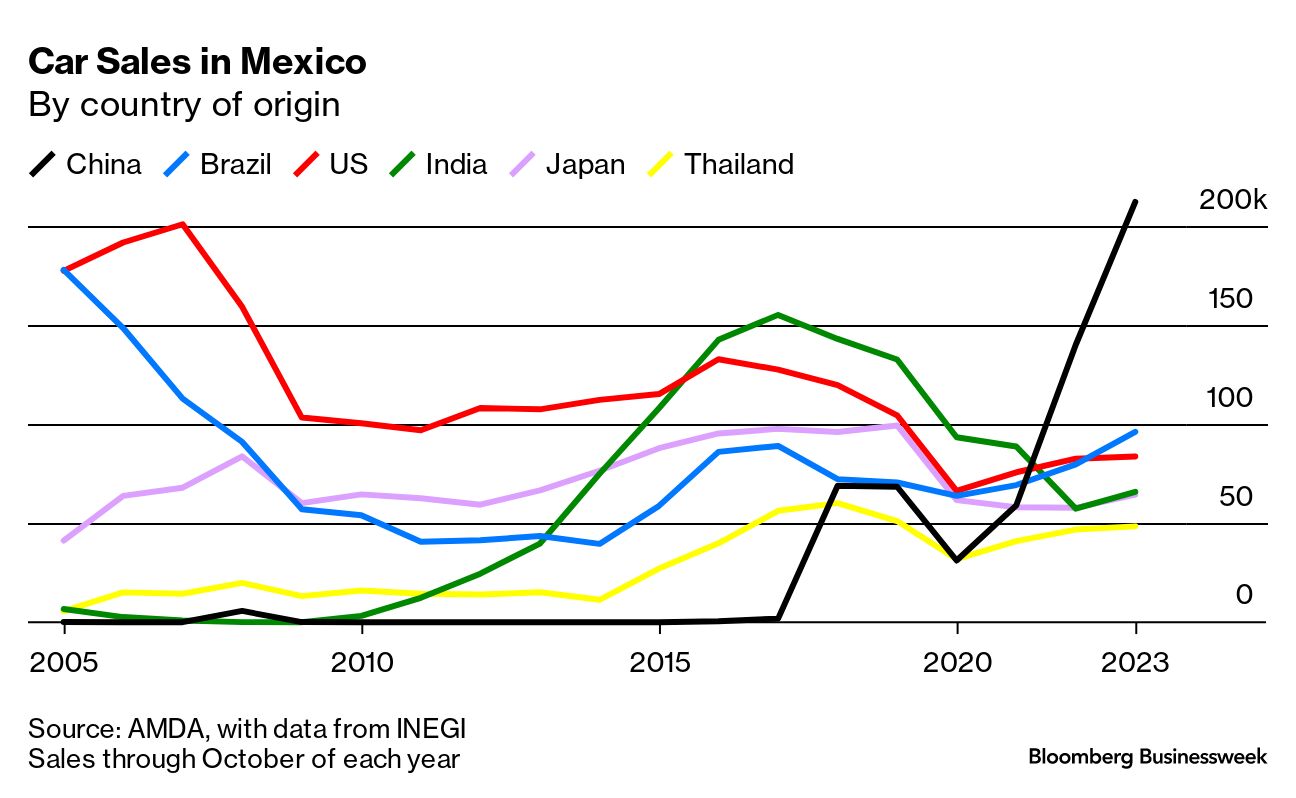

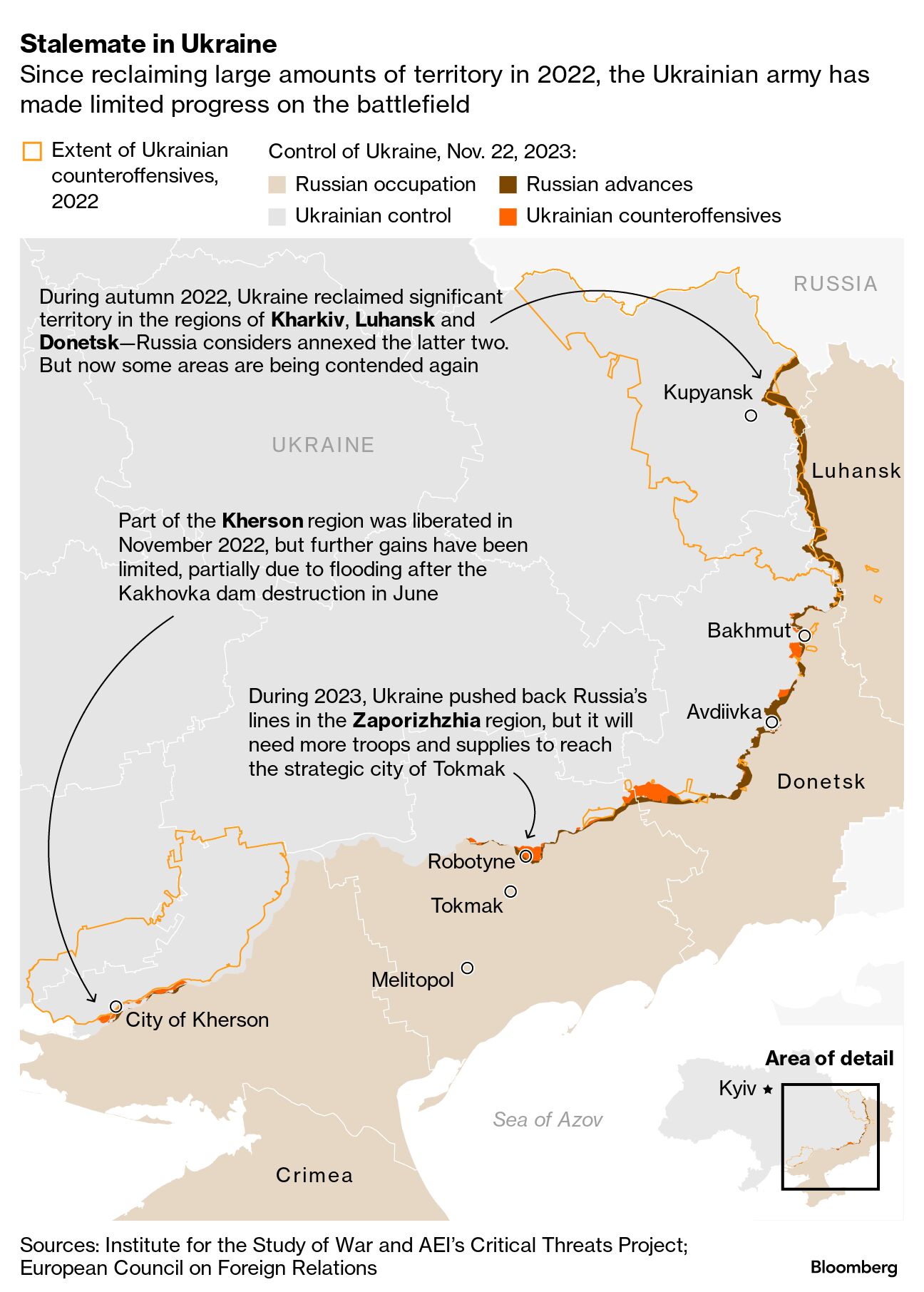

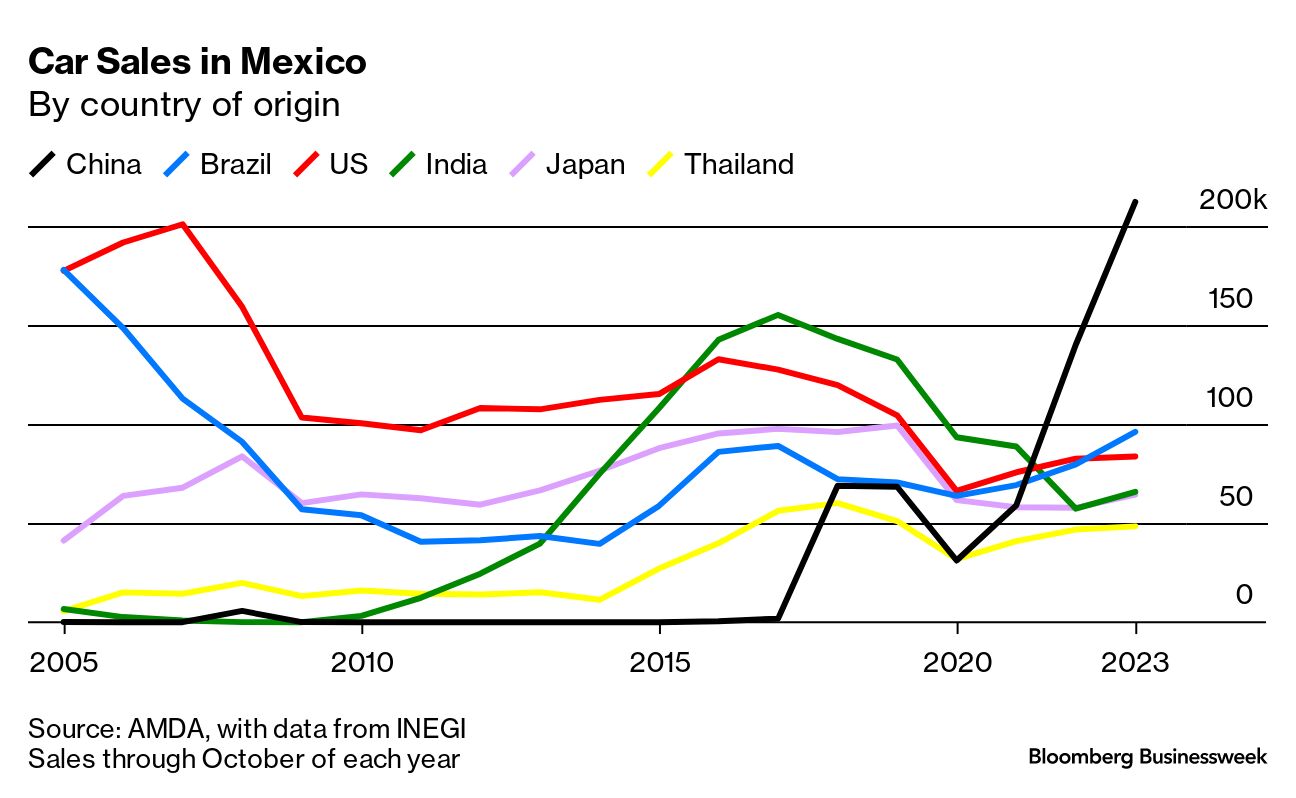

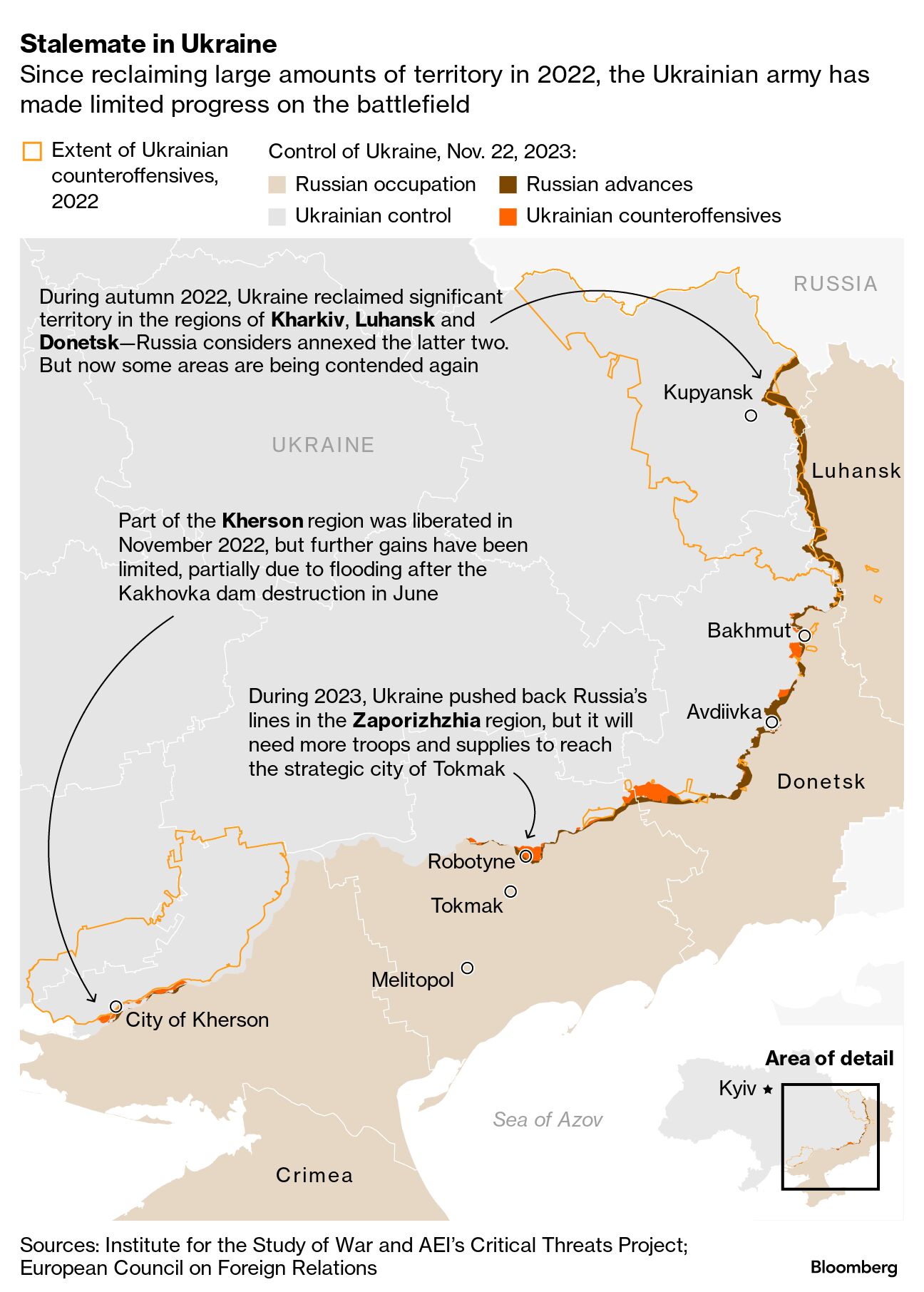

| Knowledgeable investors big and small are bidding up stocks in a fresh sign of confidence that November’s impressive equity rally will continue. In a month where $5 trillion has been added to share values, Goldman Sachs corporate clients have evidenced a jump in repurchase activity, similar to what’s been happening at the buyback desk over at Bank of America, which just had one of its busiest weeks of execution orders. “We could see insiders buying into the bull case of inflation down, rate hikes over, mission accomplished,” said Mike Bailey, director of research at FBB Capital Partners. “Insiders want to take more ownership of that message and they are willing to pony up real money to do so. That is a double-barreled sign of optimism.”  Photographer: Yuki Iwamura/Bloomberg Meanwhile, options in GameStop are seeing wild volume as traders bet that the stock will rally 50% in little over a week. A Dec. 8 $20 call option changed hands 17,500 times by midday in New York. The vast majority of the positions were