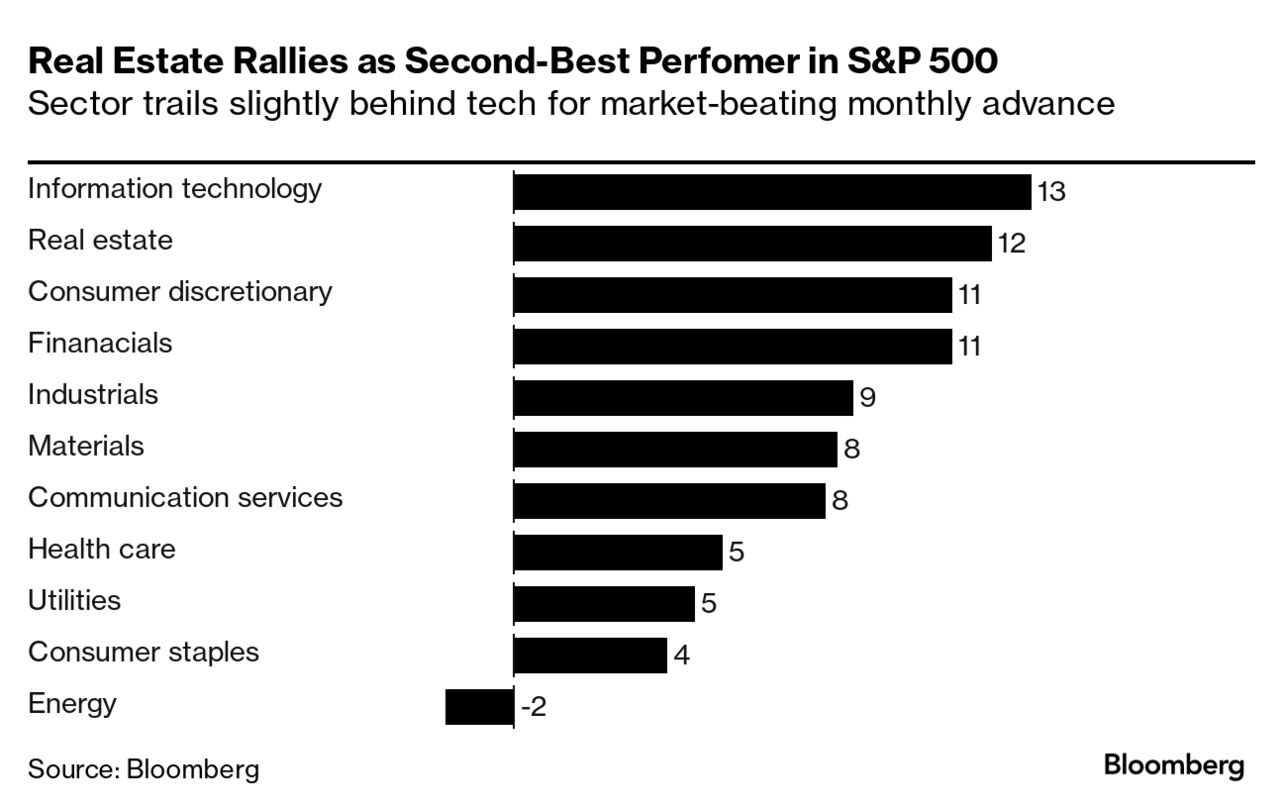

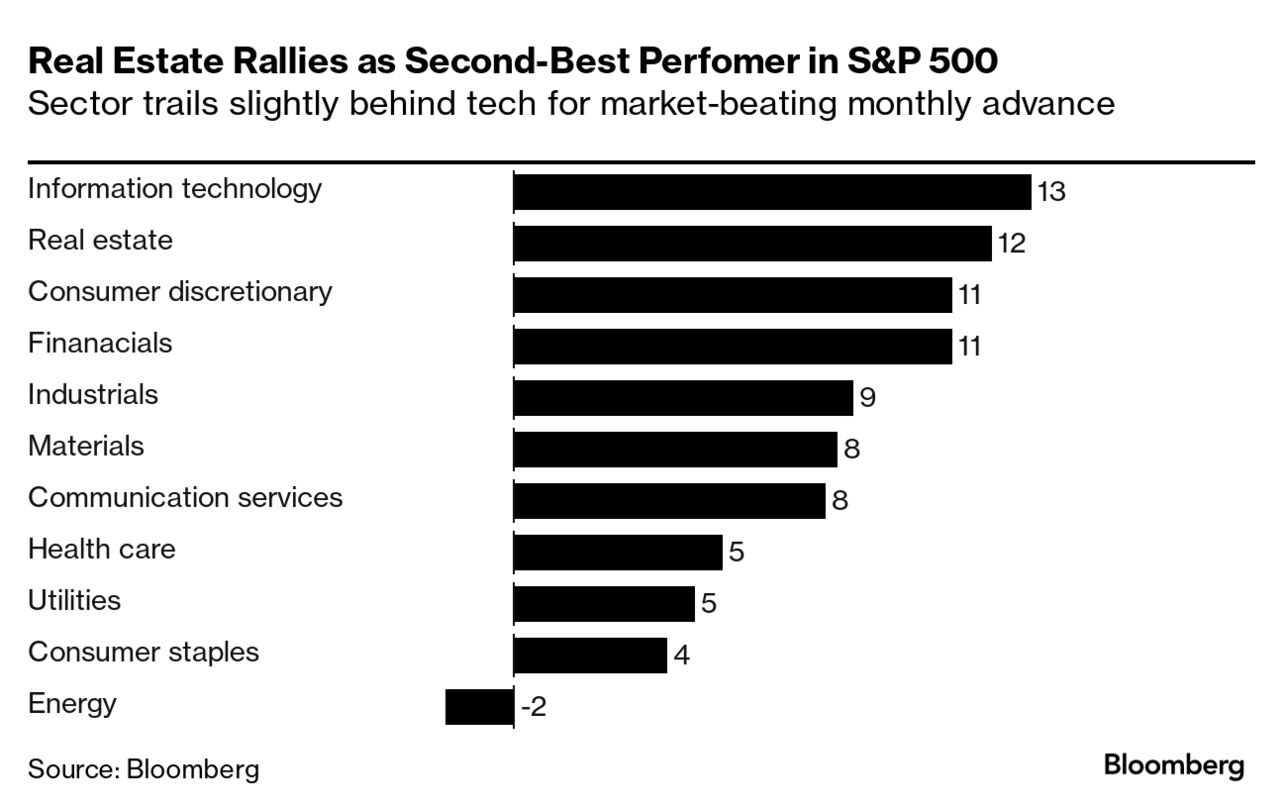

| Watch out tech stocks. Real estate finished November as the second best performing group in the S&P 500 Index. The sector added 12%, nipping at the heels of tech’s 13% gain. The momentum was fueled by—as with most everything right now—bets the US Federal Reserve is not only done raising rates, but will begin cutting them next year (just when next year is the new debate). Last month, the interest-rate sensitive real estate sector was a market outperformer as investors poured in capital. Additionally, US real estate investment trusts, which have been beaten-down by surging interest rates and economic uncertainty, are now showing signs of strength.  While the first thing most investors think of when they hear “real estate” these days is the cratering post-pandemic commercial space, battered office landlord stocks only represent a sliver of the larger whole. Real estate’s double-digit gain was its best since 2011 and compared favorably with the S&P 500’s 9% rise. For its part, Bank of America is looking kindly on the real estate space for 2024, with the bank’s Jeffrey Spector calling the REIT patch equity’s “diamond in the rough.” Investors on Friday were similarly optimistic—here’s your markets wrap. —David E. Rovella For all the bullish milestones notched by November’s stock market surge, recent history offers Wall Street a lesson in caution. Time and again, speculation breaks out that the Fed is poised to ease monetary policy soon enough—spurring even cautious investors to erupt in a spasm of cross-asset buying. Stocks jump, bond yields fall and a dash ensues among speculators into everything from meme fliers to crypto. Volatility has fallen to pre-pandemic lows and a Goldman Sachs gauge of global risk appetite has hit near the highest level in two years. Yet events in June and July—marked by another all-encompassing rally that gave way to a 10% correction—provide sobering parallels. And the risk-friendly exuberance is working against Fed Chair Jerome Powell’s goal of tightening financial conditions, a back-and-forth dynamic that’s contributed to the demise of past rallies. Tim Sloan sued Wells Fargo for more than $34 million, saying the company illegally withheld years of unpaid compensation after he stepped down as chief executive in 2019. Sloan is seeking to force Wells Fargo to honor canceled stock awards and a bonus he says he was promised. Sloan led Wells Fargo from October 2016 to March 2019, a period in which problems multiplied across business lines and the bank was hit with costly regulatory penalties, including a Fed-imposed cap on growth that has yet to be resolved. In his lawsuit, Sloan says he’s seeking unspecified damages for, among other things, emotional distress.  