|

| The Weekend Edition is pulled from the daily Stansberry Digest. The Digest comes free with a subscription to any of our premium products.

| ||||||||||

| Whether a serious bear market begins later this year as our founder Porter Stansberry has warned... or the "Melt Up" runs for another 18 months or more as our colleague Steve Sjuggerud has predicted... we believe stock market volatility is likely to remain elevated in the months ahead. In fact, as Steve has pointed out, the last Melt Up in the late 1990s saw market-leading tech stocks soar more than 200% over the last year and a half of the rally. Yet these same stocks fell roughly 10% – similar to the sharp correction we've seen this year – on five separate occasions over that time. And along the way, the market's "fear gauge" – the Volatility Index ("VIX") spiked above 25 more than 10 times. History is clear: Melt Up or "Melt Down," last year's historic tranquility is unlikely to return anytime soon. So-called "long volatility" has suddenly become a popular trade. As the Wall Street Journal reported earlier this month...

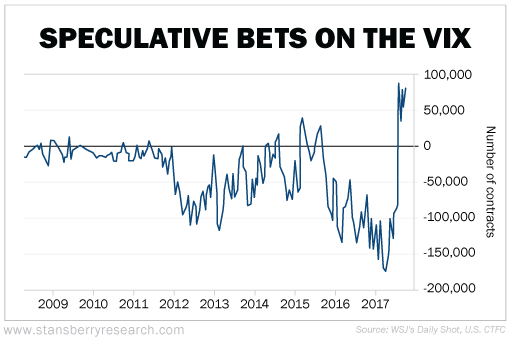

In other words, the same folks who were making record bets against volatility earlier this year – many of whom suffered huge losses during February's "volatility panic" – have flipped sides. They're now making record bets that volatility will move higher. The following chart puts this change in perspective...  These speculative traders are known as the "dumb money" for a reason. They tend to be wrong at extremes. When they're all making the same bet – whether they're all super-bullish or super-bearish – it's a sign that the trade is "crowded" and a short-term reversal is likely. As always, today's extreme doesn't mean the VIX can't move higher in the near term... And again, we continue to expect volatility to trend higher in the months ahead. But speculators are suddenly super bullish, which suggests the greater risk is to the downside today. Even during periods of elevated fear and volatility, the VIX doesn't remain at highs for long. It spikes and falls – often dramatically – before spiking again. Meanwhile, the two primary ways to bet on a higher VIX – buying futures contracts directly, or buying exchange-traded funds ("ETFs") that own these futures – have a significant cost. Due to the nature of these contracts, they tend to lose value over time. This means you can actually bet correctly and still lose money if your timing is off. Today, the odds are stacked even further against you. If you're interested in speculating, be sure to keep your position sizes small and don't risk anything you can't afford to lose. ----------Recommended Link---------

In short, news broke last month that London-based data-analytics firm Cambridge Analytica had gained access to – and improperly used – the personal data of more than 50 million Facebook users as part of an effort to influence the 2016 U.S. presidential election. The news got even worse earlier this month when Facebook said the real number of users affected by the breach was closer to 87 million. And of course, this news follows the company's admission last fall that Russian-backed operatives had exploited its site to try and influence the election as well. The stock is down about 15% from its February highs... and the company has lost roughly $100 billion in market value in the process. The big decline has left some folks wondering if the company's best days are behind it... and whether it's time to sell. Porter and the Stansberry's Investment Advisory team say the answer is clear: absolutely not. As they explained in the April issue...

But once it does, it's incredibly hard to compete with. More from the issue...

And fortunately, despite what you might assume given the news coverage, they don't believe an "exodus" is even close to occurring today...

"Hacking" already costs the global economy more than $450 billion a year. At its current pace, this figure could grow more than tenfold over the next decade. And no one – not even the government itself – is immune. In fact, there's virtually nothing any of us can do to fully prevent getting hacked today. But that could soon change... You see, several notable cybersecurity experts believe blockchain technology – yes, the same blockchain technology that powers bitcoin and other cryptocurrencies – could put an end to computer hacking and identity theft once and for all. Even better, the Stansberry's Investment Advisory team has identified one tiny company in particular that is leading this revolution. They believe buying this stock today could be like buying online-security company Check Point Software Technologies (CHKP) at the start of the Internet boom... before it soared from $4 to more than $100. Click here for all of the details. Regards, Justin Brill Editor's note: Less than 1% of people around the world use blockchain today. But in a few years, experts predict it will become a $3.1 trillion market. And early investors could make a fortune by betting on the right companies. Learn more about this coming tidal wave right here. |

| |||||||||||||||||||||

| Home | About Us | Resources | Archive | Free Reports | Privacy Policy |

| To unsubscribe from DailyWealth and any associated external offers, click here. Copyright 2018 Stansberry Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry Research, LLC., 1125 N Charles St, Baltimore, MD 21201 LEGAL DISCLAIMER: This work is based on SEC filings, current events, interviews, corporate press releases, and what we've learned as financial journalists. It may contain errors and you shouldn't make any investment decision based solely on what you read here. It's your money and your responsibility. Stansberry Research expressly forbids its writers from having a financial interest in any security they recommend to our subscribers. And all Stansberry Research (and affiliated companies) employees and agents must wait 24 hours after an initial trade recommendation is published on the Internet, or 72 hours after a direct mail publication is sent, before acting on that recommendation. You're receiving this email at newsletter@newslettercollector.com. If you have any questions about your subscription, or would like to change your email settings, please contact Stansberry Research at (888) 261-2693 Monday – Friday between 9:00 AM and 5:00 PM Eastern Time. Or if calling internationally, please call 443-839-0986. Stansberry Research, 1125 N Charles St, Baltimore, MD 21201, USA. If you wish to contact us, please do not reply to this message but instead go to info@stansberrycustomerservice.com. Replies to this message will not be read or responded to. The law prohibits us from giving individual and personal investment advice. We are unable to respond to emails and phone calls requesting that type of information. |