Employment costs spike, real consumption moderates, PCE inflation elevated

Employment Cost Index

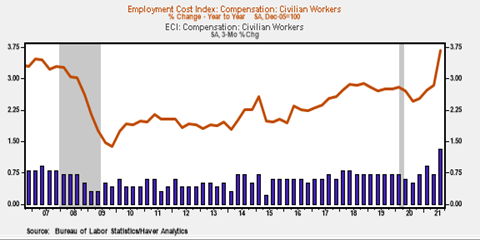

*The Employment Cost Index, a comprehensive quarterly measure of employment costs for civilian workers that measures total compensation including wages and salaries and benefits, jumped 1.3% in Q3, generating a jump in its yr/yr rise to 3.7% from 2.8% in Q2 (Chart 1). This yr/yr increase is the largest since Q4 2004. The sharp acceleration in the ECI is noteworthy insofar as it is a much broader measure of employment costs than the monthly data on average hourly earnings. The combination of strong demand for labor and labor supply shortages plus higher inflationary expectations points to further increases in the ECI.

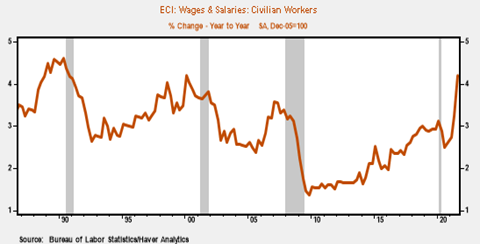

*The ECI for wage and salaries of civilian workers jumped 1.5% qtr/qtr, boosting its yr/yr rise to 4.2%. This is its largest rise since 1990 (Chart 2). The ECI for benefits rose 9%, lifting its yr/yr rise to 2.5%, only a touch higher than its average of 2.4% in 2019.

*The ECI rose 1% in goods producing industries (construction and manufacturing), lifting its yr/yr rise to 3.4%, and rose 1.5% in service producing industries, lifting its yr/yr rise to 4.2%. The largest rise occurred in leisure and hospitality, where the quarterly rise of 2.5% boosted the yr/yr rise to 6.9%.

Personal Income and Consumption

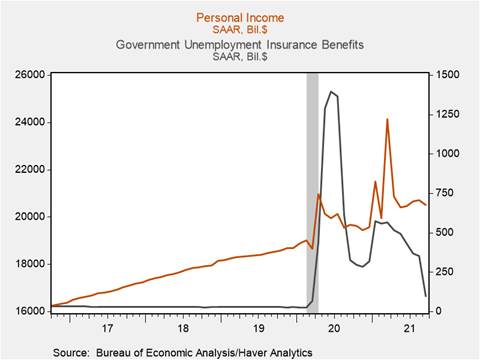

* Personal income fell 1% (-$216 billion) on an annualized basis in September underpinned by a 72.3% (-$254 billion) decline in unemployment insurance receipts, reflecting both the decline in unemployment (-8.5%) and expiration of pandemic unemployment insurance in September (Chart 3). Wages and salaries rose 0.8% lifting their yr/yr increase to 9.4%, while supplements to wages and salaries rose 0.3% reflecting labor market tightness that is prompting firms to lift compensation to attract workers, and these wage gains are likely to remain elevated throughout the upcoming holiday retail season. The personal saving rate fell to 7.5%, reflecting the reduction in personal income.

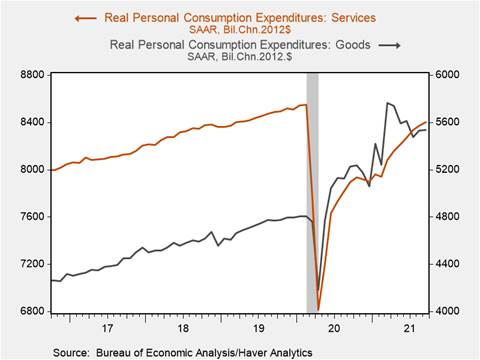

* Nominal consumption rose 0.6%, with consumption of goods rising 0.5% and services up 0.6%, and in nominal terms these measures of consumption have all surpassed their pre-pandemic levels. However, in real terms personal consumption rose 0.3% m/m with services consumption rising 0.4% m/m. Although real personal consumption is above its pre-pandemic level, this partly reflects the shift in the composition of consumption to goods, with real services consumption still 1.7% below its Jan. 2020 level (Chart 4).

* Real goods consumption rose 0.1%, while durable goods consumption fell 0.5%, its fifth consecutive monthly decline as supply shortages and disruptions to distribution constrained production and consumption of goods. Consumption of motor vehicle and parts (-3.0%) and furnishings and durable household equipment (-0.6%) fell, while consumption of recreational goods and vehicles (+1.5%) rose. Real consumption of services ticked up 0.4% despite the delta variant driven surge in COVID-19 cases, with real consumption of food services and accommodation increasing a healthy 1%. As the impact of the delta variant wanes, economic activity in high contact, service sector industries should pick up.

PCE Price Index:

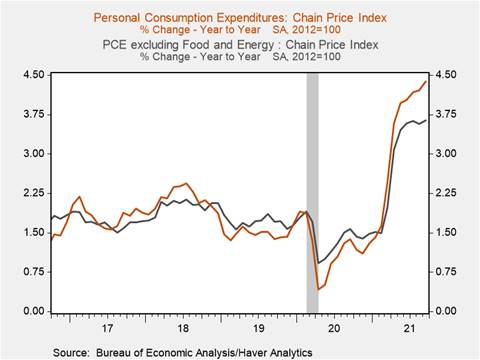

* The PCE price index rose 0.3% m/m lifting its yr/yr increase to 4.4% while core PCE, which excludes food and energy, rose 0.2% m/m and 3.6% yr/yr, its highest yr/yr increase since 1991 (Chart 5). Goods inflation remains elevated, rising 0.5% m/m and 6.1% yr/yr. Prices of used autos which surged earlier this year, picked up in September rising 2.9% m/m and 30% yr/yr, highlighting the persistence of supply chain disruptions that have exerted upwards pressure on prices. Housing prices, one of the largest components of the PCE price index, rose 0.4%, and have accelerated, rising 3.9% on a three-month annualized basis compared to 3.4% in August, as rising home prices and rents begin to reflect in the PCE price index.

Chart 1:

Chart 2:

Chart 3:

Chart 4:

Chart 5:

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2021 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.