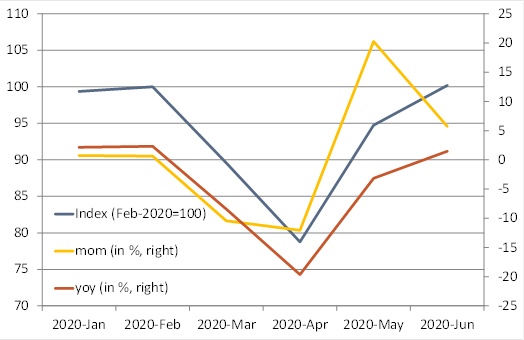

Back to pre-pandemic levels in June: Amid lockdown measures to contain the spread of the Covid-19 pandemic, retail sales had dropped like a stone by 21.2% between February and April. Since then, retail sales have rebounded rapidly as shops opened again. After a record rise of 20.3% mom in May (revised up from 17.8%), retail sales rose by a further 5.7% in June in an almost V-shaped pattern. The monthly pick-up in June fell slightly short of expectations of 5.9%. However, sales volume still ended up higher-than-expected after the upward revision to the May data. Relative to the previous year, retail sales were up by 1.5%, better than the -3.2% in May and -19.6% in April, but still down from the 2.3% yoy increase in February. While retail sales are back to February levels, it would be premature to speak of a complete recovery. For that to happen, retail sales would have to rise further over the next couple of months to make up for the very poor March and April.

Spain and Italy lagging behind, France and Germany leading: While retail sales rebounded by double digits in Spain (16.5% mom) and Italy (+12.5%), sales still remain below pre-crisis and 2019 levels (Spain: -5.3% and -4.4% yoy, respectively; Italy: -2.7% and -3.1% yoy, respectively). Going forward, Spain in particular will continue to suffer from a disappointing summer tourism season amid the current increase in Covid-19 infections. In France, sales rose by 9.4% mom boosting the yoy rate to 4.5% – the highest among the four major Eurozone economies. German retail sales corrected by 1.6% in June but remained 1.4% above February’s pre-pandemic levels after relatively small losses during March and April and a strong increase in May.

Trends across product groups normalise: Online sales skyrocketed after February as people spent more time at home. That boom eased a little in June as consumers have started to flock to shops. After 25% above pre-crisis levels in May, mail order/internet sales receded to 16% above the February level in June. Textile/clothing/footwear sales rebounded rapidly by 20.4% mom after the record 224.1% jump in May from an extremely depressed level in April. But textile/clothing/footwear sales remained still far below that of the previous year in June (-27% yoy). Shops selling clothing had been among the worst hit by lockdowns and probably most affected by the consumer switch to mail order/internet. As governments further relaxed stay-at-home orders, workers returned to their factories and travel restrictions eased, consumers bought more car fuel in June. Automotive fuel sales still remain low (almost 23% below February levels), but much less so than in the lockdown month of April (47.5% below pre-crisis level). While households expect to spend more time at home – for work or leisure, they continue to invest in their digital infrastructure: Sales of information and communication equipment rose further, but less markedly than in May (2.3% mom in June vs. 60% in May).

Outlook – recovery taking a breather after positive July: We expect a good July outside the key tourist regions such as Spain, followed by a little breather in response to the current increase in infections which, outside Northern Spain, remains modest. As consumer spending rises further and retailers sell off their stocks, production growth, which has lagged retail consumption so far, should regain some momentum as well, in line with the recent increases in the manufacturing PMIs and other surveys for July. That would bode well for the recovery of the entire Eurozone economy.

Chart 1: Eurozone retail sales in 2020 |

|

In volume terms. Sources: Eurostat, Berenberg. |

Florian Hense

Economist

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom

Phone +44 20 3207 7859

Mobile +44 797 385 2381

Fax +44 20 3207 7900

E-Mail florian.hense@berenberg.com

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom. Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and subject to limited regulation by the Financial Conduct Authority, firm reference number 222782. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html