|

| - | - | - | - | - |

| |

|

|

|---|

Saved cash? Shout it from the rooftops.If this email's ever helped you, please forward it to friends and suggest they get it via moneysavingexpert.com/tips |

| Ends Thu. BT fibre b'band & line PLUS BT Sport '£21.43/mth' The secret to getting a top broadband deal is to look for hot, short-lived promos. And this one from BT's a corker if you need fast fibre & line rent and want to watch football, rugby etc on BT Sport - but even without sport the deal's up there with the best. Here's our fast download (fibre's best for heavy downloads, gaming, streaming or multiple users.)...

|

| Warning for EVERYONE who's shopped at Tesco Express in last 3 mths. 1,000s of payments have been delayed until now, creating bill shock. See what to do in Late Tesco payments. 100+ supermarket coupons worth £100+ incl free £2ish pizza, £5 off fruit. Get February's coupons while they last. 100+ coupons Get 1.95% savings fixed for 1yr. We often focus on easy access deals but if you're prepared to lock money away, you can earn more, though you won't benefit if interest rates rise as it's, er, fixed. The top 1yr deal is from app-based Atom Bank at 1.95%. See Fixed savings for full info and options incl longer fixes. Stop press. EE price rise for millions. Hitting virtually ALL mobile pay monthly custs in March. EE price rise rights 12 roses £4 & more last-min Valentine's deals. Take advantage of the war of the roses to get cheapest in-store bouquets, plus dine-in and restaurant deals. See all last-minute Valentine's Day offers. Is it REALLY cheaper to leave the heating on low all day during this cold snap? The truth behind this & 16 other common energy-use conundrums - eg, should you paint radiators black? The arguments aren't always clear-cut. See what you should do in Energy Mythbusters. |

| |

|---|

| Revealed: Why most should NEVER pay over £10/mth for mobile use Happy with your phone? Out of contract? Had a Sim for 2yrs+? You'll likely save big by switching Sim (the chip in your phone that lets you make calls etc), because prices have dived. But don't be lured in by the huge 20GB-100GB data plans networks push because as our full mobile data poll shows, most don't need anything near that: 77% use less than 5GB/mth and 35% use less than 1GB/mth. With Sims with decent usage costing under £10/mth, why pay more? Here's what to do...

|

| 'How I cleared £180,000 of debt - such a relief, as I couldn't sleep at night.' Read forumite Lozzam's inspirational tale of how she won her 12yr battle to become debt-free with the help of debt charities and the MSE forum. Today (Wed). Buy a 6-inch Subway sarnie, get one FREE. 11am-7pm. Check if your branch is taking part. FREE Ideal Home Show London tix, norm £16-£22 (& Martin's there too). We've extended the giveaway for anyone who missed the freebies last week. 7,000+ avail. Free Ideal Home Show tix 425 spring-planting bulbs £10 all-in (norm £30ish). MSE Blagged. Five varieties - gladiolus, brodiaea, oxalis, allium and gladioli. Thompson & Morgan Sainsbury's Tu 25% off everything. All women's, men's and kids' clothing incl school uniform. Till Mon. Sainsbury's Tu Karen Millen 20% off full-price & sale items code, eg, £128 wool coat (norm £325). MSE Blagged. Online and in-store, ends Sun. Karen Millen |

| AT A GLANCE BEST BUYS

|

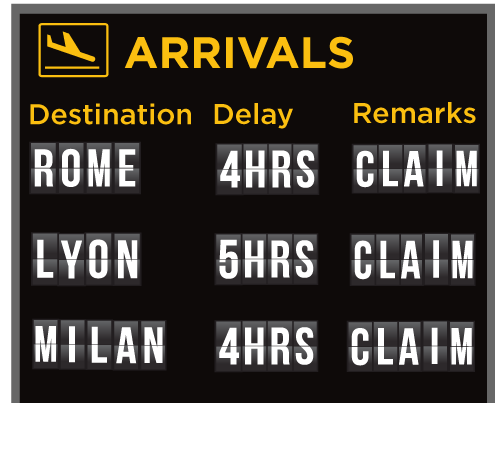

| 'I got £700+ flight delay compensation in just 3 days' Flight delays are a fact of modern life, yet if our bulging mailbox is anything to go by, more and more of you have realised you can get £££s in compensation. What's more, claiming for a flight delay is incredibly easy as Jennifer discovered: "I used your tool on the Tuesday, and by the Friday I had £706 in my account. I couldn't believe it. Thanks." Check-in with our Flight Delay guide and free claim tool to see your full rights, but here's a quick pre-flight check:

|

| £34 beauty box code (£101ish separately). MSE Blagged. Incl Murad eye serum, Balance Me face wash, Organic Pharmacy lip balm & more. Powder Box '£328 POWER OF ATTORNEY REFUND IN 5MINS' - SUCCESS OF THE WEEK £30 free-range roasting meat hamper (£54ish+ at supermarkets). MSE Blagged. All outdoor-reared UK meat. Incl beef, pork, gammon, bacon, lamb mince and sausage meat. Meat hamper |

| CAMPAIGN OF THE WEEK Students – need help with your cash? This week the National Association of Student Money Advisers is running National Student Money Week. The theme is housing costs, and if you're a student with any money questions you can get in touch with an adviser. Also see our 20+ Student Loans Mythbusters. |

| THIS WEEK'S POLL Is it OK to use a 2for1 voucher on a first date? Imagine Robert asks Ashley to dinner on a first date, saying he'll pay. When the bill comes, he pulls out a 2for1 voucher – what advice would you give Ashley? We've asked this over previous years - so let's see if attitudes have changed. Is it OK to use a 2for1 voucher on a first date? |

| MONEY MORAL DILEMMA Should I share my discount? I recently used an app to buy theatre tickets for me and my friend. I later realised the app had given me a £10 discount for buying a second ticket, but my friend's already paid me full price for her ticket. Enter the Money Moral Maze: Should I share my discount?| Suggest an MMD a> Past topics: View all THE QUICKIES - Debt-Free Wannabe chat of the week: Fantastic Feb NSD challenge |

|

| |

|---|

| MARTIN'S APPEARANCES (WED 14 FEB ONWARD) Mon 19 Feb – This Morning, ITV, from 10.30am MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Wed 14 Feb - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: I'm waiting for an operation date and have provisionally booked a holiday. We are told to take out insurance as soon as we've booked so we're covered for cancellation, but if I buy it how does that cover me given the operation? Carla, via email.

In your case, as you know about this operation (and you must declare it when buying cover), it's highly unlikely any policy will pay out if you cancelled for this reason. That said, once you've booked the holiday, it's still worth buying cover ASAB in case something else happens, though if you've a pre-existing condition not all insurers will take you on. See our Pre-existing Conditions Travel Insurance guide for help on how to find a suitable insurer. Please suggest a question of the week (we can't reply to individual emails). |

| 'RUSTED BISCUIT TINS & A LOO ROLL TUBE HOARD'. WHAT'S LURKING IN YOUR CUPBOARDS? That's all for this week, but before we go... even though technically it's not quite time for a spring clean, de-cluttering is one of the big talking points on our forum this week. Finds MoneySavers have reported hidden among their cupboard cobwebs include a selection of rusted, battered biscuit tins and a hoard of loo roll tubes. So why not share your discoveries and take the challenge by heading over to our 2018 de-clutter forum thread? We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email hsbc.co.uk, natwest.com, firstdirect.com, bank.marksandspencer.com, barclaycard.co.uk, sainsburysbank.co.uk, nationwide.co.uk, autoaidbreakdown.co.uk, americanexpress.com, productsandservices.bt.com, billmonitor.com, thepeoplesoperator.com, uswitch.com, store.three.co.uk, moneysupermarket.com, comparethemarket.com, gocompare.com, confused.com, directline.com, aviva.co.uk, admiral.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). The registered office address of both MoneySupermarket.com Group PLC and MoneySupermarket.com Financial Group Limited (registered in England No. 3157344) is MoneySupermarket House, St. David's Park, Ewloe, Chester, CH5 3UZ. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |