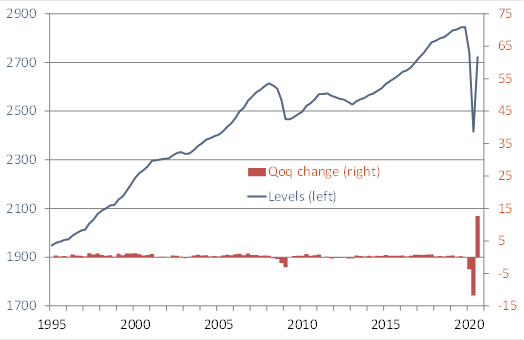

Q3 is history. Countries across Europe are tightening restrictions to contain the second wave of Covid-19. Economic activity is likely to contract in the Eurozone in Q4. But the record-breaking 12.7% qoq rebound in Q3 GDP – after a dramatic -15.1% slump relative to Q4 2019 (Q2: -11.8%, Q1:-3.7%, see Chart below) – illustrates the potential that the Eurozone economy can rebound fast once the second wave is brought under control again through restrictions, medical progress and – at the latest – the advent of spring. In this sense, the strong backward-looking result for Q3 GDP supports our cautiously optimistic view for the Eurozone economy and its markets for next year. We expect the Eurozone economy to return to its pre-pandemic level no later than mid-2022. France and Germany will likely recover faster (early 2022), with a chance of reaching the late-2019 level of GDP in late 2021 already. Italy with its deep-seated structural weaknesses may need until early 2023, holding back the Eurozone average.

Almost like a V – helped by a base effect: After a sharp snapback in May and June, the data for Q3 show that activity continued to recover strongly during July and August and – probably less so – in September. But at least half of the record gain in Q3 GDP may reflect a base effect. Any quarter that does not include a full lockdown month such as April looks less dismal than Q2. To illustrate the size of the base effect, even if activity in the Eurozone had stayed at its June level throughout the summer, Q3 GDP would probably have exceeded the Q2 average by more than 6% qoq. In Q3, despite rising by more than our above-consensus call of 9.6%, GDP still fell 4.3% short of its pre-pandemic peak of 2019 Q4 (US yesterday 3.5% below peak).

Gradual shift from consumer spending on goods to manufacturing production and trade: When non-essential shops and factories re-opened from late April or May onwards, consumer spending on most goods recovered fast. Helped by still-buoyant internet and mail-order sales, retail sales either significantly surpassed (Germany and France) or came close to (Italy and Spain) their year-ago levels in August. While consumer spending on goods gained further throughout Q3, spending on services was held back by continued uncertainty and some restrictions. Beyond consumption, manufacturing production turned ever more into the driving force of the solid upswing that gradually lost momentum over the course of Q3. Having lagged well behind the early rebound in sales of goods, the production of and international trade in goods had a lot of room to recover, even though sales growth may have stalled again at a high level in some countries in September. Following the earlier rebound in sales and due to a need to replenish inventories, factory orders and manufacturing output jumped in Q3. Judging by the available French and Spanish data, business investment also rebounded strongly during Q3. However, it remains further below its pre-pandemic level by more than total GDP, as the French and Spanish data suggest. Firms have sufficient spare capacity and remained cautious amid the beginning of the second wave. As governments continued to dole out generous dollops of survival support, augmenting incomes, limiting dismissals and helping companies to survive, public consumption is probably the only GDP component that is above pre-pandemic levels.

German GDP surged by 8.2% qoq in Q3, the strongest performance since Destatis began collecting quarterly growth data in 1970 and above expectations of 7.3%. As Germany imposed a softer and shorter lockdown in spring, activity fell by less during H1 (11.6%) than in the Eurozone (-15.1%). German GDP in Q3 thus increased from a less depressed starting level. The German economy remains 4.2% below its pre-pandemic Q4 2019 level. Destatis did not provide a quantitative breakdown of GDP components, but pointed to strong gains in household consumption, machinery investment and exports. The decline in the number of short-time (“Kurzarbeiter”) workers from just under 6 million in April down to 2.6 million in August probably contributed to improved consumer sentiment and spending.

France recorded the strongest Q3 jump in activity among the major Eurozone countries with a gain of 18.2% qoq, a pleasant surprise relative to already high expectations of 15.4%. This rebound came from a very low base as France, with one of the most stringent and longest lockdowns in Europe after Spain, had suffered a particularly sharp contraction in GDP in H1 (-18.9%; Q2: -13.7%, Q1:-6%). All expenditures components contributed to French growth. Private consumption rose by 17.8% qoq, government consumption by 15.4% and total capital formation by 23.3%. As exports outpaced imports by a wide margin (up 23.2% qoq vs. 16.0%), foreign trade added 1.1ppt to GDP after subtracting a total of 2.5ppt from GDP in H1. The whopping Q3 performance brought the French economy much closer to the pre-pandemic peak in 2019 Q4, but it still remains 4.1% below that level (US yesterday 3.5% below peak). French exports remain the most depressed at 9.2% below the pre-pandemic level.

Italy’s economy rebounded by 16.1% in Q3 from the previous three months and therefore by much more than expected (11.2%). It follows qoq declines by 13% in Q2 and 5.5% in the first quarter. Relative to the pre-pandemic quarter of Q4 2019, activity was down by 4.5% in Q3. After falling to levels last seen in the early 1990s, GDP returned to the same level as in H1 2015. ISTAT said all sectors of the economy – industry, services and agriculture – contributed to the Q3 gains, without giving any numerical details. Italy’s government has so far refrained from re-imposing restrictions as harsh as those in France or Germany on a national level, but may have to follow them soon. Infection and deaths rates are well below those of France, but above those of Germany.

Spanish GDP expanded at a record pace of 16.7% qoq in the third quarter. After the biggest collapse in activity in H1 of a combined 22.1% (Q2: -17.8%, Q1: -5.3%) among the major Eurozone countries, Spanish GDP remains 9.1% below its 2019 Q4 level. The Spanish economy thus lags well behind the Eurozone average (4.3% below the pre-pandemic level). We see three reasons: Firstly, Spain imposed one of the longest and most stringent lockdowns in spring. Its economy therefore has more lost ground to make up for. Secondly, the country is among the countries most hit by the travel restrictions this year. The tourism and travel industry makes up roughly 14% of the economy. Also, Spain was the first among the major countries to suffer from the second wave of infections and restrictions, so it could not recoup its losses from H1 as much as other countries.

Chart 1: Eurozone GDP quarterly levels (in bn) and changes (qoq, in %) |

|

Sources: Eurostat, Berenberg. |

Florian Hense

+44 7873 852381

Holger Schmieding

+44 7771 920377