| Do You Use This Trading Tool to Get an Edge? | | By Ben Morris, editor, DailyWealth Trader | | Friday, May 12, 2017 |

| Quality tools can last you a lifetime…

Even a basic set may be enough for you to do the job well, day in and day out. But you'll have limitations…

A master craftsman can tell you that certain jobs require specialized tools. Having these tools at the right times – and knowing how to use them – can prove extremely valuable.

Trading is no different…

If you're a trader, you should have all the basics in your "toolbox"… the tools that allow you to plan and execute your trades well every time. These are things like position sizing, stop losses, and a variety of trading techniques (including buying stocks, trading for income, and short selling).

You can make a lot of money in the market by using these basic tools well. But one of my goals is to show you how to use a variety of specialized tools, too…

The more specialized tools you add to your trader's toolbox, the more opportunities you'll have to make money… and the more you'll recognize certain opportunities are great, rather than just good.

Today, I want to show you another way to get an edge in your trading. It involves using public information that most folks either don't know about or don't know how to use to their benefit…

----------Recommended Links---------

---------------------------------

It's called "insider buying"…

Corporate insiders are a company's management team, directors, or shareholders who own at least 5% of a company. They have access to information that the public doesn't. But they can't trade based on that information. That's illegal "insider trading"…

Legal insider trading is different…

These same insiders are allowed to trade based on information that has been released to the public… and based on their deep understanding of their businesses. In most cases, they have to report their trades to the Securities and Exchange Commission (the "SEC") within two days. Then, their trades become public information.

This information can alert you to great trading opportunities… if you know how to interpret it. We'll just focus on insider buying today.

You see, not all insider purchases are significant. To sort out the ones that are, you need to ask a few questions…

The first is: Who's buying?

In general, the best insiders you want to see buying are the ones at the top of the company… like chief executive officers (CEOs), chief financial officers (CFOs), and chief operating officers (COOs). And multiple insiders all buying at around the same time is a good sign.

These insiders (usually) understand the details of how their companies run better than anyone else. So they know better than anyone else when the market punishes their stocks too severely.

When their stocks are deeply undervalued, these insiders know it… And they can load up on shares.

The second question to ask is: How much are they buying?

The question "how much" is relative. It depends both on the size of the company and on the compensation of the insider. Your goal is to figure out if the purchase is significant to the insider. If it is, it may be significant to you, too.

This doesn't have to be too difficult. Think about what a big stock purchase would be to you, relative to your annual compensation or your net worth.

If the CFO of a $30 billion company makes $7 million a year, to her, a $50,000 purchase is insignificant. A $10 million purchase is significant. That should get your attention.

On a smaller scale, if the COO of a $100 million company buys $1 million worth of the stock, that's 1% of the company. It's worth looking into.

When directors or major shareholders buy, you need to answer this question, too… Is it significant to them?

Now, the third question… How are they buying?

This is an easy one. Lots of insiders are awarded stock or have stock options. This isn't significant. You want to look for "open market purchases." When an insider buys shares on the open market, he's buying just like you or I would.

Insiders make major open market purchases for only one reason… They believe their stock is undervalued and is likely to rise.

To see why this is valuable, let's look at a real-life example…

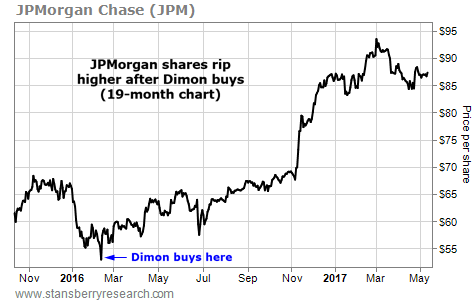

In February 2016, JPMorgan Chase (JPM) Chairman and CEO Jamie Dimon bought 500,000 shares of his company's stock on the open market. That's a huge, $26.6 million investment.

