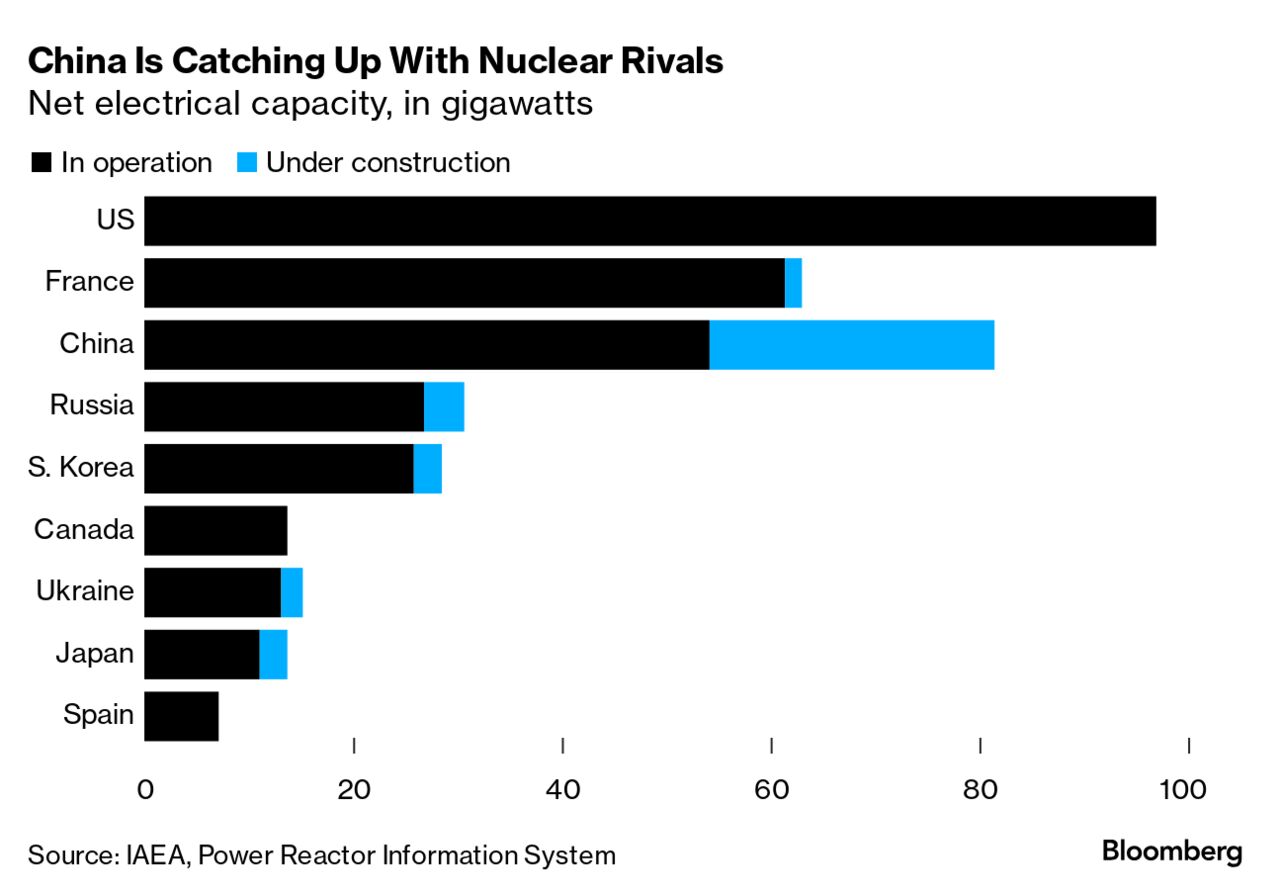

| A rapid slide in US stocks on Wednesday tied to a weak $42 billion sale of Treasuries underscored the fragility of markets, sending equities back to the neighborhood they landed in after Monday’s collapse. Mark Hackett of Nationwide said the latest events have been a “masterclass” in how emotions can dominate the movement of markets, particularly when sentiment and positioning are almost universally positive. “Stocks remain vulnerable,” added Fawad Razaqzada at City Index and Forex.com. “More evidence of a bottom is needed to excite the bulls again.” Overall, not many people were confident enough to buy the dip. But new inflation numbers set to arrive next week may lend some clarity. —David E. Rovella Quant funds that chase the hottest trades on Wall Street are getting thrashed as momentum bets backfire all at once. Going into July, trend followers were positioned for the year’s big trades to keep gathering steam: They were plowing into stocks, betting against developed-nation government bonds and counting on the yen to keep weakening. Then each of those markets moved sharply in the wrong direction, hitting them with deep losses. US 30-year mortgage rates plunged last week by the most in two years, sparking a surge in refinancing applications. The contract rate on a 30-year fixed mortgage declined to 6.55% in the week ended Aug. 2. The rate on a five-year adjustable mortgage plummeted to 5.91%, the lowest this year. The drop “should set the stage for a modest recovery in transactions the rest of the year,” Thomas Ryan, North America economist at Capital Economics, said in a note. “This marks a turning point for the housing market, which has been frozen for a while now.” Reducing America’s footprint in the Middle East to focus on China has been one of President Joe Biden’s top geopolitical priorities. But extricating itself from the region has proven much harder than he might have thought, Minxin Pei writes in Bloomberg Opinion. With a major regional war potentially on the horizon, a deeper—although indirect—cause of the recent downward spiral in the Middle East is the global contagion of the US-China rivalry.  Iranians take part in a funeral procession for Hamas leader Ismail Haniyeh in Tehran on Aug. 1. Iran and Hamas blame Israel for his assassination. Photographer: AFP China’s export growth unexpectedly slowed in July, signaling a cooling of the global demand that’s been helping prop up the nation’s otherwise wavering economy. This is especially bad news for Beijing, seeing as domestic consumers have been tightening their purse strings. Meanwhile, imports expanded 7.2%, narrowing a trade surplus to $84.65 billion from the previous month. While the US struggles to turn around its nuclear power industry, China is catching up. And