newly opened and traded in small blocks throughout the morning—a sign that appetite could be coming from individual retail traders. The trade “brings back memories of the meme craze, albeit at a much smaller magnitude,” said Daniel Kirsch at Piper Sandler. Here’s your markets wrap. —David E. Rovella The US government will back mortgages of more than $1 million in high-priced cities as home prices reach record highs. The ceiling for US backing on single-family homes in the highest-cost areas, places like New York and San Diego, will increase to nearly $1.15 million in 2024. Tight inventory has helped prop up prices in many cities. BlackRock’s researchers estimate changes to public financial institutions like the World Bank could free up as much as $4 trillion to help emerging markets address the climate crisis. Nations experiencing the fastest increase in emissions are also those facing the biggest hurdles when it comes to accessing private capital. A goal of the COP28 climate talks set to begin next week in Dubai are to come up with so-called blended finance models, whereby private investors get incentives to join public institutions in committing capital to climate projects, without the terms becoming too onerous for debtor nations. China’s automobile makers have established a beachhead in North America. Chinese car sales in Mexico rose 51% in the first 10 months of the year, with every other foreign country selling less than half that to Mexican consumers. While almost all of these vehicles are gas-powered, the trend gives China a coveted foothold in North America as it battles GM and Ford and others for supremacy in future electric vehicle sales.  The producers of cancer-linked“forever”chemicals, or PFAS, won a big victory over attempts to sue them for contamination in Ohio as a federal appeals court ordered a class action lawsuit dismissed. The suit is one of thousands that 3M, DuPont, and others have faced over alleged exposure to the chemicals, which are incredibly slow to break down in nature and accumulate inside humans. The overturned class certification would have covered 11.8 million Ohio residents. The court said the plaintiff didn’t directly tie the companies to the chemicals found in his body. This week, United Nations investigators reportedly said that PFAS contamination in North Carolina could constitute human rights violations. India