|

|

Decline in commodity prices once again led by drop in oil

|

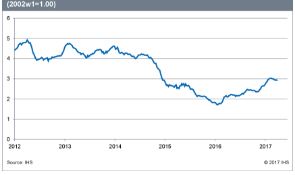

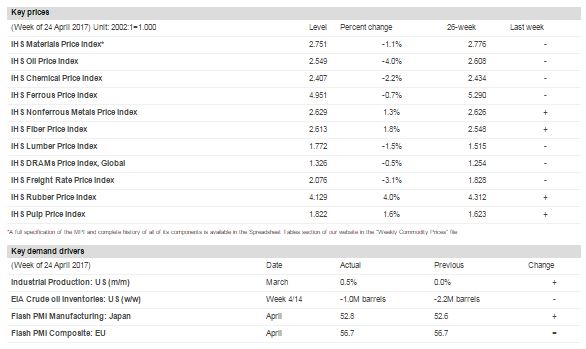

The IHS Materials Price Index (MPI) dropped 1.1% last week, marking its seventh decline in the past 10 weeks. Since hitting a high in mid-February the MPI has now fallen 10.3%. Although some of the anxiety in commodity markets has receded since the first-round election in France and the release of the Trump administration's outline for tax cuts, the optimism of the fourth quarter has not returned.

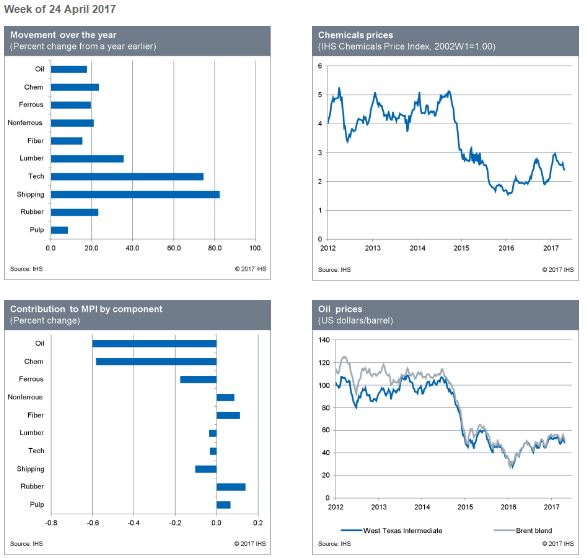

Oil led the MPI lower last week, dropping 4.0%, even though it is now widely expected that OPEC will extend its production agreement. Related to the softness in oil, chemical prices also declined by 2.2%. Additionally, lumber prices continued to experience some giveback after the record price increases earlier this month, falling 1.5%. Rubber prices showed strength last week, increasing by 4.0%.

Data releases last week remained mixed. US real GDP grew by an annualized rate of only 0.7% in the first quarter, the weakest in three years, although some of the softness was tied to residual seasonality. German retail sales held up nicely in March, however, once the timing of Easter is taken into account. In contrast, Chinese industrial profit growth slowed in March while mortgage rates moved higher in April. Further credit tightening in China represents a headwind for both industry and real estate markets as 2017 progresses. Likewise, higher US interest rates present a challenge for commodities as fixed-yield asset classes become more attractive. While an improving global outlook means the MPI's current correction will soon have run its course, tighter monetary policies in these two key economies suggests support for prices rather than real pressure going forward.

|

| | IHS Materials Price Index |  |

|

| |

| Market Insight

For an overview of the IHS Materials Price Index, view this video.

|

|  |

| | |

|

| Industrial Materials: Prices |  |

| Key Prices & Demand Drivers |  |

Construction Costs Rise for Sixth Consecutive Month in April

| | According to IHS Markit and the Procurement Executives Group (PEG), construction costs rose in April on price strength in materials and equipment. |

The headline IHS Markit PEG Engineering and Construction Cost Index registered 57.0 in April, the sixth consecutive month of rising prices, and up from the 53.9 reading in March.

Carbon steel pipe had the largest increase in the materials/equipment index this month when compared to March as higher steel input costs and better demand prospects pushed steel pipe prices higher. “Higher steel input costs and better demand prospects are pushing steel pipe prices higher and will cause prices to escalate further over the next several months. Pipe imports have increased in response to rising demand and they will continue to trend upward and maintain a sizeable share of the market,” said Amanda Eglinton, senior economist at IHS Markit.

| | Learn More |

|

| About IHS Pricing & Purchasing | | The IHS Pricing & Purchasing Service | The IHS Pricing & Purchasing Service enables supply chain cost savings by providing timely, accurate price forecasts and cost analysis. Armed with a better understanding of suppliers' cost structures and market dynamics, organizations can effectively negotiate prices, strategically time buys, and boost the bottom line.

With a database of more than 80,000 historic prices and thousands of price, wage and input cost forecasts, IHS offers more coverage than any other provider in the market. IHS has been providing forecasts of key commodity, labor, and input costs since 1970 -- helping define the purchasing advice industry. | | Learn More |

|

| Commodity Price Forecasts & Supply Chain Cost Benchmarking. Learn More | | |

|

|

|