There’s already a ton of analysis on why/how this happened. That’s important, and I will offer a few thoughts below. But first, we need a little reality check.

My dad would repeatedly use the old joke about the dog catching the car: “Now that you’ve caught it, what are you going to do with it?”

Trump and the Republicans will soon own the same economic problems they talked about in the campaign. Our big challenges won’t magically disappear. US debt is now growing twice as fast as our strong GDP. As I say often, the debt problem is beyond the point of easy solutions. All the options are bad.

Every president for my 75-year lifespan has talked about fixing the debt. In fact, apart from Clinton and Gingrich, who actually did it, they didn’t seriously try. That’s why it keeps getting worse. (Who knew we would be nostalgic for the good old days of Bill and Newt?)

Inflation is not dead. The bond market has been volatile since Tuesday, but the 10-year Treasury yield is up 60+ basis points since September. Not exactly a vote of confidence from the market, nor what the Fed wants to see. The bond market has good economic reasons for concern.

Still, the Fed cut short-term rates and plans to do more. Lower rates might marginally help the government’s interest burden, but that has inflationary consequences. There are no free lunches. TANSTAAFL bites. Riffing on Keynes, we could call it the Paradox of Deficits. More on that below.

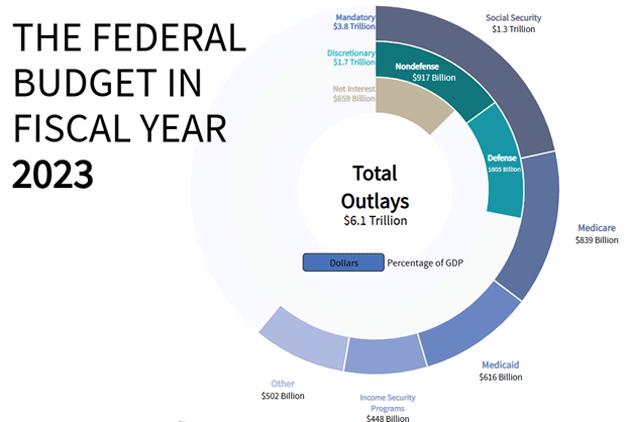

The so-called “mandatory” spending, like Social Security and Medicare, increases every year, both as more boomers reach retirement age and because of inflation.

The situation is serious, but not hopeless.

The presidency isn’t a prize; it is a responsibility. I have always, whether my party won or not, wished new presidents “good luck” in leading the country (and the world) forward. I truly do the same this time. But I fear the luck Trump needs will not be there. He is going to have to make his own luck. The good news is he has a track record of doing that.

Like the proverbial dog who chased a car and then caught it, now he has to figure out what to do.

Last week, I wrote we are on a One-Way Road to Crisis. Turning around on a one-way road is difficult, at best. So, it is with the federal debt, which is now so huge that interest alone is a bigger line item than defense. And it’s rising.

The latest CBO estimates show an FY 2025 deficit of about $1.9 trillion. It’s actually well over $2 trillion because some spending is off-budget but is never talked about in the press.

To actually reduce the debt, we must first stop digging the hole deeper. That means increased revenue and/or spending cuts of around $2 trillion per year. How?

Trump says he will appoint Elon Musk to streamline the government and make it more efficient. I truly applaud that. But non-defense discretionary spending—basically the entire executive branch except the Pentagon—will be only $928 billion this year. I actually believe we could cut $200 billion a year, with a lot of weeping and wailing and gnashing of teeth. But that’s just 10% of the deficit. Even if we took it down to zero, we’re only halfway there. We should have been doing this slowly over time. Meanwhile entitlement spending grows 3% plus every year, just from inflation.

But that doesn’t mean we shouldn’t deal with the “small stuff.” Cutting $200 billion is a great first step on what will be a long and uphill journey.

