| View in browser |

|

| |

| President Joe Biden sought on Monday to reassure markets and consumers that any collateral damage from the implosion of Silicon Valley Bank would be limited. As the government emphasized no taxpayer dollars would be used to clean up the mess (thus obviating any use of the word “bailout”), he also promised to hold responsible those behind the collapse of SVB as well as Signature Bank, whose crypto industry ties may have led to its undoing. “Americans can have confidence that the banking system is safe. Your deposits will be there when you need them,” Biden said at the White House. So who is to blame? The SVB failure has many pointing fingers at Donald Trump-era deregulation. Eight years ago, SVB Chief Executive Officer Greg Becker urged Congress to pass legislation that would let his firm skate on all the work that comes with stress tests and resolution plans. Legions of executives from other regional lenders made a similar case. Eventually, they got their wish. With more than a few Democrats joining Republican majorities in backing the measure, Trump in 2018 signed a law that allowed mid-sized banks like SVB to skirt some of the strictest post-financial crisis regulations. “We’ve known since 2008 that stronger regulations are needed to prevent exactly this type of crisis,” said Democratic Representative Ro Khanna, who represents Silicon Valley. “Congress must come together to reverse the deregulation policies that were put in place under Trump.” The policies Democrats want to reanimate stem from the famous Dodd-Frank bill that arose from the ashes of 2008. One of the deeper ironies of today’s news is that Barney Frank—the Frank in Dodd-Frank—helped oversee Signature Bank.

