Click here for full report and disclosures

Click here to request a call about this note.

â Ready to roar once lockdowns are eased: Across the advanced world, households are eager to spend more on consumer services once the pubs, shops and theatres are open again. By and large, consumers have the money to do so. We estimate that households in the Eurozone last year saved 50% more than in 2019 as lockdowns curtailed opportunities to spend, while government support kept real disposable incomes roughly constant. Of course, the surge in consumption will be less impressive in the Eurozone than in the US, where household savings doubled last year after record government transfers raised real disposable income by 5.8% in 2020. However, the bounceback in Eurozone consumer spending of 14.1% qoq in Q3 2020 after the 12.6% qoq decline during the first wave of the pandemic in Q2 2020 suggests that consumption will again drive the upturn in the Eurozone once lockdowns are eased for good.

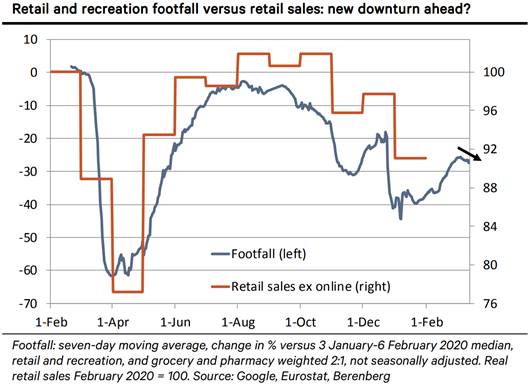

â Have money – but cannot it spend yet: Until early March, the Eurozone economy was on track for an imminent rebound. Confirmed infections with the SARS-CoV-2 virus, which had been far below those in the UK and the US during the winter, had come down nicely. Some countries relaxed restrictions; many consumers also dared to venture out more than before. As retail and recreation footfall increased (see chart), the risks to our call that an easing of restrictions and a rebound in economic activity would commence by mid-March were tilting to the upside.

â The virus strikes again: Due to the rapid spread of more contagious variants, the seven-day average of recorded daily infections has risen from 20 per 100,000 people in late February to 26 on 20 March. The pace seems to be quickening modestly. Eurozone countries have – on average – administered only 13 doses of vaccine per 100 inhabitants, versus 43 in the UK and 36 in the US so far. Many Eurozone countries thus have to extend and/or tighten their lockdowns again. The chart shows that footfall has started to recede. We now assume that a significant easing will start only in the second half of April. By then, the lockdowns, some vaccination progress and sunnier weather will – hopefully – have helped to contain the new wave to such an extent that medical systems can cope and restrictions can be eased.

â The costs of a one-month delay: We estimate that the February level of lockdowns kept economic activity c4% below normal. Due to thriving global trade, the damage is much smaller than during the first wave of the pandemic, which had also grounded parts of industry. Returning roughly to the February lockdown levels and maintaining them for one extra month will reduce annual average GDP by some 0.3ppt. The lost month takes our forecast for Eurozone growth in 2021 from 4.4% to 4.1%. If harsh lockdowns had to be extended well into May, we would have to push back the expected rebound in consumer spending accordingly and lower the 2021 GDP growth call to c3.8%.

â Rebound later but a little stronger: The likely delay in re-opening Eurozone economies is not the end of the story, though. Governments will extend their support for furloughed workers and their other transfers. Households that cannot spend as much as they want to will accumulate further excess savings. They will thus be able to spend a little more in the future than they would otherwise. In addition, a base effect from the delayed rebound in consumption from low to more normal in 2021 automatically raises the yoy rate of growth in 2022. We thus increase our estimate for spending growth after the pandemic. This takes our call for GDP growth in 2022 to 4.7% from 4.3%. We look for the Eurozone to return to its pre-pandemic level of GDP by Q1 2022. For details, see Forecasts at a Glance.

Chief Economist

+44 7771 920377

holger.schmieding@berenberg.com

Disclosures

This material is intended as commentary on political, economic or market conditions for institutional investors or market professionals only and does not constitute a financial analysis or a research report as defined by applicable regulation. See the "Disclaimers" section of this report.

The commentary included herein was produced by Joh. Berenberg, Gossler & Co. KG (Berenberg). For sales inquiries, please contact:

Phone: +44 (0)20 3207 7800

Email: berenberg.economics@berenberg.com

BERENBERG

Joh. Berenberg, Gossler & Co. KG

Neuer Jungfernstieg 20

20354 Hamburg

Germany

Registered Office: Hamburg, Germany

Local Court Hamburg HRA 42659

Kallum Pickering

Senior Economist, Director

Mobile +44 791 710 6575

Phone +44 203 465 2672

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom![]()

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom.

Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and deemed authorised and regulated by the Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authorityâs website. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html.