Message From the Editor

Flaring — or the burning of stranded natural gas directly at an oil well — is one of the drilling industry’s most notorious problems, often condemned as a pointlessly polluting waste of billions of dollars and trillions of cubic feet of natural gas. In early March, oil giant ExxonMobil signed up to meet the World Bank’s “zero routine flaring by 2030” goal, in part, it turns out, by burning stranded natural gas directly at its oil wells — not in towering flares, but down in mobile cryptocurrency mines. Sharon Kelly reports.

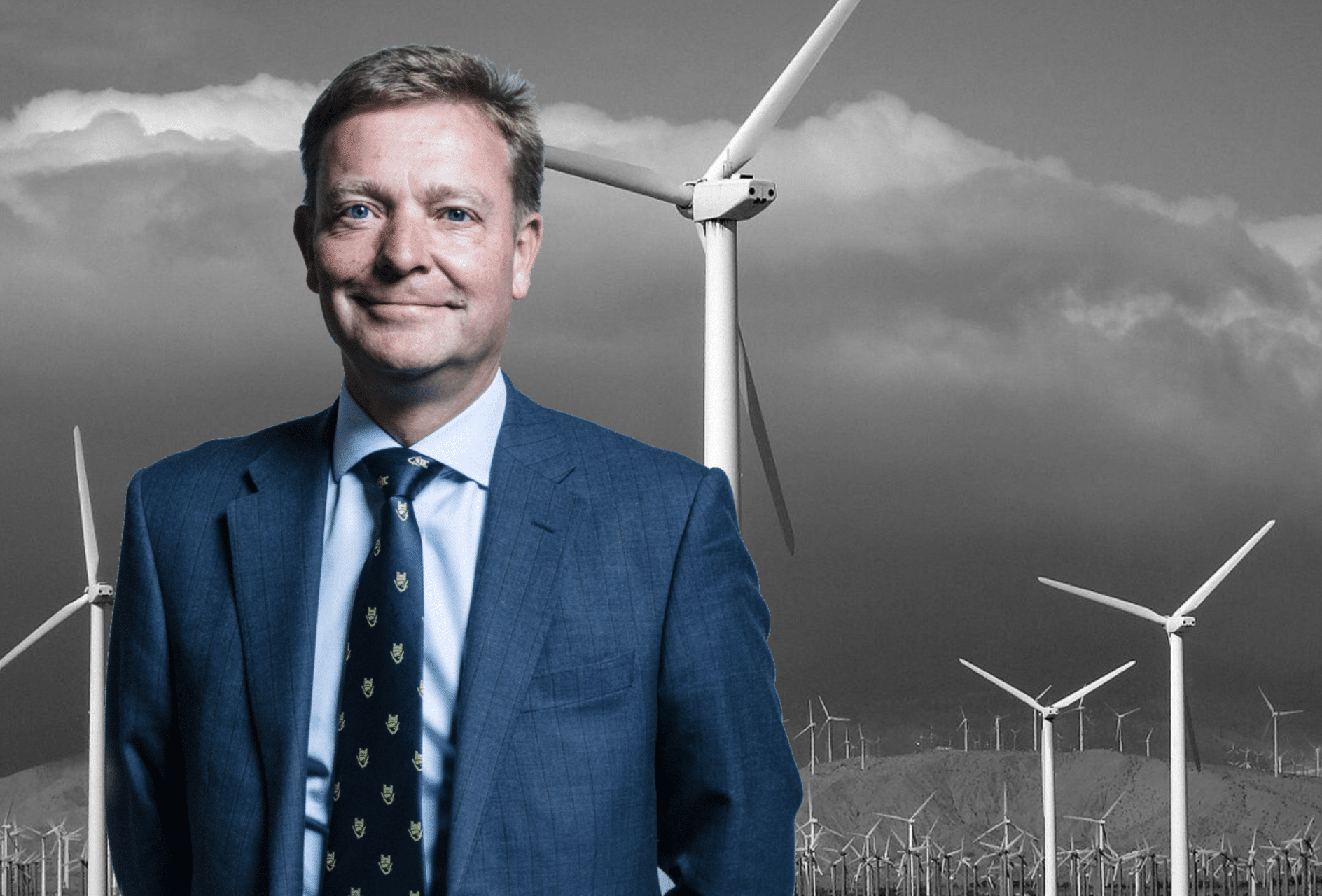

Meanwhile, our UK team brought us a story about South Thanet MP Craig Mackinlay, who has been leading a backbench revolt against UK climate policy, endorsing a report calling for renewable energy to be “wound down” completely. The report was produced by Net Zero Watch, the campaigning wing of climate science denial thinktank the Global Warming Policy Foundation; its authors are not climate scientists and have campaigned against renewable energy. Read on.

