|

|

To investors,

The promise of crypto was that decentralization would rule the day. The story was centralized institutions had overreached and now we needed a new ownership or governance model in order to fully capture the potential of the internet.

Bitcoin’s launch marked the creation of the first mass market asset that found product-market fit. Decentralized money has a very large addressable market and it is encouraging to see hundreds of millions of people adopting the technology globally.

The second big wave came from smart contract platforms. Although there is debate around how decentralized Ethereum, Solana, or any other platform may be, it is hard to argue that these technology stacks are not more decentralized than the traditional technology industry provides. There are more than 260 million unique address on Ethereum currently. It is estimated the network has more than 500,000 daily active users and over 100 million people hold Ether, the chain’s native cryptocurrency.

So where is the third major area of innovation and adoption going to come from?

The short answer is that no one can predict the future perfectly. We don’t know. But there is something very interesting happening with exchanges at the moment. First, Uniswap is estimated to have over 2.5 million monthly active users. These users conduct billions of dollars in transactions per day across various blockchains.

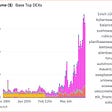

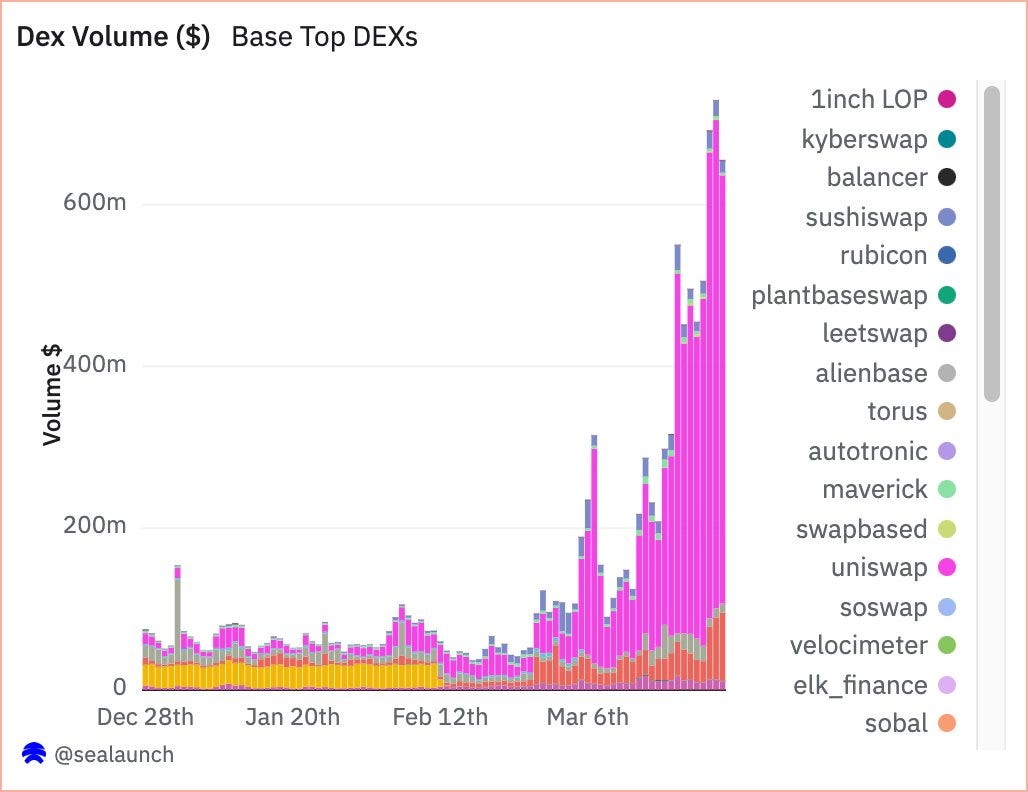

For example, you can see Uniswap’s activity on Base, the new blockchain from Coinbase, has been skyrocketing.

Volume on the decentralized exchanges built on top of Base look exactly how you would want them to look if you were trying to find product-market fit.

This is an important development because Coinbase, one of the most popular centralized exchanges, has apparently realized they can be a major player in the decentralized game as well.