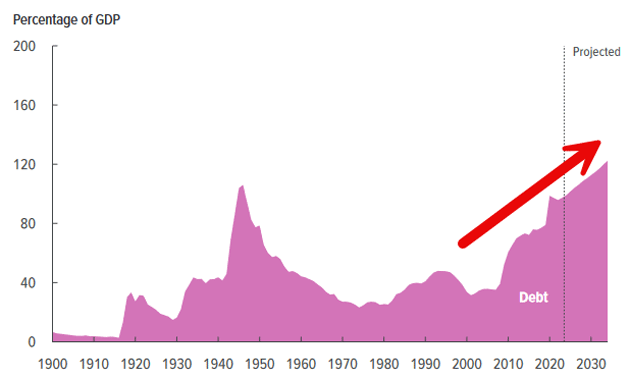

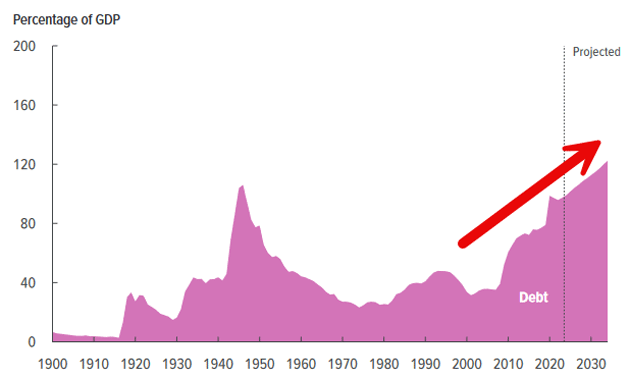

Trump has said he won’t touch entitlements. But if he doesn’t, the debt will keep growing. Here’s the CBO outlook, which is actually conservative due to a number of rosy assumptions. For one, this is “debt held by the public,” which excludes the Social Security and Medicare trust funds. Note that those funds will disappear in the early 2030s. Not counting that debt is extraordinarily misleading. It will have to be funded. If any public company used the same accounting principles as the government, they would be shut down, and there would be prison time. The SEC would justifiably call it criminally misleading.

Source: CBO

On the current course, the federal debt will exceed 120% of GDP in the next few years. If you account for all debt, it is already at 122%. That is roughly the level Greece found unsustainable during its last sovereign debt crisis. The answer there was extreme austerity. But that happened only because other EU countries more or less forced it. It is unclear who would impose such austerity on Americans. Are the bond vigilantes waiting off stage?

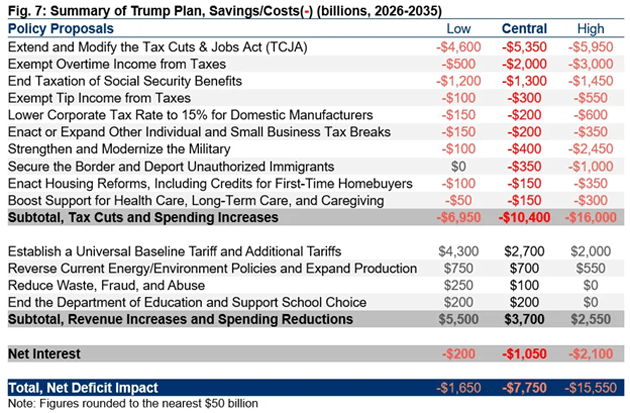

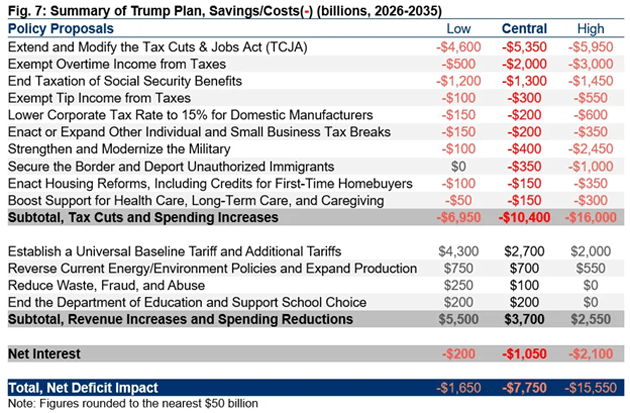

The Trump campaign is not without ideas. Last week I mentioned Trump and Harris debt estimates made by the Committee for a Responsible Federal Budget. Since we now know the outcome, here’s a deeper look at the Trump proposals.

Trigger warning: this is going to at a minimum annoy and more likely anger Trump partisans. Let me state up front that I don’t think this is a realistic assessment of what will happen. The CRFB was simply trying to analyze campaign promises. Everyone knows reality will be different. It was a different type of ugly for their Harris analysis.