is set to add another aircraft carrier to its fleet as it seeks to counter China’s naval presence in the Indian Ocean. The new ship, which can hold at least 28 fighter jets and helicopters, will fly French Rafale jets. India’s first homemade carrier, INS Vikrant, joined the fleet last year and the country also has a Russia-made aircraft carrier. A three-carrier fleet will be a significant show of strength for the Indian navy at a time when the Chinese navy has become increasingly aggressive in the South China Sea while expanding its presence across the region.  The INS Vikrant Photographer: Arun Sankar/AFP/Getty Images Hamas has turned over 12 more hostages—10 Israelis and two Thai citizens—according to Israel, despite earlier competing claims of violations of the deal that brought their war to a temporary pause. Israel in turn reportedly released 30 imprisoned Palestinians. Ukraine Foreign Minister Dmytro Kuleba said he doesn’t feel foreign partners are pushing him to start negotiations with Russia even as his country’s troops haven’t had a major breakthrough on the front lines over the past year. Russia though has reportedly suffered tremendous losses in its so-far failed attempt to take Avdiivka in the east, just as was the case with the Kremlin’s earlier focus on Bakhmut.  Charles Munger, the alter ego, sidekick and foil to Warren Buffett’s “Oracle of Omaha,” has died at the age of 99. Over 60 years, the two men transformed Berkshire Hathaway from a failing textile maker into an empire. A lawyer by training, Munger helped Buffett—seven years his junior—craft a philosophy of investing in companies for the long term. Under their management, Berkshire averaged an annual gain of 20.1% from 1965 through 2021—almost twice the pace of the S&P 500 Index. “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said.  Charles Munger, right, and Warren Buffett together in Omaha, Nebraska, in 1999. Photographer: Bob Bailie Bloomberg Green at COP28: World leaders will gather in Dubai on Dec.4-5 in an effort to accelerate global climate action. Against the backdrop of the United Nations Climate Change Conference, Bloomberg will convene corporate leaders, government officials and industry specialists from NGOs, IGOs, business and academia for events and conversations focused on creating solutions to support the goals set forth at COP28. Register here. |