Employment Cost Index rises in Q4, prices increase, personal consumption moderates

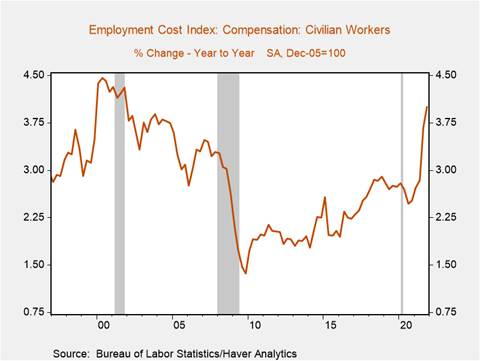

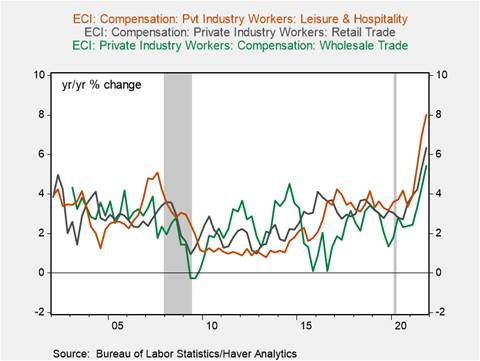

*The employment cost index for industry workers, a broad measure of employment costs watched closely by policymakers at the Fed, increased 1% q/q and 4.2% annualized in Q4, a modest deceleration from the 5.4% annualized increase in Q3, but still the fastest annualized rate since 2004, notwithstanding the rapid gain in Q3 (Chart 1). Notably, the employment cost index for service-providing industries, which tend to be more labor intensive, increased 1.2% q/q and 5% annualized, with particularly sharp increases within wholesale trade (6.3% annualized), retail trade (10.9% annualized), and leisure and hospitality (5.6%) (Chart 2). These increases have thus far largely been outpaced by inflation, and we expect nominal wages gains to remain elevated in a “catch-up” to rising prices. In Q4, wages and salaries of private industry workers rose 5% yr/yr and 8.1% among workers in service occupations.

*Labor markets are tight and are likely to tighten further, shifting the balance of power toward workers. The number of job openings per unemployed person is at an all-time high of 1.6, while early retirements, declines in immigration, caregiving obligations, and demographic trends will likely contribute to a drawn-out recovery in labor force participation, accentuating employment shortages and exerting further upward pressure on wages. Anecdotal evidence suggests rising nominal wages are increasingly impacting business price-setting behavior, and, amid strong current and anticipated product demand, businesses should retain the flexibility to pass increased labor costs on to consumers. The Federal Reserve Bank of Atlanta’s Business Inflation Expectations Survey indicates 38% of businesses expect labor costs to have a strong upward effect on product prices in the next year, and 78% of businesses expect labor costs to have either a moderate or strong upward influence on product prices in the next year.

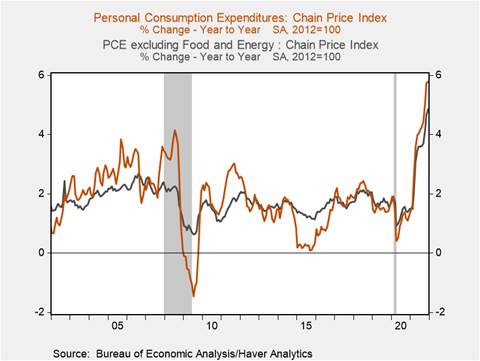

*The PCE price index rose 0.45% m/m, and 5.8% yr/yr, the highest annual rate since 1982, and accelerated on a three-month annualized basis to 7.1% (Chart 3). The core PCE price index (which excludes food and energy) rose 0.5% m/m and 4.9% yr/yr and accelerated on a three-month annualized basis to 5.8%. Goods prices rose 0.5% m/m, led by a 0.9% m/m increase in durable goods prices in part driven by a 1.8% m/m increase in motor vehicle and parts prices. Services prices rose 0.4% m/m and 4.3% yr/yr, with tenant and imputed owner occupied rent both rising 0.4% m/m. Imputed owner occupied rent has increased 3.8% yr/yr and should accelerate to reflect the sharp increase in market rents (+15.7% yr/yr, according to Zillow) and home prices. On a three-month annualized basis, imputed owner occupied rent has increased 5.2% and should contribute substantially to elevated headline and core PCE inflation through 2022.

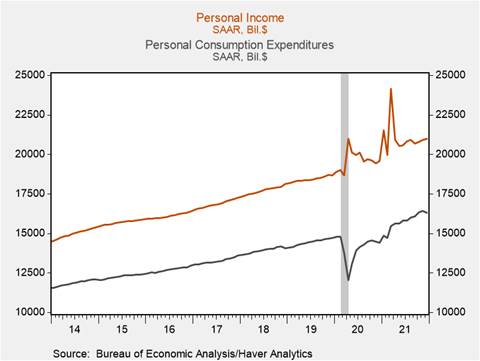

*Personal income rose a modest 0.3% m/m in December, underpinned by a 0.8% m/m increase in private sector wages and salaries lifting the annualized rate of change to 9.6% (Chart 4). Rising nominal personal income reflects solid increases in payroll employment, coupled with tight labor markets that have contributed to sharp nominal wage increases and rising aggregate weekly hours worked. Disposable income rose 0.2% m/m and a robust 5.6% yr/yr, a slight deceleration from November. The personal saving rate retraced its October-November decline, rising to 7.9%, as households cut back on consumption. We anticipate sustained increases to disposable income, which together with healthy household balance sheets and an easing of supply constraints will support consumption in 2022.

*Consistent with November and December’s soft retail sales data, personal consumption expenditures declined 0.6% in December, following a downwardly revised 0.4% m/m increase in November. December’s consumption data may reflect a variety of factors. One is that consumption rose significantly in October (1.5% m/m), potentially reflecting a “pulling forward” of holiday retail spending. Another is that supply chain disruptions and distribution bottlenecks constrained economic activity, which was exacerbated by the surge in COVID-19 cases in December that dampened retail foot traffic, measured by high frequency mobility data and further intensified labor shortages as workers were sidelined by illness. Adjusted for inflation, consumption declined 1% m/m in December on the heels of a 0.2% m/m decline in November and suggests elevated prices may have begun to curtail demand.

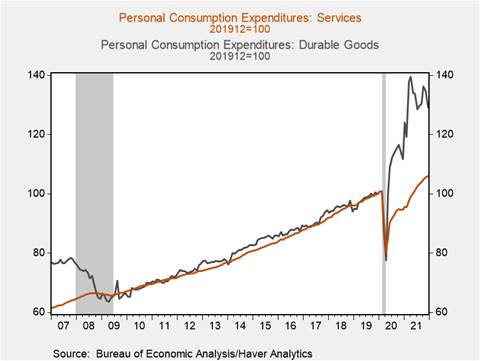

*December’s data indicate nominal consumption may have begun to rebalance away from goods, particularly durable goods, and toward services. Indeed, the December fall in personal consumption is entirely attributable to the decline in durable and non-durable goods consumption. Durable goods consumption fell 4.1% m/m while services consumption rose 0.5%, and a continuation of this trend through 2022 is possible as the impact of the omicron variant dissipates, and in-person economic activity accelerates through 2022 (Chart 5). In the near term, the omicron variant could temporarily disrupt this rebalancing as consumers shy away from high-contact in-person services consumption while COVID-19 cases remain elevated.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Chart 5.

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.