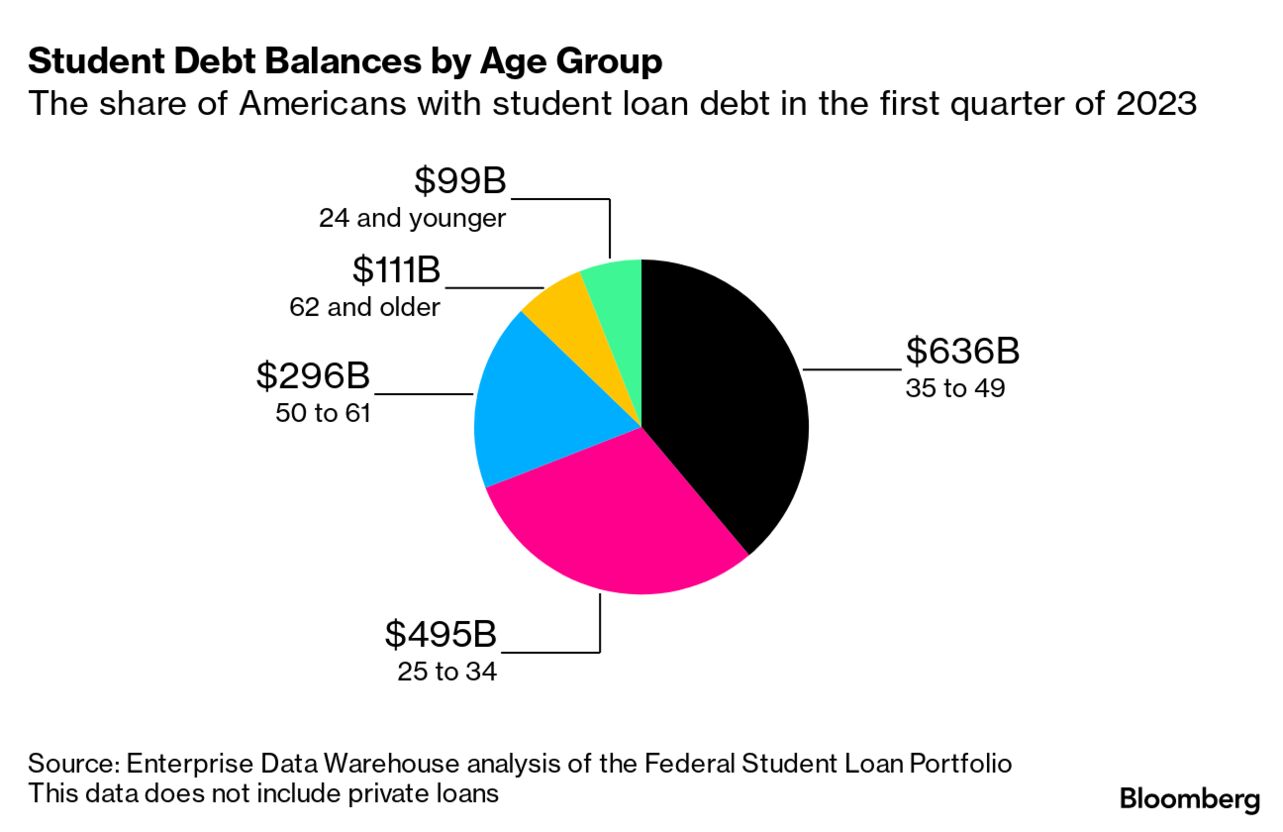

| Federal Reserve Chair Jerome Powell reckons the US economy can, in the aftermath of an inflation fight that just might be coming to an end, skirt a recession. While much of the financial world has spent the past year saying one was looming, Powell has so far done exactly that. But it seems like now, perhaps more than before, his hoped-for soft landing faces some tough odds. The confluence of a regional banking crisis and its fallout and a Republican game of chicken with the national debt may militate against the economy emerging unscathed. In Powell’s view, the strength of American labor markets—still at a half-century record—is smoothing the way for a gentle touchdown. “It’s possible that this time is really different,” the Fed chief said last week. Still, a labor market that stays hot means the Fed may have to hold rates higher for longer—and that doesn’t bode well for dodging a downturn. For the central bank, one thing is clear: there’s a lot of turbulence ahead.—Natasha Solo-Lyons and David E. Rovella Companies from automakers to hoteliers keep on sacrificing sales volume—sometimes by design, sometimes by necessity—in favor of higher prices, a dynamic that will test the Fed’s effort to rein in inflation. The latest set of earnings show businesses aren’t likely to walk away from a strategy being called “price over volume,” adopted by certain industries at the height of the pandemic when supplies and labor were both tight. Senate Minority Leader Mitch McConnell said he’ll stay on the sidelines as the government hurtles toward a financial cliff, refusing to intervene as House Republicans demand unrelated cuts to things like climate and education as their price for allowing the government to pay its bills. Investors are watching Washington as President Joe Biden prepares to host House Speaker Kevin McCarthy and other congressional leaders at the White House Tuesday in a bid to avoid a potentially catastrophic technical default.  Joe Biden Photographer: Ting Shen/Bloomberg But Bill Gross says not to worry. The former chief investment officer of Pacific Investment Management recommends buying short-term Treasury bills because he expects the debt-ceiling issue will be resolved. “It’s ridiculous. It is always resolved, not that it is a 100% chance, but I think it gets resolved,” Gross said on Bloomberg Television. “I would suggest for those who are less concerned, similar to myself, that they buy one-month, two-month Treasury bills at a much higher rate than they can get from longer-term Treasury bonds.” On the gloomier side, Allianz Chief Economist Ludovic Subran says investors should brace for months of market readjustments overshadowed by the threat of a new “financial accident.” Here’s your markets wrap. Airport blood pressure readings may be dropping to safer levels soon. Biden announced that the federal government is drafting new rules that could require airlines to provide meals, hotels and additional compensation to travelers on canceled or severely delayed flights. This just in time for a summer travel season that could be just as bad as last year. Remote jobs are still plentiful, but these days you have to know where to look. The most remote-friendly city isn’t San Francisco or San Jose but Bloomfield, Connecticut, headquarters of insurer The Cigna Group, where nearly half of job vacancies offer some freedom to work from home. Here are the full lists of US cities with the most (and least) remote jobs. A vise of college costs is about to squeeze parents with outstanding student loans. After a three-year pause, required payments on federal loans are scheduled to restart in coming months, making life even tougher for those adult borrowers trying to sock money away for their own children’s education. When you ask moms what they really want for Mother’s Day, you’ll inevitably get a wide variety of responses: a day to myself; a spa getaway; and maybe some wine and cheese. Well for Mother’s Day this year, we asked dozens of mothers and grandmothers to chime in. Here’s what they said are the best gifts, ranging from $33 to $9,500. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays. Bloomberg Invest Summit returns to New York, June 6-8. We will have influential leaders from Nasdaq, JPMorgan, the SEC, Franklin Templeton, the WMBA, Charles Schwab, Blackrock, Goldman Sachs and many more. Register now to secure your spot. |