Source: CRFB

Based on statements during the campaign, Trump would cut taxes and increase spending by a central estimate of $10.4 trillion over 10 years, reduce spending and add new revenue of $3.7 trillion, on net increasing the debt by $7.5 trillion in 2026–2035—an average of $775 billion per year.

With the real exception of extending the 2017 Trump tax cuts, I think most of those campaign spending and tax cut promises are dead on arrival. And while I take great exception to tariffs, the revenue estimates are in the ballpark. That means in the real world, total debt additions will be somewhat more than a $1 trillion increase, or $100 billion+ a year. Plus inflation.

(Sidebar: CFRB assumes that securing the border and deporting illegal immigrants would cost $350 billion. I think a proper analysis would show a net savings after the first year or two.

On that, let me suggest you read this letter by my friend Joe Lonsdale, one of the truly great venture capitalists in this country. Now living in Austin, he is the cofounder of Palantir and scores of other companies. He founded and helps fund a the Cicero Institute to promote real-world solutions on state-level policy problems around the country. You’ve seen him on CNBC and elsewhere, but the depth goes way beyond markets. Yes, a friend of Elon and highly likely to be on that government efficiency board, whatever it becomes. He does a must-listen weekly podcast, typically with some tech or national policy guru that really makes me think.)

Please note, I am not saying we should do nothing about spending and taxes. We should do whatever we can. My point is that it is very unlikely to be enough.

I explored potential debt reduction measures in depth last year (see Debt Catharsis). It was a palpably frustrating experience. If I were a member of Congress facing donors and voters? Dig into the specifics, and it’s easy to see why they haven’t acted.

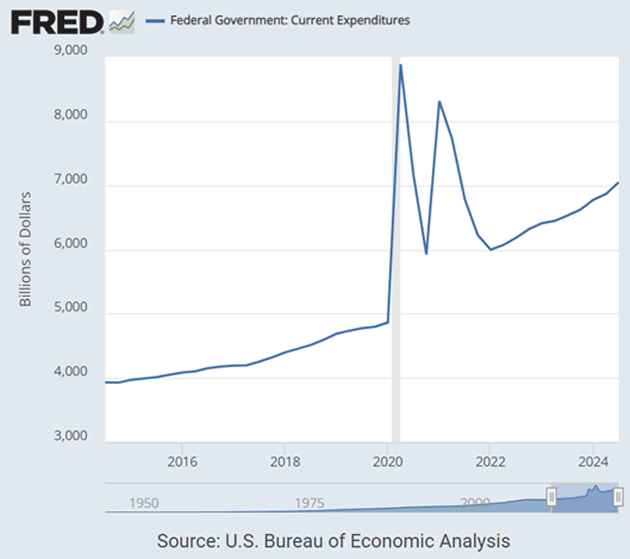

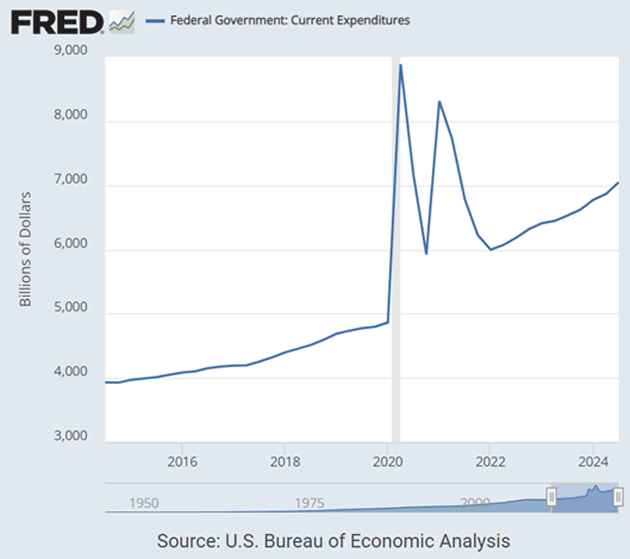

Let’s take a graphic look at the problem. A simplistic way is to ask yourself, as many do, was the government spending too little money in 2019? The total budget was under $5 trillion. Of course, COVID came along and we properly threw stimulus at the economy. But it never came back to trend.

Source: FRED

We are now spending $3 trillion a year more than we did five years ago, literally a 75% increase. Inflation in that same period totaled 23%.

