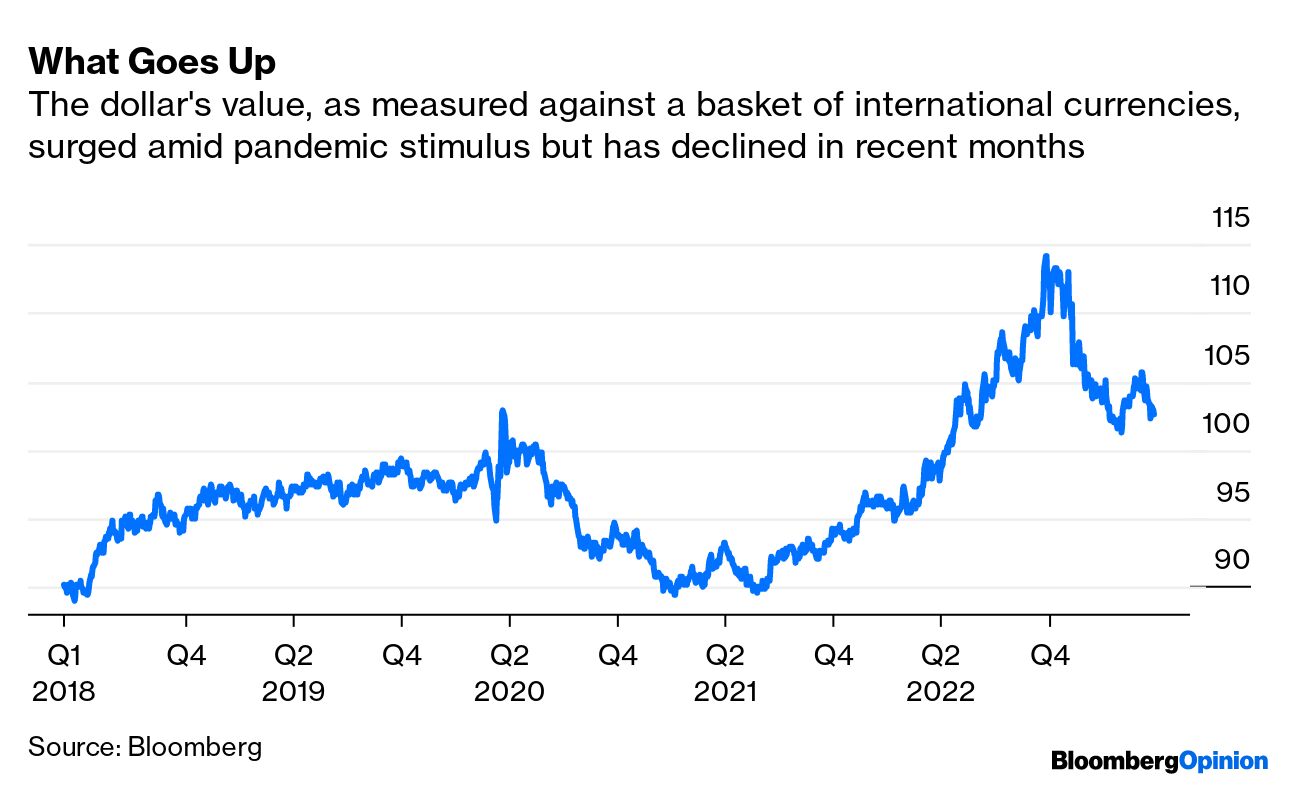

| The Federal Deposit Insurance Corp., facing almost $23 billion in costs from recent bank failures, is said to be considering steering a larger-than-usual portion of that burden to the nation’s biggest banks. The agency has said it plans to propose a so-called special assessment on the industry in May to shore up a $128 billion deposit insurance fund that’s set to take hits after the recent collapses of Silicon Valley Bank and Signature Bank. The regulator—under political pressure to spare small banks—has noted it has latitude in how it sets those fees. The KBW Regional Banking Index of 50 lenders reversed losses and rose 0.6% on Wednesday in New York after Bloomberg reported the FDIC’s internal deliberations. —David E. Rovella The global currency market is vulnerable to a liquidity crunch later this year as financial conditions tighten and economic growth slows, Bank of America warned. Even as the market emerged relatively unscathed from the recent banking turmoil, implied volatility in major currency pairs jumped this month. Here’s your markets wrap. The dollar has lost some of its luster. The twin supports of its status as the preferred haven during the pandemic and being backed by the world’s strongest economy are fading, Marcus Ashworth writes in Bloomberg Opinion. And now another prop for the greenback is wobbling amid doubts about how much higher the Fed will raise rates. The dollar looks likely to suffer an extended bout of weakness. And many will rejoice. Prime Minister Justin Trudeau’s plan to add billions of dollars in new annual spending has some economists worried that Canada is at risk of racking up unsustainable debt—especially if economic growth comes in worse than expected. UBS is bringing back Sergio Ermotti as chief executive to oversee the historic acquisition of Credit Suisse, tapping a Swiss insider with extensive restructuring experience to replace Ralph Hamers after just over two years.  Newly appointed UBS CEO Sergio Ermotti appeared at a press conference in Zurich Wednesday. He spent nine years restoring UBS's reputation after its bailout by the Swiss government during the 2008 global financial crisis. Photographer: Arnd Wiegmann/AFP When Vladimir Putin said he would put short-range, tactical nuclear weapons in Belarus, NATO officials said it wouldn’t change the pact’s nuclear posture. But on Wednesday, a Kremlin official reportedly said Russia would no longer notify the US of any planned tests of its intercontinental ballistic missiles. Such communications