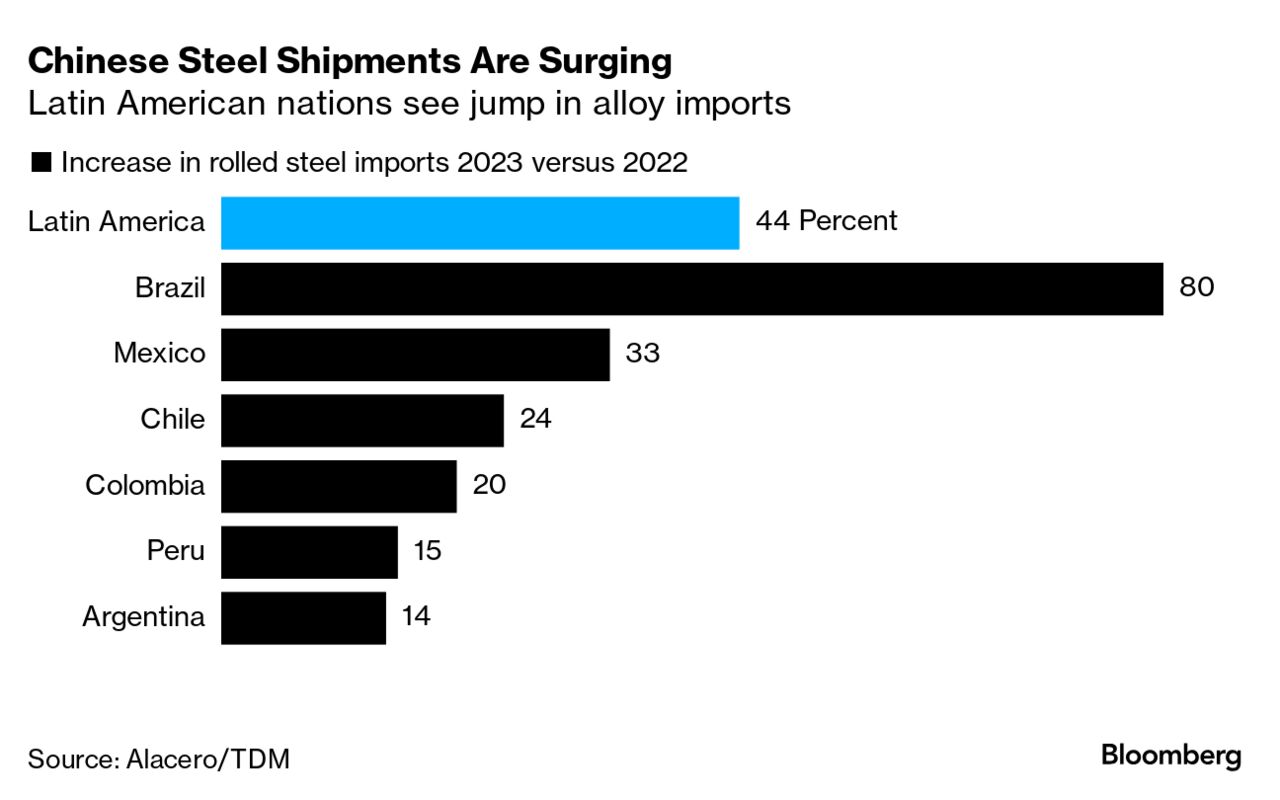

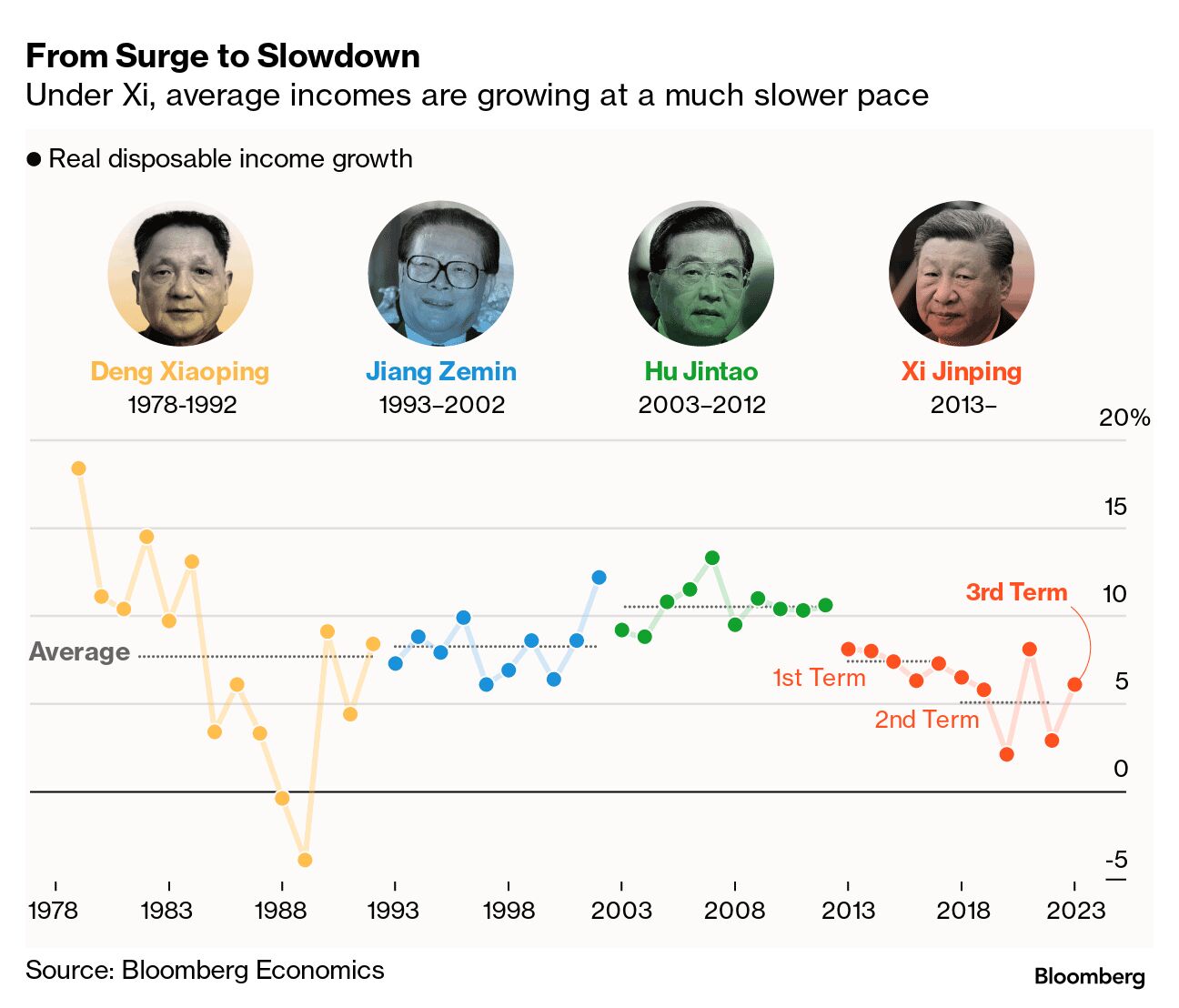

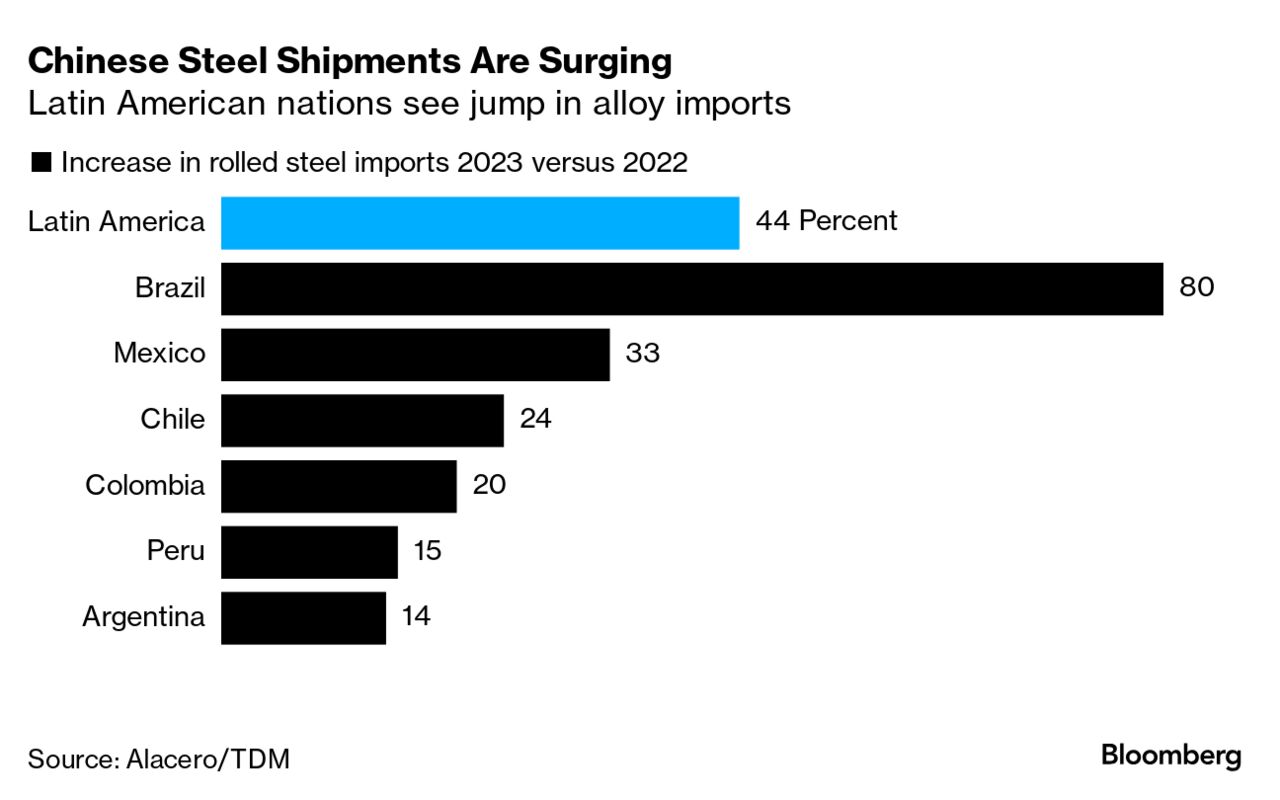

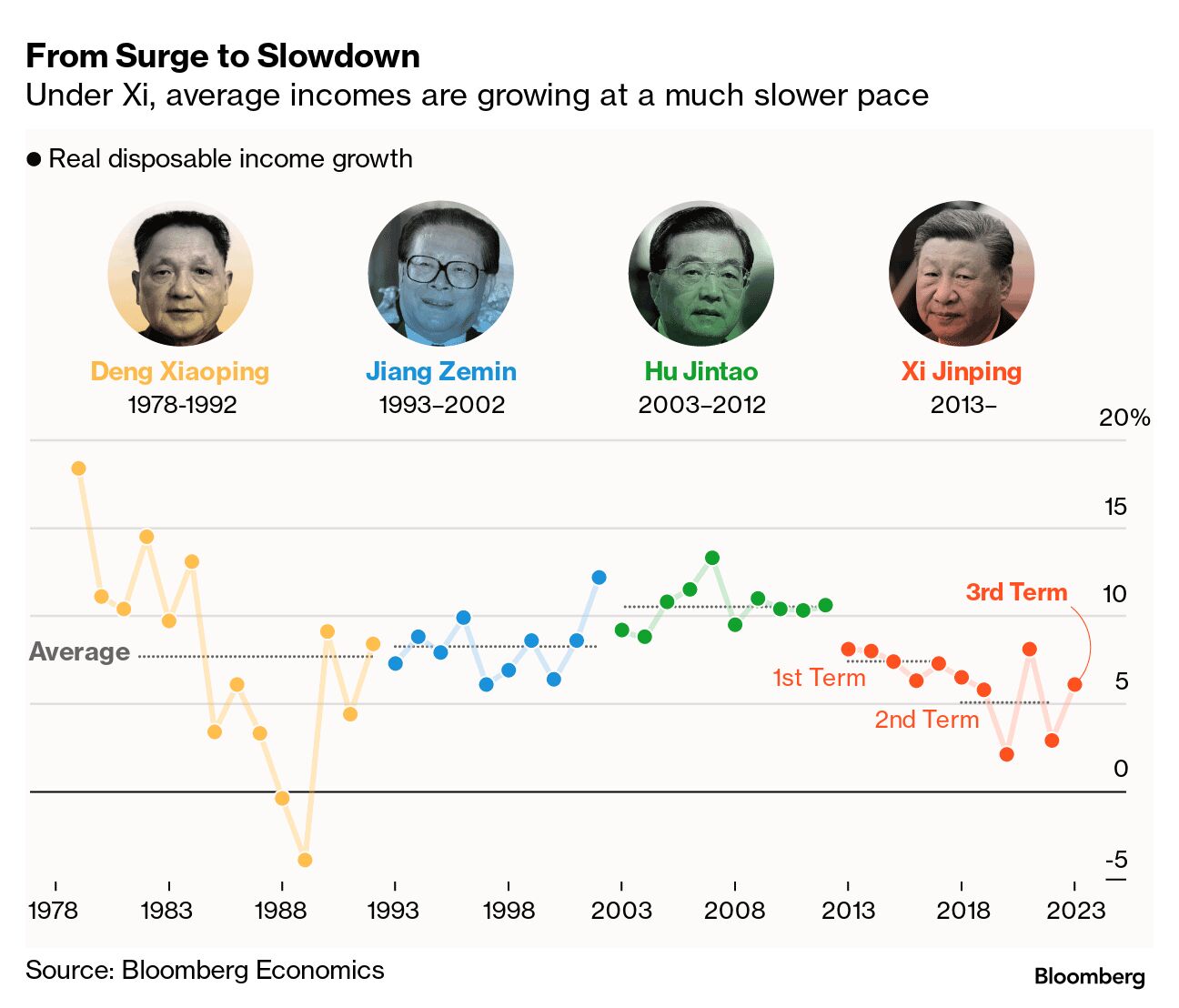

| Stocks rose to another record ahead of results from Nvidia, the giant chipmaker at the heart of the artificial-intelligence revolution that’s been powering the recent bull market. But the bar is high for the company, whose shares have soared more than 90% this year after tripling in 2023. Investors are waiting to see whether it will be able to match all the sky-high expectations surrounding the technology. Nvidia’s revenue is expected to be buoyed by soaring demand in its data-center business. “With markets trending upward and emotions in check, Nvidia’s performance will be pivotal in gauging the sustainability of the current market run and the potential for a more inclusive market rally,” said Mark Hackett at Nationwide. —David E. Rovella For everyone on Wall Street, in C-suites and across newsrooms predicting the direction of US interest rates, many would likely agree that being wrong has been the year’s only constant. Even Paul Krugman says he has no idea what’s going on. The Nobel laureate in economics said it’s entirely unclear where interest-rate levels are headed over the medium term, with arguments in favor of both a return to pre-pandemic levels and a higher-for-longer