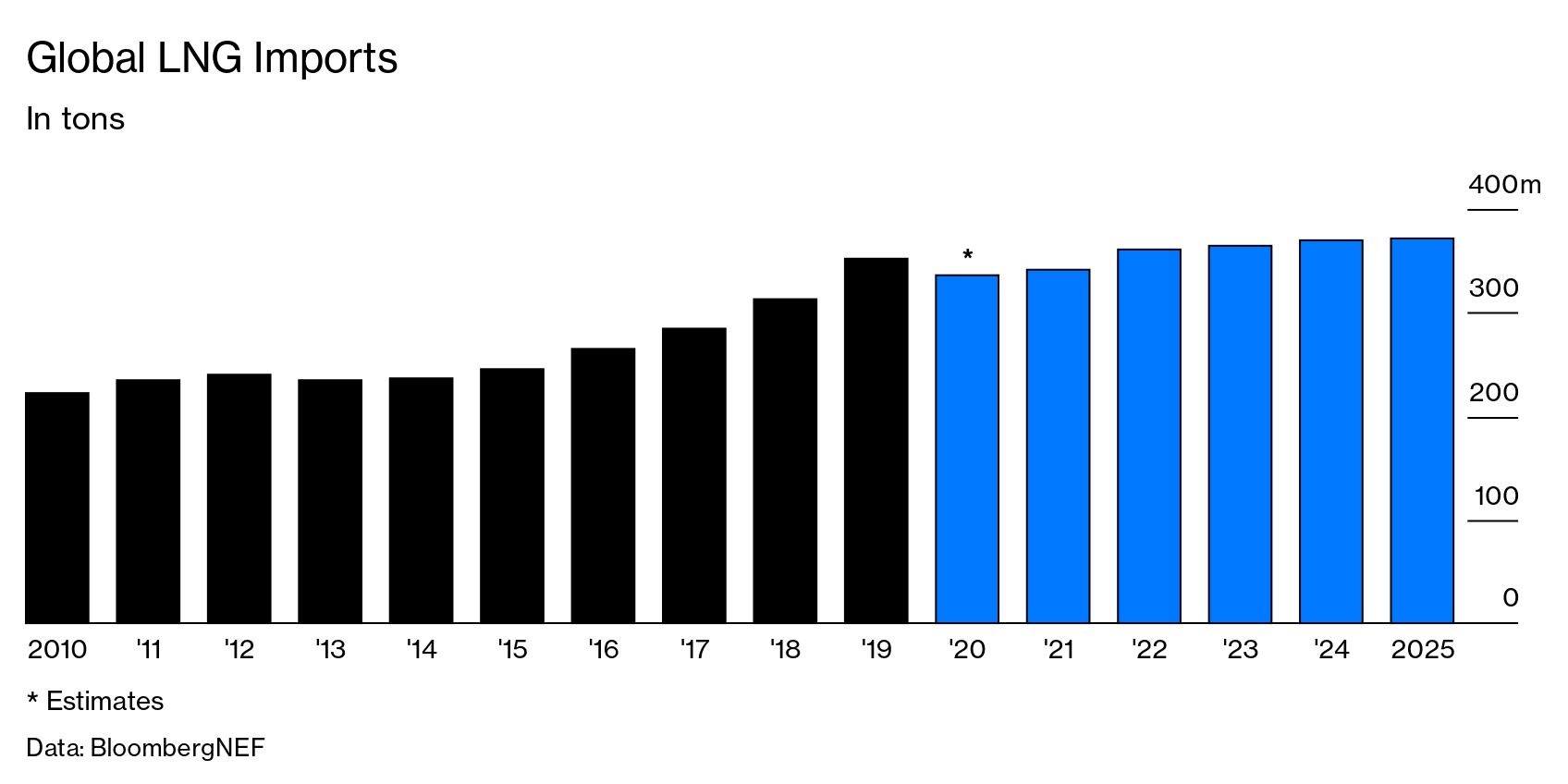

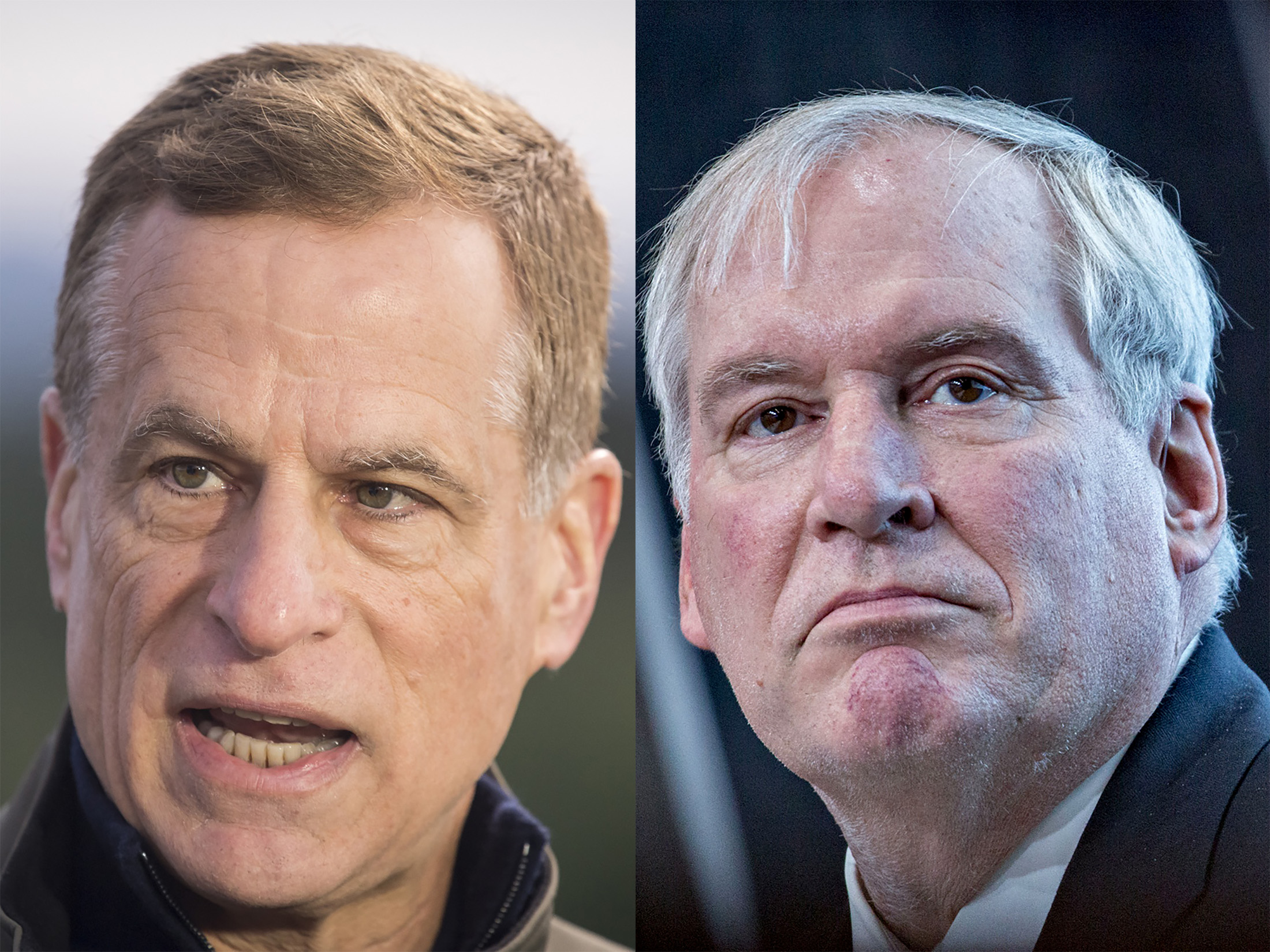

| Nations are more reliant than ever on natural gas to heat homes and power industries amid efforts to quit coal. But there isn’t enough to fuel the post-pandemic recovery and refill depleted stocks before winter arrives in the northern hemisphere. Countries are trying to outbid one another for supplies as exporters move to keep more for themselves. And while the crisis is afflicting Europe right now, soon it may be a problem for the whole world. —David E. Rovella Bloomberg is tracking the coronavirus pandemic and the progress of global vaccination efforts. This billionaire philanthropist who made his fortune betting on natural gas prices said the crisis in Europe should serve as a cautionary tale for the U.S. about transitioning away from fossil fuels too quickly. Tens of thousands of Chinese households who bought high-yield investments risk being sucked into the spectacular unraveling of China Evergrande Group. Niall Ferguson writes in Bloomberg Opinion that, China permabears notwithstanding, the developer’s looming collapse isn’t leading to global contagion. But China’s looming economic disaster might. In an unprecedented development in the Fed’s 100-plus year history, Boston Fed chief Eric Rosengren and Dallas’s Robert Kaplan on Monday separately announced plans to step down following embarrassing revelations of stock trading last year.  Robert Kaplan and Eric Rosengren Fed Chair Jerome Powell told the U.S. Senate on Monday that supply bottlenecks have lasted longer than expected, and that inflation pressures will remain high in the coming months before easing as predicted. “They will abate, and as they do, inflation is expected to drop back toward our longer-run 2% goal,” Powell said. As Treasury yields pushed higher after a hawkish tilt from the Fed last week, some of the world’s largest technology companies continued to sell off. Here’s your markets wrap. At Bitfinex, one of the crypto world’s most controversial exchanges, they paid $23.7 million in transaction fees to deposit $100,000 on the blockchain, in what appears to be a fat-finger trade for the history books. U.S. House Speaker Nancy Pelosi and the White House are working to close divisions in the Democratic Party that stand between them and enacting President Joe Biden’s economic agenda. Pelosi and Biden have been calling lawmakers to bridge remaining differences between moderates and progressives that are stalling votes on a bipartisan infrastructure bill and a larger measure aimed at enhancing the social safety net and fighting climate change. Every year, hundreds of thousands of men pack their bags and fly to Turkey because they desperately want to get their hair back. The nation’s hair treatment industry, centered on Istanbul, is worth more than $1 billion. But the clinics that provide such services are lightly regulated, and often it’s the technicians rather than doctors who do most of the work. As the sector expands, some experts both in and out of Turkey are wondering whether profit is being prioritized over patients. Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. Bloomberg New Economy Conversations—Getting to Net Zero: The cost of scaling up renewable energy has fallen dramatically. Is 2021 the year in which we’ll see major investments in areas like green hydrogen, carbon capture and other technologies needed to prevent environmental catastrophe? What are the most promising new areas and who is at the forefront? Join New Economy Editorial Director Andrew Browne on Sept. 28 at 10 a.m. as he discusses these issues with HSBC Group Chief Executive Noel Quinn, Hyundai Motor Co. Vice President of New Energy Business Development Jae-Hyuk Oh, and others. Register here. |