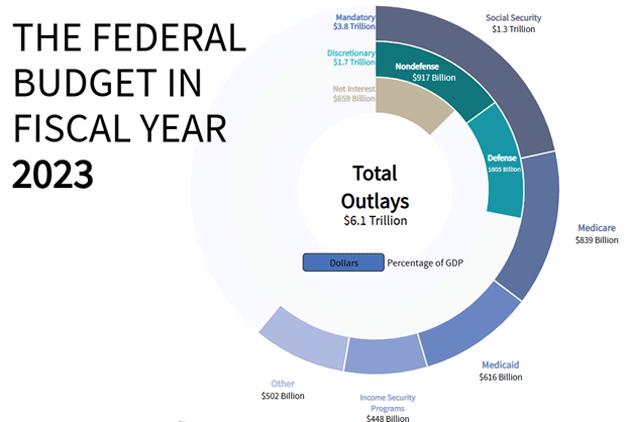

Let’s look at the CBO’s 2023 budget breakdown, the latest data we have.

Source: CBO

Fast forwarding to 2025, mandatory spending will be up a minimum of 6% due to more people simply getting older and inflation. That’s almost $250 billion.

The problem isn’t on the revenue side. Federal tax revenues are up $1.1 trillion, over 30% since the 2017 tax cuts. And yes, extending them will make the deficit worse. Biden/Harris have a point when they said the economy is strong. That’s why revenue is up so much. The problem for their campaign was that a stronger economy didn’t translate into a strong personal situation for the large majority of citizens. Inflation is insidious and visible. While 3% GDP growth is great, it’s not visible in your pocketbook.

The point is there is some room to cut spending. Just as only Nixon could go to China, maybe only Trump can corral the herd of cats in Congress and get them move toward a balanced budget. Simply getting us on a 5-to-7-year path will calm the bond market and get us out of the coming crisis.

As much as I hate tariffs, it is a halfway point to a full value added tax (VAT). It would be a net trade positive for the US as the VAT would disappear for our exports. There would be no threat of a Smoot-Hawley type tariff retaliation, because every other country already has a VAT.

You could actually reduce income taxes across the board, especially and significantly for the bottom 50%. You could go to a flat tax at each bracket. Substitute a portion of the VAT for Social Security, and you can eliminate FICA withholding on the first $50,000 of income. There are literally a ton of ways to make a VAT more palatable.

Yes, I know it is the camel’s nose under the tent. But as I’ve demonstrated in previous letters, you simply can’t raise income taxes enough to make up a $2 trillion difference. You would literally need to tax 100% of incomes on the top 50%. And it still doesn’t get there.

Which is why I say that the situation is desperately serious, but not hopeless. There are different ways to accomplish a balanced budget without a VAT, just not as easily. I have repeatedly said that it will take a crisis to force us to deal with the issue.

In 2002, Ben Bernanke gave a now famous speech called “Deflation: Making Sure ‘It’ Doesn’t Happen Here.” It became known as the helicopter speech. He laid out the principle that deflation wasn’t a problem because we can always print money and bring back inflation.

The problem today is we’re printing money via deficit spending. Deflation is obviously not the problem. Deficit spending, especially at the level we are doing it, is by definition inflationary. It is also eventually going to hinder growth, as deficit spending is negative savings in the macroeconomic sense. The negative savings of the US government is now big enough to offset private savings and investment, and that will hinder future growth. It won’t show up for years, but it’s real.

Further, the bond market senses it. It is why forward measures are signaling higher inflation, and they’re not buying the concept that the Fed has inflation under control.

Powell can cut rates a little more, as he will be chairman through 2025, and he made it clear this week he is not leaving before the end of his term. They can take short-term rates down, but if long-term rates don’t follow, it is not going to help home buyers or businesses or commercial real estate or (pick an industry). The lower short-term rates will actually hurt retirees and savers.

I have been saying that I don’t think the real crisis happens until later this decade. That’s just the way the cycle structure seems to work out. But what if I am wrong? (Always a real possibility.)

Is the recent rise in long-term rates a signal that bond vigilantes may not be dead? Could it be that they are waking up and are at least on the sidewalk outside of the cemetery?

Let’s clearly understand. Tariffs are inflationary. (So is a VAT, and it would have to be layered in over time.) Deficit spending is inflationary. The Fed will only have so much room to cut in an inflationary environment. Trump’s natural instinct to want lower rates is going to meet the reality of the inflation that he also hates.

