No surprises ahead of the summer break. The ECB took a breather and kept its monetary policy stance unchanged at its June meeting. During the press conference, ECB President Christine Lagarde said âwe are in a good place at the momentâ. That moment may last a little longer. If economic developments continue in line with, or slightly better than, the ECBâs forecasts, the ECB will likely remain on hold for the remainder of the year.

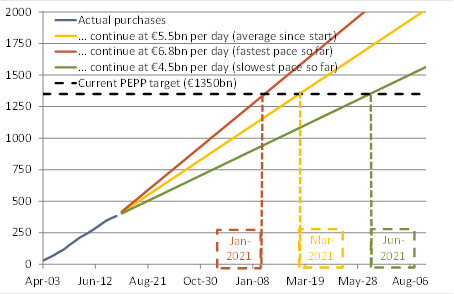

No need to do more yet: After the increase of the Pandemic Emergency Purchase Programme (PEPP) to a total â¬1.35trn at its last meeting in June, and amid the slowdown in the pace of purchases since then, the ECB will not hit its target for quite a while (see Chart 1). Additionally, the Eurozone economy is recovering nicely â in line with our call for a tick-shape rebound. If anything, the incoming data point to a recovery that is a little faster than we and the ECB had expected six weeks ago.

Too early to relax: The ECB stressed that the uncertainty about the outlook is âelevatedâ and the recovery was only in the âearly stagesâ. The risks to the outlook remain tilted to the downside â Lagarde stressed that the rise in infections in the US is a major concern. Consequently, the ECB reiterated that it would stand ready to provide more support if needed. In the same vein, Lagarde also pointed out that fiscal policy makers should phase out current (un-)employment support schemes gradually to avoid a cliff edge in householdsâ income and consumption. The case to maintain an aggressive stimulus near-term and stay supportive for a long time remains thus strong (see ECB asset purchases: not proportionate, yet).

Full use of â¬1.35trn PEPP:A discussion among Governing Council members had recently started about whether the ECB would use the â¬1.35trn envelope fully. Lagarde clarified that, baring a âsignificant upside surpriseâ, the ECBâs would do so. Not using the â¬1.35trn envelope fully was simply ânot in the cardsâ, Lagarde added. In our view, the ECB has set the bar for not using PEPP fully, thereby, very high â higher than the bar for increasing PEPP further.

See you later this year: With more data published by the time of its next meeting on 10 September, the ECB should have a better idea of the pace of the recovery and the impact of its recent policy decisions by then. As long as the economy evolves roughly in line with a tick-shape recovery, we expect the ECB to maintain its current policy stance. It may not be before the December meeting, when ECB staff present 2023 numbers for the first time, that the ECB will have to make a call again on when âit judges that the coronavirus crisis phase is overâ and thus the end of PEPP. In the meantime, it may raise its tiering multiplier, the threshold for which the ECB levies the penalty deposit rate. According to Lagarde, the Governing Council did not discuss it today.

Strategy review: The ECB paused the strategy review it started at the beginning of this year during the Covid-19 pandemic. Lagarde said that the review would resume shortly, with the first meetings starting in September. Lagarde âguessedâ that the review would end throughout H2 2021.

Over to you, EU leaders: Lagarde wished EU leaders âluck, determination and a spirit of cooperationâ at tomorrowâs EU summit, pointing out that they were âcarrying a lot of hopesâ.She reiterated that the EU should see to it that the divergence between member states â which existed already before and worsened during the Covid-19 crisis â would not persist. In the introductory statement, the ECB also stressed that the recovery fund would only âreach its full potentialâ if EU countries implemented âsound structural policiesâ, somewhat supporting the line of the Frugal Four. In other words, reforms would be as important as money.

Chart 1: Projections of when ECB will hit new PEPP target |

|

In bn euros. Sources: ECB, Berenberg. |

Florian Hense

Economist

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom

Phone +44 20 3207 7859

Mobile +44 797 385 2381

Fax +44 20 3207 7900

E-Mail florian.hense@berenberg.com

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom. Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and subject to limited regulation by the Financial Conduct Authority, firm reference number 222782. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html