Tim Sloan Photographer: John Taggart/Bloomberg What if researchers discovered a scientifically sound formula for predicting returns in the bond market? If you were a number-crunching investor known on Wall Street as a quant, it could validate your approach and offer clues to new trading strategies. But what if you later found out that key data underlying that breakthrough were actually wrong? That’s the unsettling prospect facing the quantitative investing world now, thanks to the detective work of a doctoral student named Alex Dickerson. Why is oil like a roller coaster these days? In the past two months alone, prices threatened to reach $100 per barrel, only to whipsaw into the $70s. On one day in October, they swung as much as 6%. And so far in 2023, futures have lurched by more than $2 a day 161 times. What’s happening can’t be entirely explained by Russia’s war on Ukraine, OPEC or the Israel-Hamas conflict. The day-to-day business of trading crude futures is increasingly dominated by speculative forces, and traders are pointing the finger at one opaque group of algorithmic money managers known as commodity trading advisors—or oil bots—and they are swinging a big stick. “You would be absolutely shocked how large their positions are,” said Ilia Bouchouev, a managing partner at Pentathlon Investments. “They are probably bigger than BP, Shell and Koch combined.”  As global delegates gather at the United Nations climate summit in Dubai, global warming is laying waste to a key cash crop in West Africa in real time—the latest agricultural victim of human-induced global warming. The climate crisis is playing out across Ivory Coast and Ghana, the heavyweights of cocoa, with consequences for global food inflation. Too much rain is lowering output and delaying harvests, with the resulting shortfall catapulting wholesale prices in New York to their highest in 46 years. And if you’re thinking that the farmers are benefitting from the bounty, think again. Allegations that an Indian government agent ordered the killing of a US citizen in New York risk spoiling the Biden administration’s effort to deepen ties with Prime Minister Narendra Modi’s