In 2016, Dimon earned about $28 million in total compensation. So his purchase represented nearly a full year of earnings. Not only that, but corporate insiders need to hold on to their shares for at least six months. It was a big vote of confidence for the stock.

As you can see below, shares bottomed the day his purchase was declared and are now up more than 64%…

You can look for insider buys in two ways. You can look for recent buys, then dig deeper on the ones you find interesting. Or you can look for insider buys in a specific company. Either way, you can find this information for free on a lot of websites, such as GuruFocus, Yahoo Finance, or Insider Monkey.

Insider buys can be a great alert. But don't base your trading decisions entirely on this one piece of information.

They tell you that someone with a deep understanding of the business (and the smarts to get to a top position) thinks the stock is cheap… and may be ready to move higher.

If you keep an eye out for big insider buys, you'll likely spot great opportunities that others don't. Just remember, ask who's buying, how much are they buying, and how are they buying… And you'll be in good shape.

There you have it… A new specialized tool for your trader's toolbox.

Good trading,

Ben Morris

Editor's note: Adding to your trader's toolbox can help you spot opportunities in the markets that others miss... And Ben recently identified one with high upside and low risk. This growing tech company has 93% upside from here. To learn more about Ben's DailyWealth Trader service – and how to access this recommendation – click here. |

Further Reading:

"Lots of traders don't know anything about it... But you can look at a specific number for just about any stock you want to trade," Ben says. "When it's big enough, it can help you make a lot of money, very quickly." Learn how to use this indicator to your advantage right here: Use This Little-Known Number to Find Explosive Stocks. "Nerves don't help you make money or protect what you have," Ben writes. If you're nervous about buying stocks today, having a plan and risking less up front can give you confidence in your trades. Learn how three simple trading tools can help you reap the benefits of this bull market right here: Are You 'Stock Shy'? Don't Be. |

|

THIS HIGH-TECH STOCK IS SOARING

Today's chart highlights a huge rally in the tech sector... Regular readers know we are always looking for big secular trends to invest in, such as major advancements in technology. And in recent years, one of the fastest-growing tech developments has been 3D printing. If you're not familiar, rather than conventional "on paper" printing, 3D printing manufactures solid objects (like a prosthetic arm, or even a house). One of the main players in this space is 3D Systems (DDD). The company makes 3D printers, as well as 3D-printing materials and software. Its technology is used to design, refine, and create products like tools, parts for cars and airplanes, medical devices, and even human tissues. Our colleague Ben Morris told his DailyWealth Trader subscribers to buy shares last year. As you can see in the chart below, the stock has surged recently... 3D Systems recently announced two new software releases, which it expects will significantly improve productivity and lower costs. Shares are hitting a new 52-week high – and Ben's subscribers are enjoying the uptrend. This is one tech trend you'll want to keep an eye on... |

|

| Three tips to becoming a better investor... Even with the best strategies, quality stocks can turn into losing trades. Today, Dave Eifrig shares three principles to help you become a better investor... |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

| Is This Popular Investing Myth Hurting Your Portfolio? | | By Meb Faber | | Thursday, May 11, 2017 |

| | Today, we're taking a look at the damage that one popular investing myth may be doing to your portfolio... |

| | The Most Contrarian Opportunity of My Career | | By Dr. Steve Sjuggerud | | Wednesday, May 10, 2017 |

| | Today, we're staring at what could be the most contrarian idea of my career... |

| | China's Big Problems Are Creating a Big Opportunity | | By Dr. Steve Sjuggerud | | Tuesday, May 9, 2017 |

| | China's local stock market has fallen for four consecutive weeks. Investors are spooked. |

| | You Don't Need to Be Rich to Win. You Need This... | | By Brian Weepie | | Monday, May 8, 2017 |

| | "Having the most money doesn't always make you the winner," Moneyball author Michael Lewis said to us on stage. |

| | More Proof That This Bubble Is About to Pop | | By Justin Brill | | Saturday, May 6, 2017 |

| | The latest data suggest the boom in auto sales has already peaked... |

|

|

|

|