Existing home sales edge down, supply constraints weigh on new construction

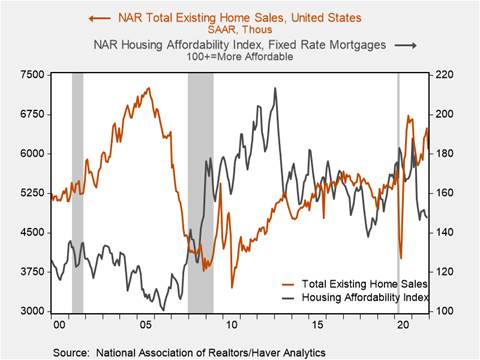

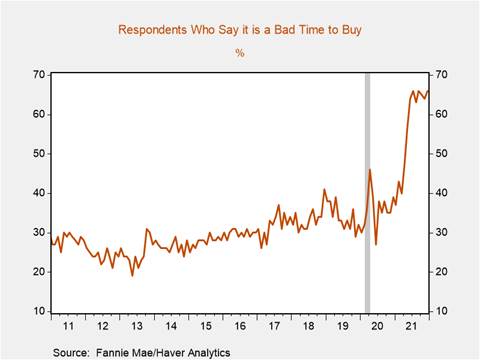

*Existing home sales declined 4.6% m/m to 6.2 million annualized (-300k), but are 15% above their 2019 average reflecting a mix of limited supply, rising mortgage rates, and declining housing affordability (Chart 1). The median sales price ticked up to $358k and is 33% higher than in February 2020. Housing demand overall remains robust despite survey respondents to Fannie Mae’s National Housing Survey overwhelmingly indicating it’s a bad time to buy a house (Chart 2).

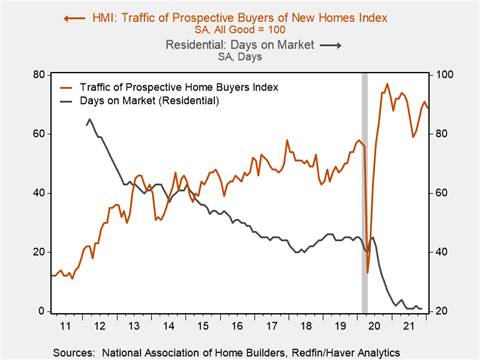

*There are indications December’s softening existing home sales were driven by insufficient supply. Housing inventory has declined to historically low levels, according to data from Redfin, a residential listing is on the market for 21 days on average, a more than 50% decline from its 2019 average, while traffic of prospective (new) home buyers increased 3% m/m in December, pointing to sustained strong demand for housing more generally through Q4 (Chart 3).

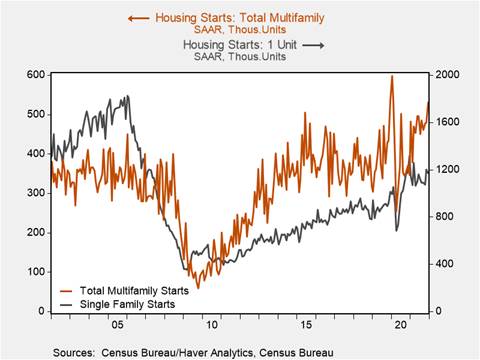

*Housing starts edged up to 1.7 million annualized, its highest level since March 2021 led by a 50k annualized uptick in multifamily housing (Chart 4). Single family housing starts softened modestly, declining 30k annualized, but remain 120k above its pre-pandemic level. Material shortages and supply constraints have delayed construction and driven up costs, according to the National Association of Home Builders “the price and availability of building materials, and the supply chain in general, remains the most pressing, immediate challenge for builders as they seek to add housing supply”. Construction costs increased 15.3% yr/yr in November and are likely to remain elevated in the near term, with lumber prices more than doubling from its August levels, while average hourly earnings for construction workers have increased 4.6% yr/yr.

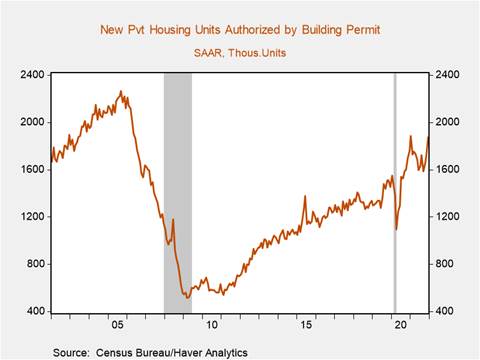

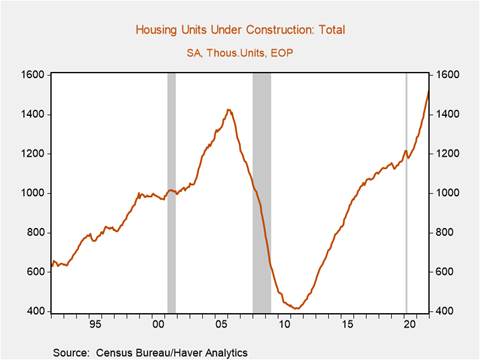

*Building permits surged to a near pandemic high of 1.87 million annualized, again led by a notable rise in multifamily permits (+135k annualized, Chart 5). Reflective of labor and material constraints that have held up construction, the number of housing units permitted but not started continues to trend upwards, rising to a new all-time high of 270k, a 55% increase over its 2019 average. Other data point to the same story, housing completions rose 20k annualized in Q4 relative to Q3, well below the relative rise in housing starts. Similarly, the number of housing units under construction ticked up to 1.5 million, with the number of units under construction 20% higher than in December 2020 and higher than at any point during the debt financing boom of the early 2000’s (Chart 6).

*Taken together, starts, permitting, and construction data through H2 2021 point to a significant degree of housing supply in the pipeline that will enter the market through 2022-2023 as supply disruptions dissipate.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Chart 5.

Chart 6.

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.