Expectations of Powell at Jackson Hole: Further tilt toward tapering, few new insights

*Fed Chair Powell will make a presentation Friday at the Federal Reserve Bank of Kansas City’s annual economic symposium in Jackson Hole. This year, the symposium is entitled “Macroeconomic Policy in an Uneven Economy” and Powell’s speech will be on the economic outlook. Over the iconic history of the Jackson Hole meetings, Fed Chairs have occasionally used the forum to roll out new policies or make major statements. Last year, Powell described the Fed’s new strategic plan. Friday, Powell’s speech is not likely to provide any breaking insights into the Fed’s outlook for the economy, inflation, or the Fed’s conduct of monetary policy. Under current circumstances of a solid recovery in labor markets and inflation far above the Fed’s 2% longer-run target, we think it would be appropriate and timely for Powell to provide detail on how and when the Fed will begin to unwind its emergency monetary policies, including tapering its asset purchases and also provide guidelines on the Fed’s plans to normalize interest rates under different scenarios. However, it is most likely that Powell’s speech will stick to the Fed’s recent script of tip-toeing toward tapering and disassociating the unwinding of its asset purchases from the eventual liftoff of rates.

*In summary, Powell’s outlook on the economy likely will be upbeat, consistent with the Fed’s forecast of solid economic growth in 2022-2023 and declines in the unemployment back down to 3.5 percent, although he will draw attention to renewed health concerns from the spike in Delta variant infections that may temporarily dampen near-term activity.

*Pertaining to the Fed’s monetary policy, Powell is expected to:

1) Acknowledge further improvement in labor markets and state that “substantial further progress” toward the Fed’s employment mandate had been achieved. The minutes of the July FOMC meeting indicated that the Fed’s requirement of “substantial further progress” on its maximum inclusive employment mandate had not been met; however, following the robust July Employment Report and June JOLTs data of strong employment gains, several FOMC members joined others in stating that the requirement had been met.

2) Acknowledge that inflation has risen materially above the Fed’s longer-run 2% target and has met the Fed’s requirement that higher inflation makes up for the sub-2% inflation in prior years. The minutes of the July FOMC meeting said this requirement had been met. Powell likely will echo the Fed’s assessment that the higher inflation has been attributable to temporary factors, particularly supply constraints that are expected to dissipate.

3) State that the Fed is moving closer to announcing that it will begin tapering its asset purchases, most likely by year-end, if everything goes well. In this regard, Powell is not expected to provide any further details on the timing and magnitude of the unwinding of the Fed’s asset purchases, but is likely to repeat his earlier statement that when the Fed does begin to taper, it does plan to reinvest the proceeds of maturing assets in its portfolio to avoid any runoff of the balance sheet. Powell is also likely to repeat recent guidance that the timing of the tapering will not imply anything about when the Fed will begin raising the Fed funds rate, which has been anchored to zero since March 2020.

*Following the Jackson Hole meeting, we expect the Fed will announce its tapering schedule at either its September or November meeting, and begin reducing the amount of new asset purchases by year-end. The Fed may delay this unwinding if the Delta variant transmission continues to spike and rise and dampen economic growth more than expected.

As we emphasized in our recent assessment of labor market improvements, tapering asset purchases is a minor first step toward unwinding the Fed’s emergency monetary policies, and “The far bigger challenge is normalizing interest rates” (“Updated expanded labor market dashboard indicates ‘substantial further progress’ toward the Fed’s employment mandate”, August 12, 2021).

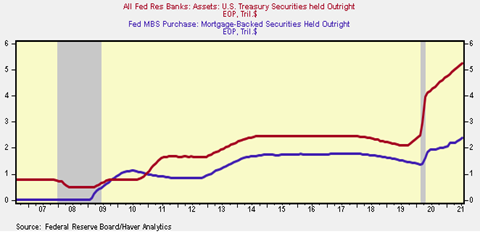

In reality, the exact timing of when the Fed tapers or even how fast it unwinds its asset purchases has virtually no impact on the economy. The Fed holds over $5.3 trillion in Treasuries and $2.2 trillion in MBS, and there are trillions of dollars of excess reserves in the banking system (Chart 1). Tapering its asset purchases while reinvesting maturing assets means continued expansion of its balance sheet.

Meanwhile, the Fed estimates the natural interest rate to be 2.5% (2% inflation plus 0.5% real), so keeping the Fed funds rate at zero until a 2023 liftoff, as the Fed’s June forecasts suggest is appropriate, implies a further prolonged period of monetary accommodation. That seems risky, in several regards. Inflation is far above the Fed’s 2% target and the Fed has acknowledged that its inflation make-up strategy has been fulfilled. Anecdotal evidence suggests that businesses are planning and consumers are expecting further price increases, and wage negotiations are building in expectations of persistent inflation. These are classical signs of an overheating economy.

During the Fed’s strategic review, Powell acknowledged the difficulty and uncertainties in forecasting inflation. Now the Fed’s monetary policy strategy of tip-toeing toward tapering its asset purchases and delaying any normalization of rates is based on the median best-case forecast of FOMC members that inflation will fall back to the Fed’s 2% target on a timely basis, which assumes that the recent inflation is temporary, due entirely to supply constraints. If the Fed decides that Chair Powell should not take the opportunity at Jackson Hole to communicate how the Fed may respond if inflation continues to exceed the Fed’s forecasts, such an asymmetric approach to risk management would be a bit disappointing. We’ll be watching Friday.

Chart 1: Fed holdings U.S. treasuries and mortgage-backed securities

Mickey Levy, mickey.levy@berenberg-us.com