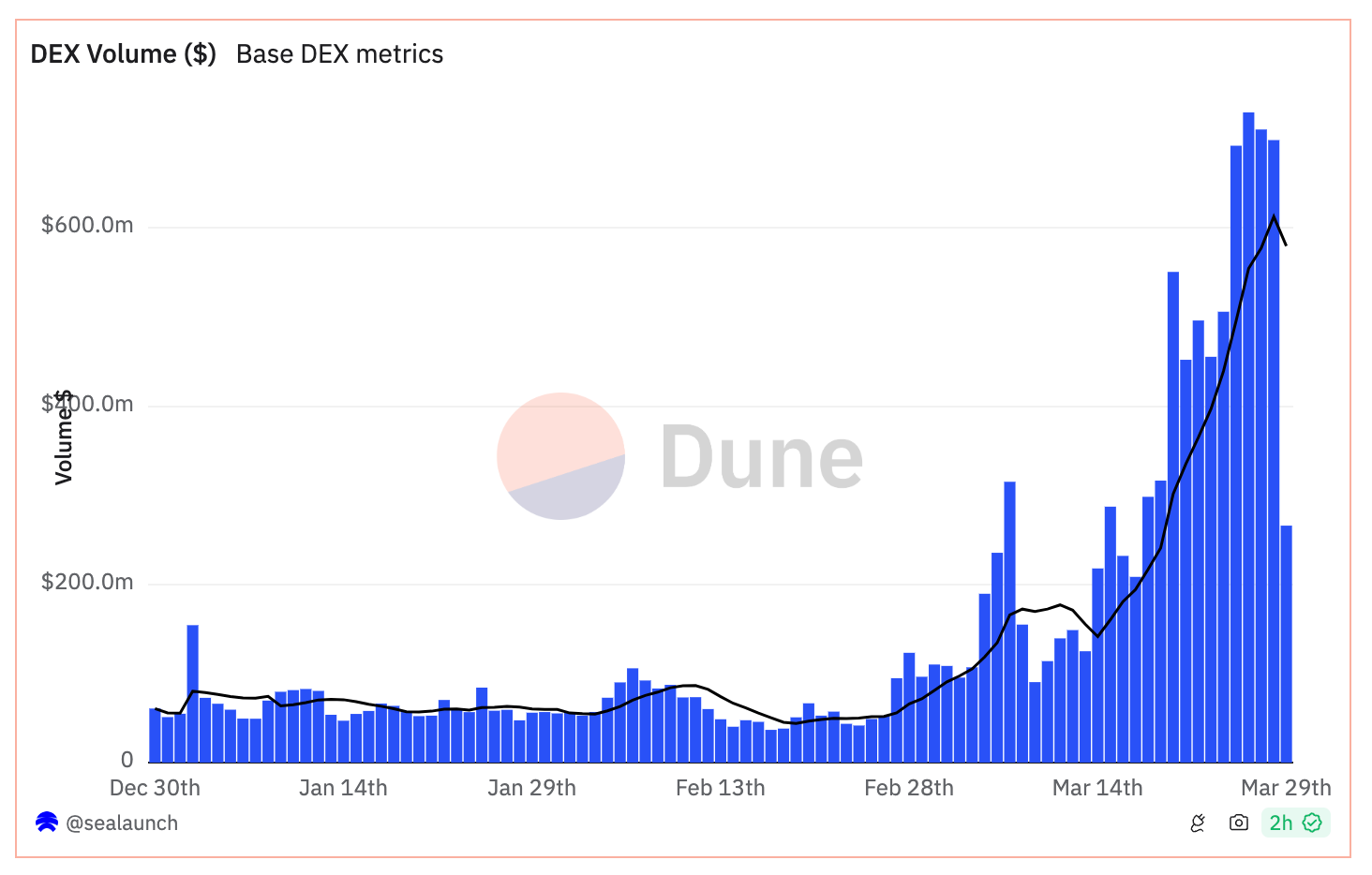

Coinbase is not doing this merely out of the goodness of their heart though. On one hand, a decentralized offering allows them to become more crypto native and resilient as regulators around the world put more pressure on them. On the other hand, Coinbase stands to make a lot of money if this is successful. According to Defi Llama’s 0xngmi, it appears Base is already on a $500 million annualized run rate and continuing to accelerate.

Coinbase and Base are not the only players in town though. Last night ShapeShift founder Erik Vorhees explained how successful their transition from a centralized player to a decentralized front-end for DEXs has been:

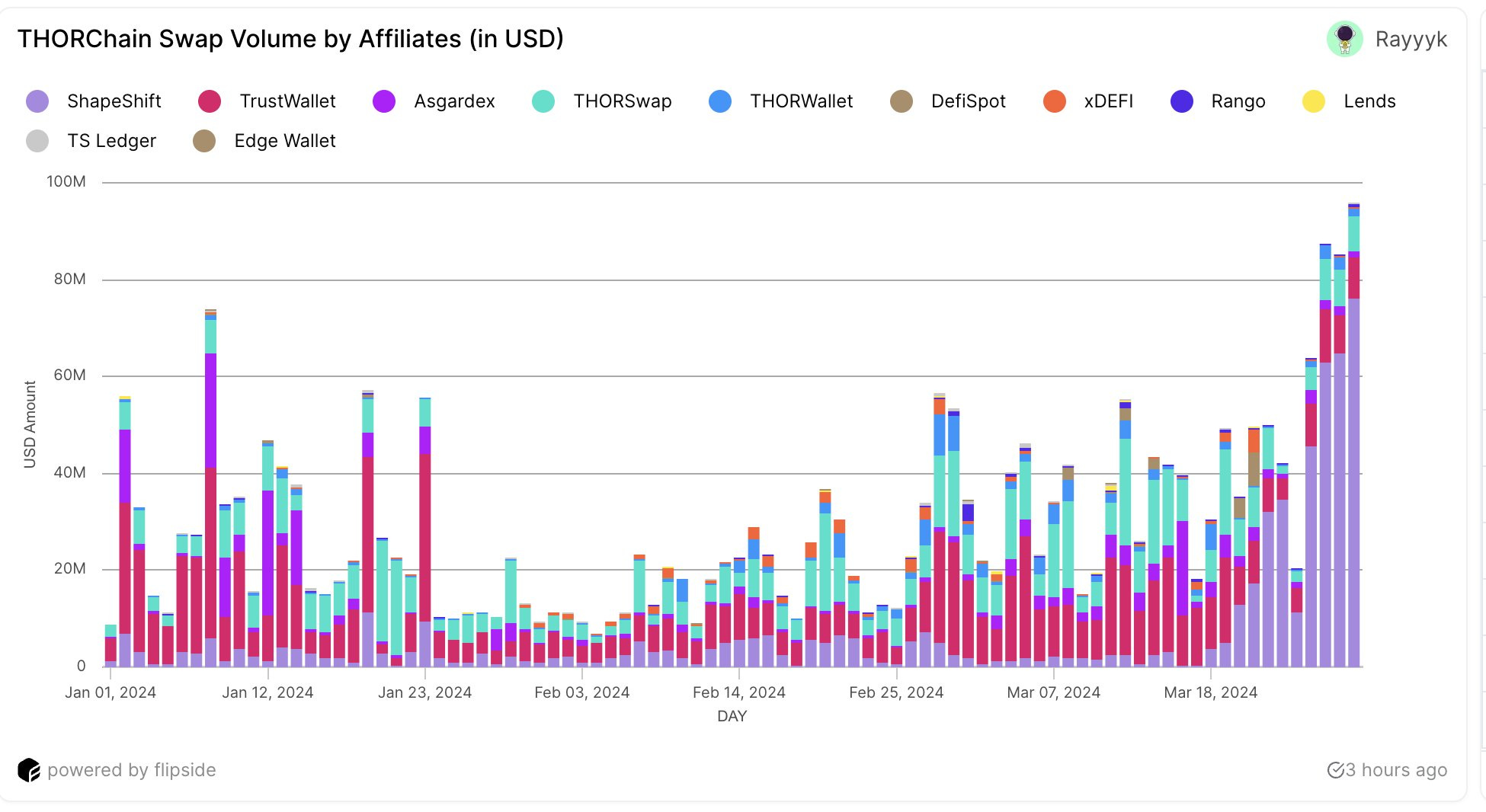

“Six years after ShapeShift's business collapsed under an onslaught of state tyranny, its transformation into a decentralized, open-source project has proven effective. Over the last month, huge trade volumes surging through ShapeShift helped carry Thorchain's monthly volume over $10 billion.

All of it permissionless and non-custodial; a beautiful resurrection of the dream that began way back in 2014 when we processed our first BTC to LTC trade without custody in the wake of the MtGox collapse. All credit for the recent resurgence belongs with the ShapeShift DAO, of which I am only a grateful observer and occasional participant.

Thank you guys. And thank you ThorChain for your resilience and ambition in building the most impressive DEX aparatus in all cryptoland. Despite every setback, crypto is relentlessly working, and the saddened defenders of those fiat ramparts have but years of decay ahead, while a more virtuous civilization builds justly upon their ruins.”

These decentralized exchanges are seeing big trading volumes. The underlying blockchains are becoming very interesting pieces of infrastructure that can’t be ignored. The front-end affiliates are driving adoption at a pace that industry leaders previously dreamed of.

It is too early to claim victory, but the recent developments signal a growing adoption of decentralization outside of just bitcoin and smart contract platforms. If the trend continues, the promise of crypto related to decentralization will be one step closer to coming to fruition.

Pretty cool to see.

Hope you all have a great end to your week. I’ll talk to everyone on Monday.

-Anthony Pompliano

Mike Novogratz is the Founder & CEO of Galaxy Digital. This conversation was recorded at Bitcoin Investor Day in New York.

In this conversation, we talk about the macro environment, bitcoin, political overlay, regulation, what Galaxy is doing, and how Mike sees the next couple months playing out.

Listen on iTunes: Click here

Listen on Spotify: Click here

Mike Novogratz Explains Why Bitcoin Keeps Going Up

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.