| Exactly Why Gold Is Up and Will Keep Going Up | | By Dr. Steve Sjuggerud | | Tuesday, March 15, 2016 |

| Don't make this complicated… The story is simple:

When both gold and paper pay you zero-percent interest, you should prefer gold over paper.

Today, gold pays you zero-percent interest, and so does paper money. So gold is going up. Pretty simple.

Let me show it to you visually…

----------Recommended Link---------

---------------------------------

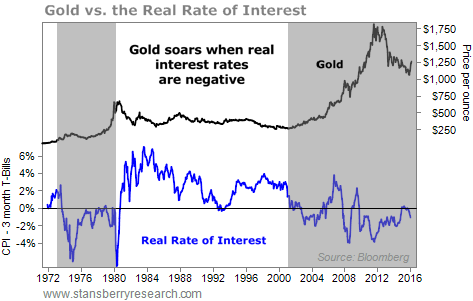

As the chart below shows, over the long run, investors would rather hold gold than paper when "real" interest rates are negative. And investors would rather hold paper than gold when real interest rates are positive. ("Real" interest rates are interest rates MINUS inflation.) Take a look:

(Our friend John Doody – the editor of the excellent Gold Stock Analyst newsletter – runs this chart all the time.)

As you can see, in the 1980s and 1990s, gold did nothing. At the same time, real rates were extremely positive… Investors chose paper over gold.

But in the 1970s, and for much of the 2000s, gold performed extremely well. At the same time, real interest rates were mostly negative.

Today, the real interest rate is negative… Short-term interest rates are 0.3%, and inflation is at 1.4%. So you want to own gold.

Today, the situation with negative interest rates has reached an extreme…

"About a third of global government debt is already paying negative interest rates," Rudi Fronk, the CEO of Seabridge Gold, explained to me on the phone earlier this month. "That's nearly $9 trillion worth. Central banks are paying negative interest on their deposits in the eurozone, Japan, and Scandinavia."

In short, in a world of negative interest rates, gold should outperform…

Yes, gold has run up in 2016… but I feel strongly that the move in gold is just getting started…

Nobody is buying… yet. So that helps me think that we are closer to the bottom than the top.

Gold may have peaked around $1,900 per ounce back in 2011… but it took investors until 2013 to give up on gold.

This next chart tells this story… It is a "real-money" indicator for us – it is the dollar value of the money in the SPDR Gold Shares Fund (GLD), the main gold exchange-traded fund (ETF). Take a look:

You can see that the money in this fund fell from a peak around $80 billion in 2011 to a trough near $20 billion at the end of 2015.

This tells me that investors gave up on gold – that gold finally became extremely hated, particularly in late 2015.

Then, it all changed…

You can see the change in 2016… Investors are getting back into gold again.

We have a perfect setup…

Gold is cheap, down $700 from its highs. It's hated, as everyone gave up after 2013, and nobody is back in yet. Lastly, the uptrend has returned this year. We have everything I want to see in an investment.

Best of all, now is the optimal time to own gold… Remember, when both gold and paper money pay zero-percent interest, investors prefer gold over paper.

Right now, paper money is paying you zero… it's time for people to own gold…

Make sure you get your money there first…

Good investing,

Steve

Editor's note: As Steve showed you today, now is the perfect time to own gold. And when it comes to investing in the world's best gold stocks, there is no one we recommend more than Gold Stock Analyst editor John Doody. John's track record speaks for itself. From 2001 to 2015, gold stocks fell more than 10%... but John's proprietary gold-stock strategy returned 369%, turning every $10,000 invested into nearly $50,000. Until midnight tonight, you can sign up for Gold Stock Analyst for nearly HALF OFF the normal retail price. Learn more here. |

Further Reading:

"The biggest risk you face with gold today isn't buying just before a sharp correction," Ben Morris writes. "It's the possibility that there won't be a significant correction, and that you don't own enough gold... or worse, any at all." Learn more in this essay from last week. |

|

THIS DISCOUNT RETAILER IS SOARING

In short, low interest rates and the Fed's loose-money policies are allowing the wealthy to borrow money and buy stocks, real estate, and other hard assets. But rising prices squeeze lower-income wage earners, who have to pay more for everything while their wages stagnate or fall. Because of this, Americans are choosing to shop at the smaller discount retailers. And one in particular stands out to us: Dollar General (DG). Dollar General sells everyday goods people need at low prices. It is the largest discount retailer in the U.S. by number of stores, with more than 12,000 in more than 40 states. And its large physical presence means the average American is in closer proximity to a Dollar General than he is to the nearest Wal-Mart. As you can see below, shares have taken off. The company is up 25% over the past month, and just struck a new all-time high yesterday. This trend is still going strong and DG continues to be one of the prime beneficiaries. |

|

| Do more of what's working and less of what's not... We want to follow trends, not fight them. And we want to do more of what's working and less of what's not. |

Are You a

New Subscriber?

If you have recently subscribed to a Stansberry Research publication and are unsure about why you are receiving the DailyWealth (or any of our other free e-letters), click here for a full explanation... |

|

Advertisement

If you were born before 1950 there's a chance you can grab a key Social Security claiming strategy before it disappears forever. There's just one catch... You must apply before April 29, 2016. Find out how to get the most in retirement, by going here. |

| Double-Digit Gains, Starting Soon, in European Stocks | | By Dr. Steve Sjuggerud | | Monday, March 14, 2016 |

| | Based on history, we will likely see big gains in European stocks as this extreme reverses... |

| | The Correction in Gold Is Here | | By Ben Morris | | Friday, March 11, 2016 |

| | This could be the best day to buy gold for the next 20 years... |

| | Record-Low Mortgage Rates Are Coming | | By Dr. Steve Sjuggerud | | Thursday, March 10, 2016 |

| | Mortgage rates in the U.S. are incredibly low... and there's a great chance they'll go lower... |

| | Here's How You Beat a Down Market | | By Dr. David Eifrig | | Wednesday, March 9, 2016 |

| | Today, David "Doc" Eifrig is going to take the time to answer how and why we can profit in a down market... |

| | Why Gold Could Climb Nearly 20% in the Next 12 Months | | By Brett Eversole | | Tuesday, March 8, 2016 |

| | Gold is up... And it could go up a lot more... |

|

|

|

|