, Patek Philippe and Audemars Piguet models have been plummeting, thanks in part to higher interest rates and the collapse of crypto currencies.  Photographer: Betty Laura Zapata/Bloomberg Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. The Bloomberg Invest series returns to London on March 22, gathering leading thinkers in investing to identify the biggest risks and greatest opportunities facing those in the region. Join in London or online to hear from executives from Blackstone, QuantumLight, and Sotheby’s. Register here. |