In the weeks since Putin invaded Ukraine, investors have ditched stakes in Russian oil and gas with unprecedented speed. Banks, pension funds, and investors are finally acting on calls campaigners have made for years and unshackling themselves from investments in companies and states complicit in destruction in Ukraine. This transformation happened within weeks — and demonstrates that divesting from fossil fuels can be a bold political move that raises the standard for corporate behavior in those companies, argues guest author Robert Noyes.

Have a story tip or feedback? Get in touch: editor@desmog.com.

Thanks,

Brendan DeMelle

Executive Director

P.S. We have powerful investigations coming in the next few weeks, made possible by our generous donors. If you’d like to help, can you donate $10 or $20 right now?

As Oil Giants Turn to Bitcoin Mining, Some Spin Burning Fossil Fuels for Cryptocurrency as a Climate Solution

— By Sharon Kelly (7 min. read)—

Flaring — or the burning of stranded natural gas directly at an oil well — is one of the drilling industry’s most notorious problems, often condemned as a pointlessly polluting waste of billions of dollars and trillions of cubic feet of natural gas.

In early March, oil giant ExxonMobil signed up to meet the World Bank’s “zero routine flaring by 2030” goal (a plan that — when you look just a bit closer — doesn’t entirely eliminate flaring but instead reduces “absolute flaring and methane emissions” by 60 to 70 percent.)

How does ExxonMobil plan to reach that goal? In part, it turns out, by burning stranded natural gas directly at its oil wells — not in towering flares, but down in mobile cryptocurrency mines.

Green Groups Decry US Energy Panel’s Reversal on Gas Pipeline Climate Reviews

— By Jessica Corbett, Common Dreams (2 min. read) —

U.S. climate activists were outraged after a federal regulatory agency on Thursday, March 24 walked back plans to consider the planet-heating emissions and environmental justice impacts when weighing whether to approve new fossil fuel infrastructure.

Federal Energy Regulatory Commission (FERC) Chair Richard Glick, a Democrat, announced that the policy statements issued last month will now be considered “drafts” and won’t apply to any pending projects until the agency issues final guidance.

Anti-Net Zero MP Backs ‘Laughable’ Report Urging Renewables be ‘Wound Down’

— By Adam Barnett (4 min. read)—

A Conservative MP leading a backbench revolt against UK climate policy has endorsed a report calling for renewable energy to be “wound down” completely.

South Thanet MP Craig Mackinlay, who chairs the Net Zero Scrutiny Group (NZSG) in parliament, is quoted in the press release for the report Taking Back Control: Addressing Britain’s Energy Crisis, which was released over the weekend and covered in the Telegraph newspaper.

Why Rapid Russian Divestment Should Signal An End To Fossil Fuel Finance

— By Robert Noyes (2 min. read) —

In the weeks since Putin invaded Ukraine, investors have ditched stakes in Russian oil and gas with unprecedented speed.

The financial sector is finally acting on the calls campaigners have been making for years. Banks, pension funds and investors are unshackling themselves from problematic investments in companies and states complicit in destruction in Ukraine — and they’re doing it fast.

This transformation happened within weeks — and demonstrates that divesting from fossil fuels can be a bold political move that raises the standard for corporate behaviour in those companies.

A Catastrophic Tornado in the New Orleans Metro Area Raises Questions About Connections to Climate Change

— By Julie Dermansky (5 min. read)—

Tornadoes hit fast and hard, as those in the path of the tornado that hit Arabi in the New Orleans metro area experienced firsthand. The tornado — which spun up at speeds up to 165 miles per hour, hitting EF3, the third strongest on the tornado rating scale — badly damaged 150 homes and killed a young man and his dog.

A few minutes after images of the tornado began spreading on social media, I got my gear together to go to Arabi to document the damage. But first I had to calm my nerves and take stock of how lucky I was to be safe and unharmed. My past experiences with extreme weather — including living through Hurricane Ida, which damaged my home last year, and a likely EF1 tornado in 2014 that spun my house at the time in Deposit, NY — seem to raise my blood pressure when new extreme weather threatens to head my way.

From the Climate Disinformation Database:The Steamboat Institute

SecondStreet.org explores how “government policies impact everyday Canadians,” according to its website. SecondStreet.org describes its mission as to “tell the stories of ordinary Canadians and their families, and show how public policy choices harm or help their prosperity, freedom and lives.” The group has regularly produced policy briefs and polls opposing carbon taxes in Canada. SecondStreet.org is a Canadian member of the U.S.-based Atlas Network, a group that has been described as the “Johnny Appleseed of antiregulation groups” that helps support free-market and conservative think tanks across the United States and 95 countries, including Canada. The Atlas Network has received funding from Koch-related foundations, over $1 million from ExxonMobil, and millions from “Dark Money” donors groups like DonorsTrust.

Read its full profile and browse other individuals and organizations in our Climate Disinformation Database and Koch Network Database.