AI is here. Are you ready?

On Tuesday, Cisco released its new AI Readiness Index. The company surveyed over 8,000 senior executives at global companies with 500-plus employees. A full 97% reported increased urgency to leverage AI for their businesses, but only 14% were ready to do so.

Only 30 or so companies have already successfully integrated AI across all aspects of their businesses, according to Tom Davenport and Nitin Mittal’s new book, All In on AI.

We’ll hear from Davenport, a senior advisor to Deloitte’s AI practice, next week on Global Macro Update. But today, instead of an interview, I’m going to share a bit about how we are looking at opportunities in artificial intelligence.

AI is a catalyst for rapid fundamental change. Harvard Business Review estimates that AI could add $13 trillion to the global economy over the next decade. PwC’s estimate is more aggressive: $15.7 trillion by 2030.

Executives will talk about AI on every earnings call for the next several years. With all the hype, how can you identify the companies truly leveraging AI to maintain a competitive edge?

One way is to look at changes in worker productivity. On its own, today’s level of artificial intelligence won’t make entire companies radically more productive. But companies that integrate AI with their enterprise software and automation will boost productivity to a degree not seen in decades. I call this the “holy trinity of technology.”

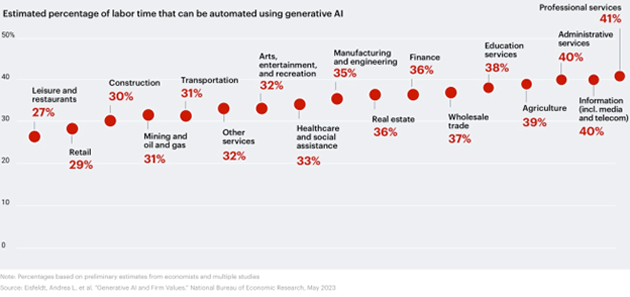

The success of businesses will depend on if, when, and how well they integrate the holy trinity. For those that get it right, productivity could soar 40%. This goes for companies in healthcare, financial services, legal services, education, entertainment, manufacturing, transportation, and agriculture. Just about everyone.

Source: Bain & Company

Big business has an edge here.

Take law firms, for example. A small firm with one to five lawyers could spend $400 a year for Casetext’s “AI legal assistant” CoCounsel, and the firm might get 30% more done. That’s great, but large, multinational law firms that generate billions in annual revenue won’t settle for a $400 off-the-shelf product. They can afford customized, AI-driven enterprise software to boost productivity.

Multinational law firm Allen & Overy is already doing this. The UK-based firm, which employs over 3,500 lawyers, partnered with Harvey AI to automate some of its legal research and drafting through tailored AI-driven enterprise software. The firm says it’s the first in the world to use generative AI at the enterprise level. Attorneys at bigger firms will become much more productive. (As an aside, I’m not sure that’s such a good thing.)

No one can integrate the holy trinity on that scale without help. This is where facilitators come in…

Facilitators (aka consultants) will lead the process of integrating AI, enterprise software, and automation at most Fortune 500 businesses. Remember, only 14% of large global companies say they’re ready to implement AI, and only 30 or so have fully integrated it. It’s a good time to be an AI facilitator.

Global spending on AI is projected to top $301 billion by 2026, according to Dataiku. Much of that will go to consultants. You can think of them as AI’s “picks and shovels” plays. They’ll make money no matter what.

All the large business consultancies have an AI division. McKinsey’s is called QuantumBlack, and it operates its own in-house AI lab. QuantumBlack has helped clients like Texas energy company Vistra Corp. implement custom AI to improve thermal efficiency, resulting in around $60 million in savings for the company.

It’s also helped the Emirates Team New Zealand build an AI bot that could test new designs by sailing them on the team’s simulator. This helped the team defend its America’s Cup title.

Source: McKinsey

Boston Consulting Group’s GAMMA division helps implement and scale AI solutions. Its clients include fashion retailer H&M Group, which uses AI to better manage its supply chains and predict trends.

Bain & Company offers similar services. So do KPMG, Deloitte, and PwC.

The hurdle for investors is that most facilitators are private companies.

The Macro Team and I have pinpointed a small group of investable facilitators that we’re following. More on this soon.

Best regards,