|

|

To investors,

The bitcoin spot ETFs have sucked all the air out of the room over the last two months. With more than $60 billion collectively in the various ETFs and more than $1 billion in net inflows, there is good reason for so many people to be paying attention.

But the new shiny development has allowed most people to stop thinking about a prior shiny story: nation-state adoption of bitcoin.

Back in the summer of 2021, the country of El Salvador decided to embrace bitcoin in a way that no other country ever had. They made bitcoin legal tender in the country. They created a bitcoin wallet app and gave every citizen $30 of bitcoin who wanted it. They also started mining bitcoin with their volcano-energy production facilities.

And the icing on the cake? The President of El Salvador started buying bitcoin directly on the country’s balance sheet.

His first purchase was 200 bitcoin on September 6, 2021 — a historic moment in history.

President Bukele followed up the first purchase with another 200 bitcoin later in the same day.

For those who were not paying attention at the time, you can imagine the reaction from people when they saw the President of a small country market-buying bitcoin and then tweeting after each purchase.

It was entertaining to say the least. The bitcoiners loved it. Nation states were finally adopting bitcoin. Shortly after Bukele began buying bitcoin, various politicians across Latin America pledged to help their countries buy bitcoin as well.

Almost none of them have been successful so far, especially when compared to the level of success and speed that Bukele has implemented in El Salvador.

That was the end of the story though, right? El Salvador bought some bitcoin and did a few experiments in their country. It was cute. The country is small. No one really cared after awhile. You didn’t hear any stories about bitcoin — instead most of the El Salvador stories were around the reduction in crime that the President was able to usher into reality.

The novelty of the bitcoin game had worn off.

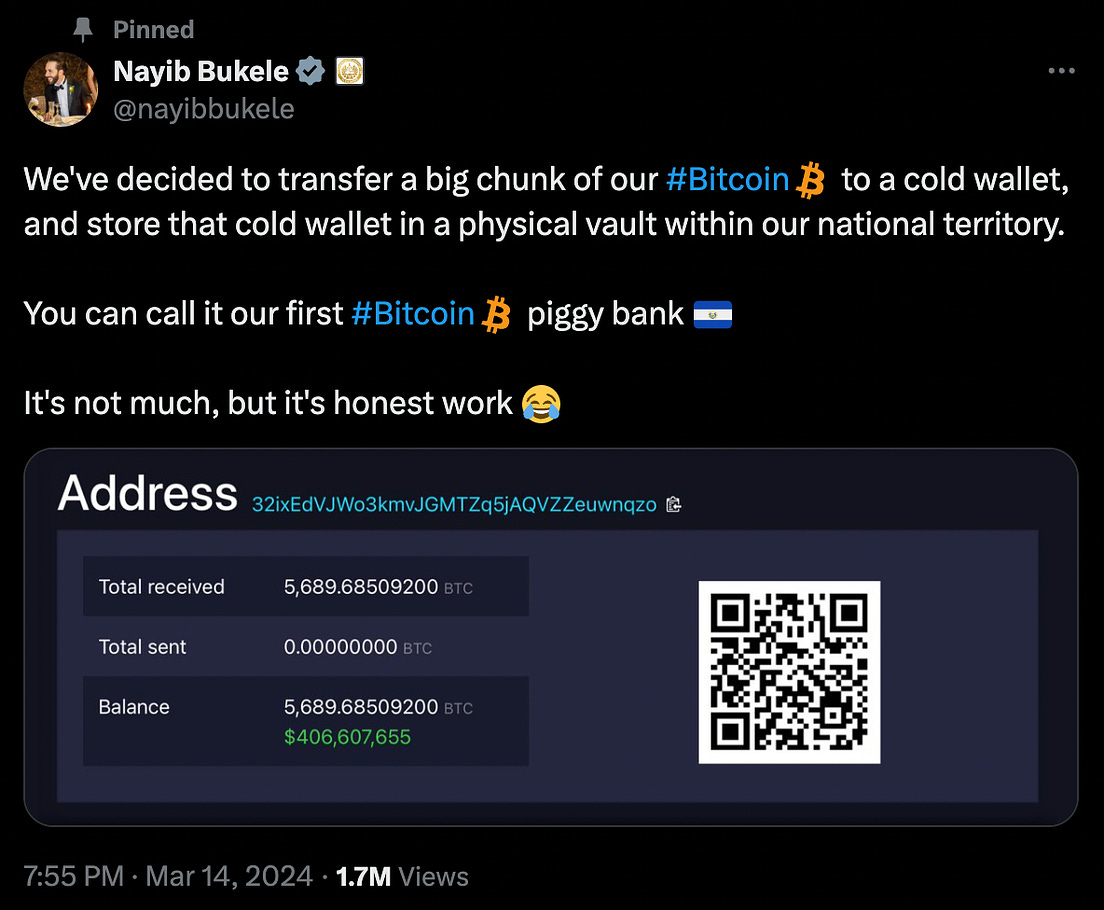

Well, that all changed yesterday. President Bukele announced that El Salvador would be moving their bitcoin to cold storage and holding the cold storage device within the country’s borders.

This development alone would be newsworthy. A country’s leadership was taking custody of their bitcoin, which shows how well they understand the value proposition of bitcoin.

But there was a new detail in this announcement — Bukele tweeted the country’s bitcoin wallet address and it was revealed that El Salvador has 5,689 bitcoin which are worth more than $400 million today.