Which gives me a somewhat irrational hope that Trump could go to China, i.e., put us on a path to a sustainable budget. There are things the Fed could do to help. Serious, but not hopeless.

Quickly around the horn let’s look at some winners and losers. The biggest loser is the mainstream media. We have seen a paradigm shift in information blossom right before our eyes. It is Martin Gurri’s The Revolt of the Public writ large, where he posited that new forms of information dissemination have disintermediated traditional media. The demise of local newspapers is clear. I used to throw 2- to 4-pound newspapers on Thursday and Sunday mornings for the Dallas Morning News. That world has gone.

We have seen the rise of podcasts. Forty-five million viewers watched the Joe Rogan interview. There are not 45 million disaffected young men in this country. There are scores of other podcasts in the half-million to million+ range. These are bigger audiences than any of the mainstream media shows. Plus Instagram, Tik-Tok, Facebook, and, yes, X. And Discord and a host of other apps that us old fogies don’t even realize are there.

Mainstream media won’t go away but will be increasingly irrelevant.

The big winner? Bari Weiss and The Free Press. The former New York Times reporter now has around 800,000 subscribers and 100,000 who pay $80 a year. It is one of my must-reads in the morning. It feels like what waking up to the Dallas Morning News and the Wall Street Journal used to feel like 30 years ago. She has an all-star team of journalists who are also wordsmiths—brilliant writers who are committed to free speech and journalism—you know, truth, justice, and the American way?

My bet is that in a few years she has more subscribers than her former employer, the New York Times, who refused to defend her from outrageous attacks from what were really pretty radical progressives, because that is what the NYT staff had become. The NYT has to be tone deaf not to hear her footsteps rapidly coming up behind them. It’s been less than four years since she launched. We will know that The Free Press has arrived and is ready to supplant the NYT when she launches a sports page. Will the comics be far behind?

At the very least, subscribe for free, and then when you find it to be as addictive as I do, pony up the $80. We should encourage talented people like Bari and her all-star team to give us balanced journalism.

An obvious winner is Elon Musk. The loser is Rachel Maddow, et al., who said that he must be stripped of his SpaceX and Starlink contracts because of his politics.

China’s currency is the loser. Israel is a clear winner. Unless we see a change of heart, those who would prefer a balanced budget are probably losers, but only marginally less so than with Harris.

If your government job can be automated, just like in the real world, you are likely a loser.

The culture war is not going away, but “woke” at least lost this battle. I frankly hope that the Democrats can get their act together and not blame the American people. They lost in almost every demographic. More than 40% of Hispanics is not saying racist to me. It will be interesting if progressives now decide that Hispanics are white (note sarcasm). I frankly never saw them as anything but.

Then again, I have 10.5 grandchildren and only one of whom is pure Caucasian. Five are Black, three are Asian, and two are in the I-don’t-know category, and I’m not asking, as I don’t care. It’s complicated. But a lot of fun.

Let’s have a conversation. Who do you think the winners and losers are? Put it in the Mauldin Economics app. I think it will be splendid fun.

Buckle up because it’s going to be an interesting four years.

I will be in Dallas the week of Thanksgiving. Family and kids will gather. I will be in New York the third week of December, Austin second week, Newport Beach two weeks later, and likely back to Dallas and a few trips to the East Coast. I will traveling more in the coming year for the new longevity venture as we will be opening clinics all over the country.

This has been an emotional week for a lot of us. A significant part of the country is not happy this week. I get it. I was prepared for and even suspected there would be a Harris presidency. Even among the majority that voted for Trump, there is concern. I did not realize that I was personally stressed over the not knowing, the concern for the direction of the country rather than the particular leadership, and I was more relieved than anything when that stress went away.

I have had ADD since I was young, before we had a name for it, which I have made a feature and not a bug of my life. But in the last three months, my ADD has simply been on steroids. I was really concerned but didn’t know how to express it. For whatever reason, that went away Wednesday morning. I hope it stays away, and I can become more productive and mentally focused, with just my normal distracted self.

And with that, I will hit the send button and wish you a great week. As my schedule firms up, perhaps there will be times this year where I can be in a city near you. I do miss the personal interaction more than you can possibly imagine. And don’t forget to follow me on X!

Your facing-a-turbulent-future-with-a-full-heart analyst,