| |

|

| Follow Us | Get the newsletter |

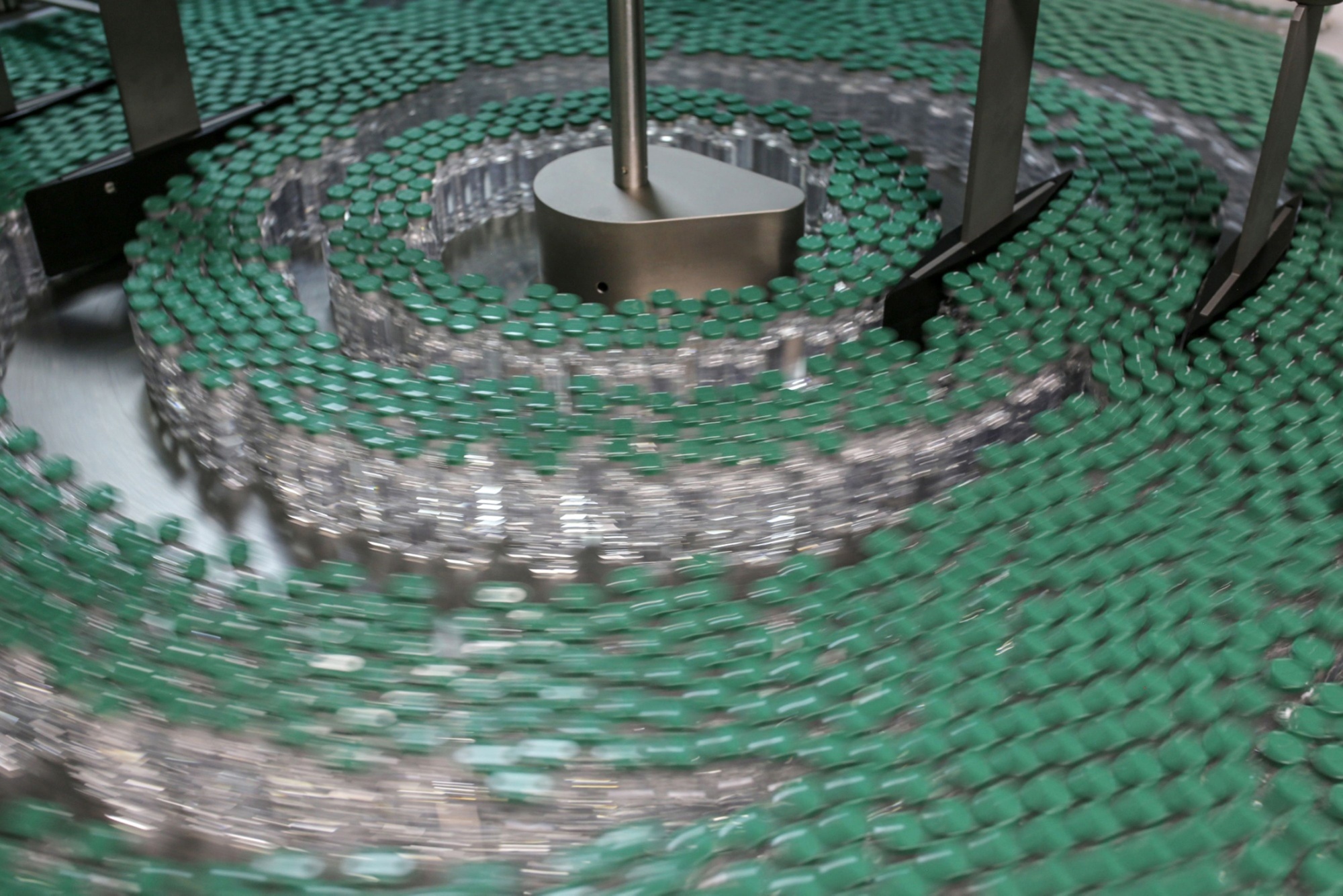

| Johnson & Johnson’s Covid-19 vaccine is safe and effective, U.S. regulators said Wednesday. It’s a key milestone toward giving Americans access to what would be the nation’s first single-dose vaccination. Emergency authorization from the Food and Drug Administration could come as soon as this week. Covid variants are expected to be a key topic during approval discussions as 4,000 cases of re-infection were found in South Africa, where a more transmissible and vaccine-resistant strain has been spreading. Moderna said it completed manufacturing doses of a new version of its Covid-19 vaccine modified to target the South Africa strain and shipped it to researchers for clinical study. Here’s the latest on the pandemic. —Margaret Sutherlin Bloomberg is tracking the progress of coronavirus vaccines while mapping the pandemic globally and across America. Here are today’s top storiesThe Federal Reserve began restoring some services following widespread outages across key payment systems operated by the U.S. central bank. The financial world is understandably nervous about the disruption of critical infrastructure. The Fed is investigating. U.S. equities reversed losses Wednesday as Fed Chair Jerome Powell reaffirmed his view that the banged up U.S. economy still needs support. During a second day of Congressional testimony, he insisted the labor market is still in trouble and signs of rising prices won’t necessarily lead to persistently high inflation. However, he deflected questions on two items near and dear to Wall Street: whether the Fed will drop restrictions on bank dividends and if it will keep giving lenders a break on capital demands due to Covid-19. Here’s your markets wrap. Don’t look now but GameStop shares more than doubled. The trigger may have been its chief financial officer getting pushed out in a disagreement over strategy. Perhaps investors took it as a sign the video-game retailer is on the comeback trail? Shares soared 104%.  Photographer: Bloomberg Photographer: Bloomberg Two more top U.S. Capitol security officials plan to blame faulty intelligence for their failure to anticipate the deadly assault by Trump followers on Congress Jan. 6. In testimony before the House Thursday, they are to say assessments from the Federal Bureau of Investigation and other Trump administration agencies were “muddled or contradictory.” Goldman Sachs Chief Executive Officer David Solomon has a message about remote work: “It’s an aberration that we are going to correct as quickly as possible.” Solomon has been one of the more vocal business leaders pushing to bring employees back to offices. New York commercial landlords meanwhile are trying a new tactic to bring workers back: creating full Covid-19 testing centers for their buildings.  David Solomon Photographer: Bloomberg Exchange-traded fund superstar Cathie Wood’s main ETFs whipsawed Wednesday as bond yields surged and data showed investors pulled a record amount of cash from the firm during this week’s tech selloff. What do you pack for a business trip? One former Glencore director said he carried a bag stuffed with 500,000 pounds to seal deals in London, just one lurid story from the commodity industry and its long history of corruption. Payments weren’t called bribery, he said: they were called a “commissions.” What you’ll need to know tomorrow

What you’ll want to read tonight in BusinessweekHow AstraZeneca’s Shot May Get Back on TrackTens of millions of people around the world are desperately trying to get their hands on a potentially lifesaving coronavirus vaccine. But in Europe, a group of Italian doctors are appealing to the country’s health ministry to avoid taking the Covid-19 shot offered them: the one made by AstraZeneca, which they believe is less effective. Now AstraZeneca is banking on new study data to get things back on track.  Photographer: Dhiraj Singh/Bloomberg Photographer: Dhiraj Singh/Bloomberg Like getting the Evening Briefing? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. The Bloomberg Crypto Summit: With Bitcoin burgeoning and markets jumping as vaccines signal the coming end to the pandemic, the future of digital assets is bright. Join us Feb. 25 as we analyze what it takes to push cryptocurrencies into the portfolios of the world’s largest investors. Sponsored by BitGo and Grayscale Investments. Register here. Download the Bloomberg app: It’s available for iOS and Android. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

| You received this message because you are subscribed to Bloomberg's Evening Briefing newsletter. |

| Unsubscribe | Bloomberg.com | Contact Us |

| Bloomberg L.P. 731 Lexington, New York, NY, 10022 |