were put in place to avoid one side mistakenly interpreting a test as a nuclear attack, triggering retaliation. On the ground in Ukraine, Russia is bracing for an expected counteroffensive. But Putin’s drive to expand his armed forces is adding to labor shortages at home. Government data suggest a net increase in the military last year of approximately 400,000 amid already record-low unemployment, Bloomberg Economics estimates. Here’s the most recent news on the war.  Everybody is talking about the artificial intelligence behind ChatGPT. Less noticed is a jobs market mushrooming around the technology, where these newly created roles can pay upwards of $335,000 a year. And for many a computer engineering degree is optional. Healthy children and adolescents may no longer need Covid shots, the World Health Organization said, updating its guidance on vaccines as the world adjusts to living permanently with the virus. But older people and other higher-risk groups, including those with underlying conditions, should get Covid boosters between six and 12 months after their last injections, the WHO said in a statement announcing a revised vaccine road map for the new stage of the pandemic. Bloomberg continues to track the global coronavirus pandemic. Click here for daily updates. The finest bottles of champagne aren’t just a delight to sip, they’re also pouring out heady returns. And as the market bubbled ever higher in 2021 and 2022, speculators pounced. For example, a case of all-Chardonnay 2012 Salon Le Mesnil recently soared 232% from £3,800 to £12,600 ($4,670 to $15,485), according to Liv-Ex, the London International Vintners Exchange. The Liv-Ex Champagne 50 Index, which tracks the price performance for recent vintages of a dozen top brands, was a runaway star, outperforming gold, the FTSE, and the S&P 500, as well as the Bordeaux First Growths and even Burgundy.

Get the Bloomberg Evening Briefing: If you were forwarded this newsletter, sign up here to receive it in your mailbox daily along with our Weekend Reading edition on Saturdays.

Bloomberg Green Summit: Join us in New York on April 26 where we will gather climate champions at the crossroads of sustainability, science and culture to highlight the solutions needed to address the planet’s most pressing climate challenges, from climate economy to greener living, global changemakers and cleaner tech. Register here Evening Briefing readers: Thank you kindly for your attention. We’d be grateful if you could spare a few minutes to fill out this survey so we can better serve you. |