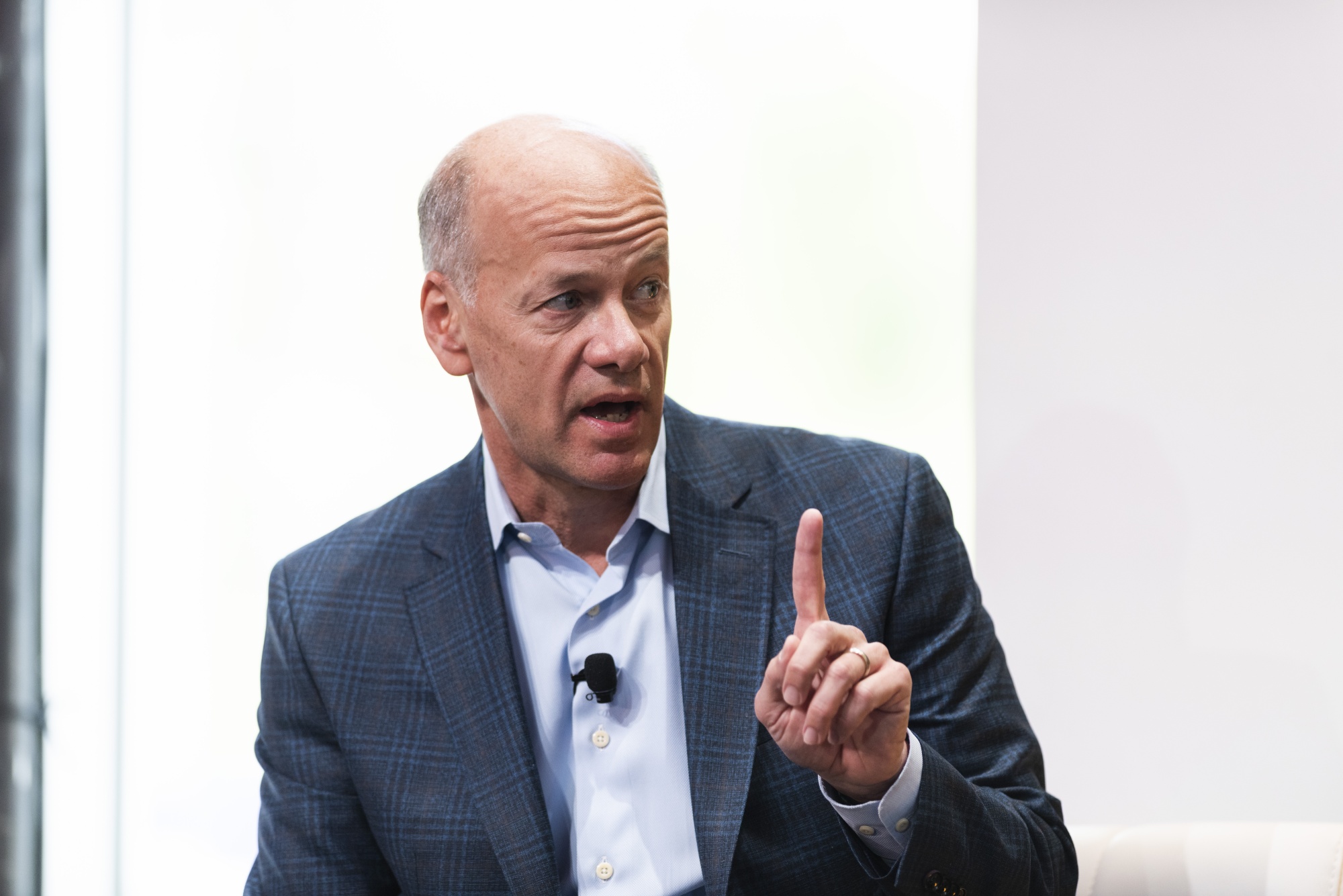

Markets went for a wild ride Monday but ended up mostly where they started—except for bank stocks, which cratered. The yield on the two-year Treasury note plunged in its biggest one-day slump in decades while tech stocks rebounded from last week’s rout. And potential good news for investors: Maybe Fed interest rate hikes will be put on ice. Wall Street traders looking at market charts in the months ahead won’t have any trouble pinpointing the very moment SVB blew up. Worries about banking sector stability and new Fed policy headaches have sparked dramatic moves across everything from bond yields and financial stocks to haven trades like gold. Here are six charts that show the shock of SVB’s collapse. SVB was hit with the first of what will likely be many securities-fraud lawsuits by shareholders. The securities class action was filed on behalf of Chandra Vanipenta, who bought SVB shares at what he argues were artificially inflated prices due to false statements made by CEO Becker and Chief Financial Officer Daniel Beck.  A Brinks armored truck in front of Silicon Valley Bank headquarters. Photographer: Justin Sullivan/Getty Images Trouble at SVB (and Silvergate, and Signature, and First Republic) may be signaling a reckoning for California. Politicians and executives scrambled over the weekend to contain the broader fallout for the state’s economy. But the damage caused by SVB’s collapse has already spread beyond Silicon Valley, where it counted half of all US venture capital firms as clients, to other important California industries, including cleantech companies and wineries. Texas federal judge Matthew Kacsmaryk tried to keep secret a hearing on the so-called abortion pill. Anti-abortion groups have asked Kacsmaryk to reverse longstanding government approval of the drug, mifepristone. Kacsmaryk, who has been criticized by Alliance for Justice President Nan Aron as someone who “harbors strong hostility” to women’s rights, reportedly asked lawyers in the case to keep details of a coming hearing private so he could delay publicizing it. A group of media companies called the Trump appointee’s plan unconstitutional. The lawsuit is widely seen by legal experts as specious, but Kacsmaryk could nevertheless bar the sale of the pill nationwide while the case proceeds. Any appeal would go to the US Court of Appeals for the Fifth Circuit, one of the most conservative in the nation. Following the outcry, Kacsmaryk on Monday reversed himself and made the hearing date public. It’s on Wednesday.  Matthew J. Kacsmaryk during his nomination hearing before the Senate Judiciary Committee in Washington in 2017. Source: US Senate Judiciary Committee Trump and Ron DeSantis see schools as the path to a 2024 Republican presidential nomination. The hopefuls are competing over issues like sex- and health-education classes, gender identity in team sports and how far to go in striking diversity programs and banning books from schools, state colleges and universities. When Microsoft invested $1 billion in OpenAI in 2019, it agreed to build a massive, cutting-edge supercomputer for the artificial intelligence research startup. The only problem: Microsoft didn’t have anything like what OpenAI needed and wasn’t totally sure it could build something that big in its cloud service without it breaking. Tired of attending useless meetings? Turns out, your boss is probably sick of them, too. Executives spend an average of 25 hours a week in meetings, yet nearly half of those Zoom calls and project updates could disappear without any negative impact. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates.

Spring is the perfect time to plan a getaway to the British countryside. The fresh weather encourages exploration of historic stately homes, buzzing seaside towns, verdant natural attractions, gastropubs with world-class chefs and green rolling hills as far as the eye can see. This year, from southwest England up to the Isle of Skye, there are some very exciting arrivals in the hospitality space. The openings come as travelers are increasingly choosing to stay in the UK for vacations, due to the cost-of-living crisis and a desire to avoid chaos or strikes at airports. Here are six of the best new places to stay.

| |||||||

| Follow Us | ||||

|

|

|