June FOMC Meeting Minutes reaffirm Fedâs commitment to 2% inflation target

*The June Federal Open Market Committee (FOMC) meeting minutes framed the Fedâs decision to hike rates by 75bp in June as motivated by a sharp and broad-based increase in Mayâs Consumer Price Index and the risk that inflation expectations become unanchored. A key theme reiterated throughout the minutes was the need to return inflation to the Fedâs 2% objective to âcreate[e] conditions conducive to a sustainably strong labor market over time.â Indeed, the minutes suggested the Fed is willing to slow economic growth âfor a timeâ because âthe return of inflation to 2 percent [is] critical to achieving maximum employment on a sustained basis.â

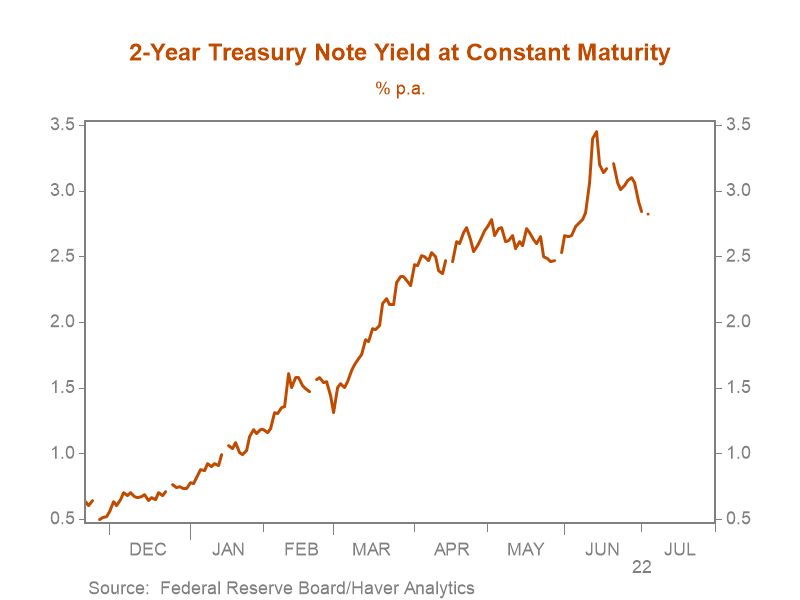

*The tone of the June minutes is largely consistent with the inflation-fighting resolve Fed Chair Powell emphasized in his semiannual testimony before Congress. We doubt the extent of the Fedâs âunconditionalâ commitment to return inflation to 2% in the near term (âFed Chair Powellâs testimony before Congress underscores the Fedâs inflation fighting resolve. Will it last?â). We continue to view the Fedâs economic projections as far too sanguine given the extent to which they forecast inflation will moderate, and consider the Fedâs forecast that the unemployment rate will rise to 4.1% by year-end 2024 as overly optimistic. Our expectation is that in the face of slowing economic growth and deteriorating labor market conditions, the Fed will likely pause its rate hikes and move to ease policy while referencing the need to remain balanced in pursuit of its dual mandate (âU.S. Tilting Toward Recessionâ). Market expectations of a policy pivot are reflected in the 60bp decline in two-year Treasury yields from their mid-June peak (Chart 1), with Fed funds futures markets now pricing in rate cuts as soon as mid-2023.

*The June minutes indicated Fed members are likely to consider a policy rate increase of either 50 or 75bp at the July meeting, although a raft of FOMC members in the weeks following the June meeting have publicly thrown their weight behind a 75bp rate hike. It is worth stressing that a number of those comments and the Fedâs deliberations at the June meeting occurred before data on personal consumption in May and revisions to Q1 GDP pointed to a weaker domestic demand backdrop than known at the time. The Fed is tilting toward, and we continue to expect, a 75bp rate hike in July. However, considering recent economic data, and an anticipated slowing in m/m headline inflation beginning in July, the Fed, as it did in June, could turn on a dime and opt for a more conservative 50bp hike by appealing to âdata dependency.â

*Inflation expectations likely played a decisive role in pushing the Fed toward a 75bp rate hike in June. According to the minutes âmany participants raised the concern that longer-run inflation expectations could be beginning to drift up to levels inconsistent with the 2 percent objective.â This marked a distinct departure from the May minutes, in which âsome participants emphasized that persistently high inflation heightened the risk that longer-term inflation expectations could become unanchored.â Importantly, the minutes suggest the Fed views the costs of returning inflation to the Fedâs 2% target once inflation expectations have unanchored as significant, and as such, justifies its current aggressive policy stance.

*The minutes reinforced comments from Fed Chair Powell that labor markets remain âextremely tightâ and suggest one factor underpinning the Fedâs desire to restrain aggregate demand is the need to reduce labor demand relative to supply and âaddress imbalances in the labor market.â Notably, the minutes suggest just âa number of participantsâ, rather than some or many, expect this moderation in labor demand to be achievable by primarily reducing job openings with a âless significant effect on the unemployment rate,â underlining the expectation among most Fed members that unemployment will need to rise as part of the Fed-induced rebalancing in labor markets.

*FOMC members continue to express uncertainty and concerns over the supply side of the economy, with the minutes indicating âparticipants saw little evidence to dateâ of meaningful supply chain improvements. Moreover, according to the minutes, âsome ... judged that the economic effects of these constraints were likely to persist longer than they had previously anticipated.â This assessment aligns with the minutesâ account of anecdotal evidence from Fed business contacts noting that âsupply constraints overall were significant and ... likely to persist for some time.â These supply-side considerations contributed to FOMC participantsâ assessment that inflation risks are skewed to the upside and given the Fedâs move away from a ânuancedâ interpretation of inflation, suggest further supply-side disruptions could be met by further rate hikes.

Chart 1. Two-Year Treasury Yields

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (âBerenberg Bankâ). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCMâs prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.