â Assessing the progress: Economists cannot answer the questions about how safe it is to ease the lockdowns and how to go about it. We can merely look at some key parameters that are informing the political decisions. A major decline in new infections and deaths related to COVID-19 may suggest that some restrictions can be removed. A high capacity to test people for the virus at an early stage would also make it easier to switch to a test-and-trace strategy.

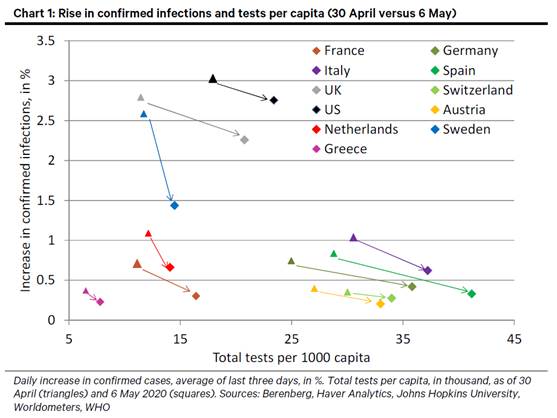

â All countries are different: Judging by how much the infections curve has flattened, Austria, Switzerland, Spain, Italy and Germany could be well placed to ease the (often quite different) restrictions they had imposed before their peaks of the pandemic. The same could apply to Greece and France, despite a low rate of testing. The US, the UK and Sweden seem to lag behind (see Chart 1).

â The risk of renewed waves of infections after a premature easing up looms large: New lockdowns could lengthen and deepen the recession and trigger financial turmoil. Only time will tell how safe it is to ease the lockdowns already. The initial evidence is encouraging. Numbers keep coming down in Austria, which allowed small shops to re-open on 14 April, as well as in Germany where many shops opened again on 20 April. But it is very early days.

â Tick-mark recovery: Our forecast that much of the advanced world will soon embark on a tick-mark-style recovery from a deep trough in Q2 rests on two key assumptions. 1) The lockdowns will be eased cautiously enough to prevent renewed waves of infections that could force major countries to re-impose very disruptive restrictions. 2) Monetary and fiscal policy will do âwhatever it takesâ to prevent a major credit crunch and support the post-lockdown economic recovery

â Watching the data: In this report, we summarise key parameters of the pandemic, lockdowns and exit strategies for major countries in Europe and the US (Table 1). We also summarise the fiscal and monetary policy responses (Table 2). With the exception of a common EU/Eurozone fiscal response, these policies seem adequate.

Click here for full report and disclosures

Chief Economist

+44 7771 920377

holger.schmieding@berenberg.com

European Economist

+44 7973 852381

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659