outcome. “On interest rates I am fanatically confused,” Krugman said Tuesday on Bloomberg Television’s Wall Street Week with David Westin, with regard to whether borrowing costs will remain above pre-Covid levels. “Anyone who claims to know for sure what the answer is to that, is deluding themselves.” Latin American nations are following in the footsteps of the US and Europe by imposing prohibitive tariffs on Chinese imports—a new strain in what’s been an otherwise cozy connection. Mexico, Chile and Brazil have hiked—and in some cases more than doubled—duties on steel products from China over the past several weeks, and Colombia may be next. The relationship is being tested by a global turn toward protectionism, and a flood of Chinese imports that threatens to put Latin American steel producers out of business and risk a combined 1.4 million jobs.  Donald Trump has repeatedly said he wanted to take the stand in his own defense at the first of four felony trials he faces. He subsequently complained during the proceedings that he wasn’t being allowed to adequately defend himself. So it may have surprised some when, shortly after the prosecution rested, the defense did, too—without calling Trump. Jurors never got to hear his take on the New York grand jury indictment alleging he paid to keep embarrassing liaisons secret from voters in the run-up to the 2016 election, and then illegally hid those payments with accounting sleight of hand. Closing arguments are set to begin next week. If convicted, Trump could face prison time. US President Joe Biden denounced Trump after a video was posted to the Republican’s social media account that referenced a “unified reich” as a potential news headline if he won a second term. “This is Hitler’s language and not America’s,” Biden said of the video during a Tuesday campaign fundraiser in Boston. As the rematch between Biden and Trump draws nearer, political professionals are detecting an unusual concern among some undecided voters: that if Trump returns to the White House, he’ll refuse to step down when his term is up.  Trump followers attacked police at the US Capitol on Jan. 6, 2021, in a bid to stop President Joe Biden from taking office. Photographer: Joseph Prezioso/AFP/Getty Images In an about face, German officials are said to be ready to support a US plan to leverage the future revenue generated from frozen Russian assets (mostly stranded in Europe) to back $50 billion in aid to Ukraine. Germany’s assent could be a crucial step that brings Washington and its allies closer to securing a substantial new aid package for Kyiv and ensuring US engagement regardless of the outcome of the November election. When it comes to ranking the best cities in the