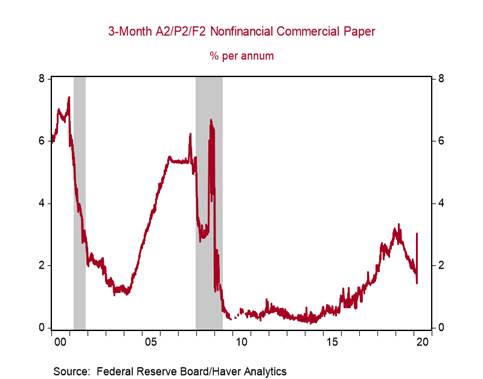

The Fed today re-introduced the Commercial Paper Funding Facility (CPFF) to alleviate strains in the commercial paper market, where stresses have emerged and yields have spiked despite the Fed's recent emergency infusions of liquidity into funding markets (Chart 1). We note that the spike in CP yields have been far less severe than those that occurred during the 2008-2009 financial crisis.

The Fed established the CPFF program under the authority of Section 13(3) of the Federal Reserve Act with approval of the Treasury Secretary. The Fed last used this facility between October 27, 2008 and February 1, 2010.

The CPFF allows the Fed to provide a liquidity backstop to commercial paper issuers through a special purpose vehicle (SPV) that buys commercial paper from eligible companies. It currently expects to cease these purchases on March 17, 2021, but has the right to extend the facility if necessary.

Currently, there is ~$1.1 trillion of commercial paper outstanding, and its smooth functioning is critical to the plumbing of the financial system. Non-financial firms use commercial paper to fund basic operations, invest and to provide credit to businesses and households. The sharp curtailment in economic activity stemming from the pandemic crisis and containment measures has increased demand for liquidity in funding markets as businesses seek to smooth operations, pay bills and maintain payrolls, but amid the heightened uncertainties, some financial institutions have cut back lending, contributing to the temporarily imbalance and spike in yields in the CP market.

To date, the Fed's various measures to increase liquidity -- lowering its Fed funds rate to zero, cutting its discount window rate, Large-Scale Asset Purchases (LSAPs, or QE), dramatically increasing its temporary repo operations, and lowering bank reserve requirements to 0% -- have not been sufficient to alleviate strains in short-term funding markets. That presumably reflects heightened uncertainties that are creating bottlenecks in the short-term funding markets.

We note that under far more severe strains in the CP market during the financial crisis, after the Fed instituted its CP facility in October 2008, the short-term funding markets remained largely dysfunctional for months. This time is very likely to be far different, as the Fed's aggressive action is expected to achieve quicker results, even as the acute stage of the pandemic generates deep economic contraction.

Chart 1:

Mickey Levy, mickey.levy@berenberg-us.com

Roiana Reid, roiana.reid@berenberg-us.com