there’s no great industrial secret to what the Asian giant is doing. It’s largely a matter of vast scale, state support and relatively simple, replicable construction. It’s a success that could also be transferred abroad, because the appetite for nuclear power is growing thanks to energy security and climate imperatives. Along with Russia and South Korea, China is one of only a small handful of nations supplying the technology as US and French stalwarts are weakened, raising both diplomatic and, in some quarters, safety concerns. Beijing hasn’t reported a major disaster, but accidents in other sectors and a culture of secrecy have rattled skeptics.  The US Hispanic population grew by 3.2 million from the beginning of the coronavirus pandemic to the middle of last year, making up 91% of the country’s overall gain. An uptick in immigration alongside shifts in both births and deaths from April 2020 to July 2023 has contributed to a “diversity explosion,” according to William Frey, a demographer and senior fellow at the Brookings Institution. Overall, the US population increased by 3.4 million over the period. At the same time, the White population declined by 2.1 million, and the shrinking group of White youth drove a 1.6 million drop in the number of Americans under the age of 18. DBS Group Holdings said Tan Su Shan will take over from Chief Executive Officer Piyush Gupta in March, becoming the first woman to lead Southeast Asia’s biggest bank. Tan, 56, is currently head of DBS’s institutional banking group. She’s the only female banker among the four contenders who were being groomed to replace Gupta. She’s credited with expanding the consumer and wealth businesses, which accounted for about a third of pretax profit by the time she moved to her current job in 2019.  Tan Su Shan Photographer: Lionel Ng/Bloomberg Switzerland (of all places) is in the midst of a heated debate about inheritance taxes on the super-rich. A proposal to take half of any passed-on wealth above 50 million francs ($59 million) has prompted public warnings from business-owning multi-millionaires and billionaires that they’ll go elsewhere. Similar debates are playing out around the world as governments consider ways to squeeze more from the richest to help deal with huge deficits and fund public services. Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily. Bloomberg Power Players: Join us in New York on Sept. 5 during the US Open Tennis Championships and hear from leaders working to identify the next wave of disruption that could hit the multibillion-dollar global sports industry. With us will be A-Rod Corp founder Alex Rodriguez, Boston Celtics co-owner Steve Pagliuca, Carlyle Executive Chairman and Baltimore Orioles owner David Rubenstein and US Women's National Team forward Midge Purce. Learn more. |