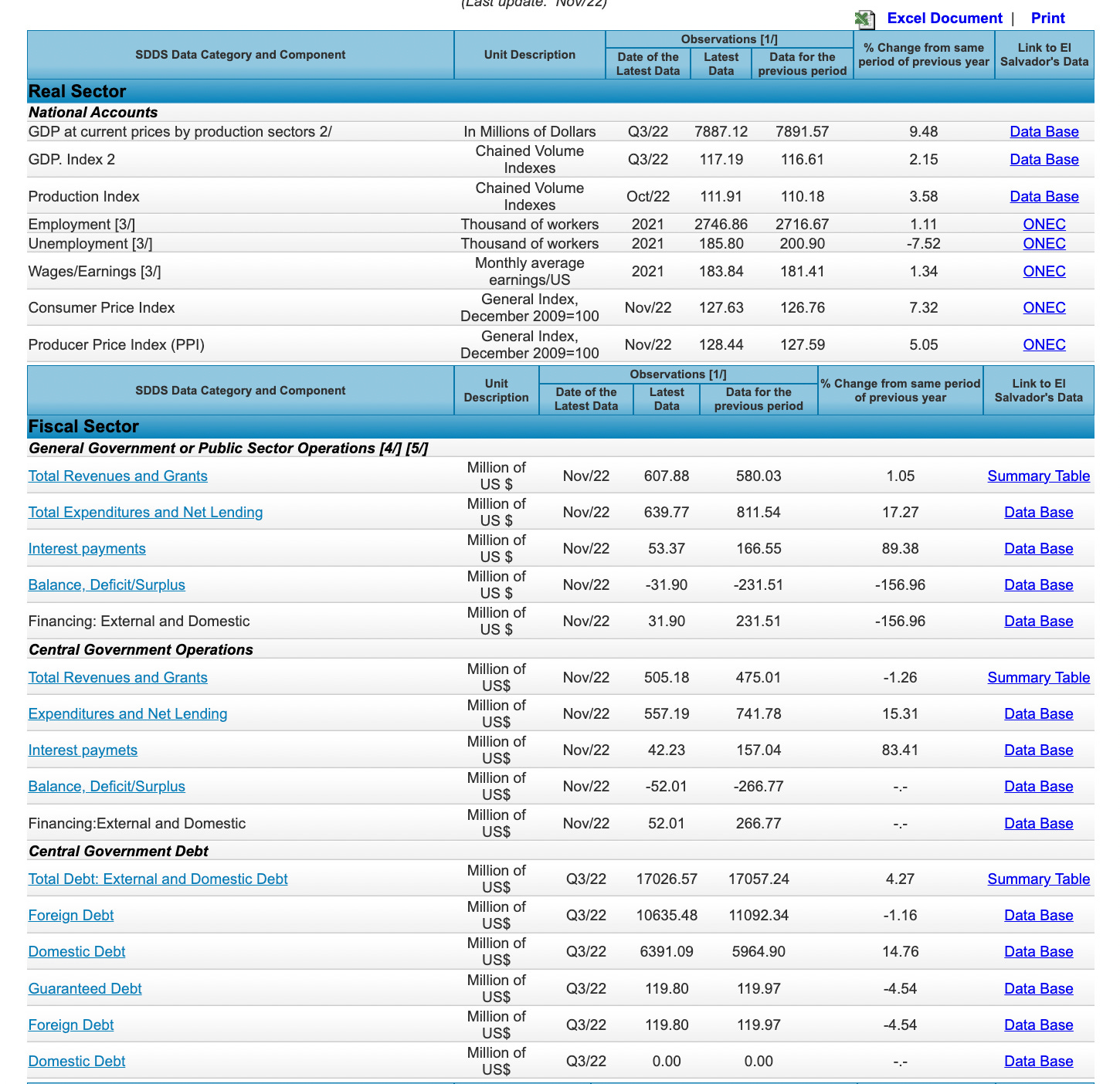

That may not seem like a massive number, but this is coming from a country that has less than $2.5 billion in total revenue and grants on an annualized basis.

So the ETFs are fun to watch because we get a daily update of the net inflows. We can see the price of the digital currency rapidly appreciating. And the mainstream media is covering the progress daily.

Just don’t forget that there are plenty of other people, corporations, and countries vying to get as much bitcoin as they can purchase as well. Watching El Salvador go from their first 200 bitcoin purchase to more than 5,000 bitcoin is quite impressive, especially since they did it so quietly.

We will find out in the coming decades how important it is for a country to buy and hold bitcoin, along with how prescient President Bukele will appear with the benefit of hindsight.

Hope you all have a great weekend. I’ll talk to each of you on Monday.

-Anthony Pompliano

Sam Corcos is the Founder & CEO of Levels.

In this conversation, we talk about how to run a high performing startup, calendar management, team management, personal productivity tips, decision making, networking, and more.

Listen on iTunes: Click here

Listen on Spotify: Click here

How To Run A High-Performance Startup

Podcast Sponsors

Supra - Join Supra’s early integration program for zero-cost access to the fastest oracles and dVRF across 50+ blockchains.

Propy - Now, anyone can start their on-chain journey by minting home addresses via PropyKeys and staking them for profit until they are ready to sell their home.

BetOnline - Use crypto to bet on sports, casino games, horse racing, poker and more with promo code POMP100.

Espresso Displays - The world's thinnest touchscreen portable monitor. Expand your workspace and work from anywhere.

Base - Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub - Your data-driven gateway to the US housing market.

Bay Area Times - A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.