government, although both sides are playing down the significance. US prosecutors in Manhattan accused an Indian national of attempting to orchestrate the murder of a Sikh activist in June, under the direction of an unidentified Indian official who once allegedly served in India’s internal security forces. But unlike the heated confrontation between India and Canada over a killing there, the fallout so far seems muted. The geopolitical stakes for Washington and New Delhi—the US sees India as key to countering China in Asia—are high. Israel and Hamas resumed their war in the Gaza Strip on Friday morning after a week-long truce ended with the two sides failing to agree on the release of more hostages held by the militant group and Palestinians imprisoned by Israel. The renewed hostilities come a day after a news report revealed that Benjamin Netanyahu’s government and the Israeli military knew more than a year ago of the plan employed by Hamas on Oct. 7 in which it launched a raid on southern Israel that killed 1,200 people.  An Israeli soldier wanders among the debris left after the Oct. 7 Hamas attack on a music festival in southern Israel. Photographer: Aris Messinis/Getty Images Military combat drones keep getting better, cheaper and more dangerous. Unmanned aircraft are now employed in swarms by well-funded aggressors like Russia and are even affordable enough for non-state actors like Islamic State. Meanwhile the best counter systems cost many millions of dollars to deploy and use. It’s an out-of-whack equation that military analysts say will likely become only more troubling over time, in terms of both costs and the threats to the safety of soldiers on the ground. Now a startup in Southern California that fashions itself as a new-age defense technology and weapons maker has created a product dubbed Roadrunner that it bills as an answer to the US’s rising drone threat.  A Roadrunner and Anduril founder Palmer Luckey. Photographer: Peter Adams for Bloomberg Businessweek Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. Bloomberg Green at COP28: World leaders will gather in Dubai on Dec. 4-5 in an effort to accelerate global climate action. Against the backdrop of the United Nations Climate Change Conference, Bloomberg will convene corporate leaders, government officials and industry specialists from NGOs, IGOs, business and academia for events and conversations focused on creating solutions to support the goals set forth at COP28. Register here. |