world, it’s a crowded field and an inexact science. But there’s a new player in town. Oxford Economics on Tuesday released its inaugural Global Cities Index, which it calls a “comprehensive evaluation of the world’s 1,000 largest urban economies.” The index was compiled using five broad categories—economics, human capital, quality of life, environment and governance—with weighting placing most emphasis on economic factors such as GDP and employment growth. Here are the winners. Americans are regularly asked by presidential candidates whether they feel better off now than four years ago. Well a version of that loaded query is arguably on the table in China. The nation’s economic miracle is ending, leaving Xi Jinping with a challenge none of his predecessors faced: how to govern after the boom. For four decades, China’s 1.4 billion population experienced unparalleled gains in income and wealth. But recently, the blows have just kept coming. Real estate collapse, a US trade war, Xi’s crackdown on entrepreneurs, extended Covid lockdowns and a catastrophic reopening said to have claimed almost two million lives. All have combined to stall the prosperity engine.  Reality television and real estate: What more could one ask for? And how about setting it in London? Netflix has swapped the Hollywood Hills for Mayfair in its new real estate show Buying London, the UK’s answer to the popular Selling Sunset reality program. The stars are Daniel Daggers and his agents at DDRE Global. Daggers has sold more than $5.5 billion of real estate to some of the world’s wealthiest people, including a $120 million mansion to hedge fund billionaire Ken Griffin. Much like Selling Sunset, the show features tours inside multimillion-dollar mansions set against reality-TV drama between glamorous agents.  A pool inside one of the properties featured on the new reality television show Buying London. Source: Netflix Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive Bloomberg’s flagship briefing in your mailbox daily—along with our Weekend Reading edition on Saturdays. The Big Take Asia podcast: Each week, Bloomberg’s Oanh Ha reports on critical stories at the heart of the world’s most dynamic economies, delivering insight into the markets, tycoons and businesses driving growth across the region and around the world. Listen in here. Bloomberg Wealth: Can prosperity and instability comfortably coexist? Join us in Hong Kong on June 5 as we gather leading investors, economists and money managers for a day of solutions-driven discussions on wealth creation. Speakers include Hong Kong Exchanges and Clearing Limited Chief Executive Bonnie Y Chan and Hong Kong Monetary Authority Chief Executive Eddie Yue. Learn more. |