The Fed left the target range for the Fed funds rate unchanged at 0-0.25% and announced no new policy initiatives at the conclusion of its April 28-29 FOMC meeting given the extensive steps it has already taken to smooth financial market functioning and increase the flow of credit to households and businesses (see “Fed announces bold new initiatives” or Table 1). The Fed reiterated that it is committed to using “its full range of tools to support the U.S. economy in this challenging time.”

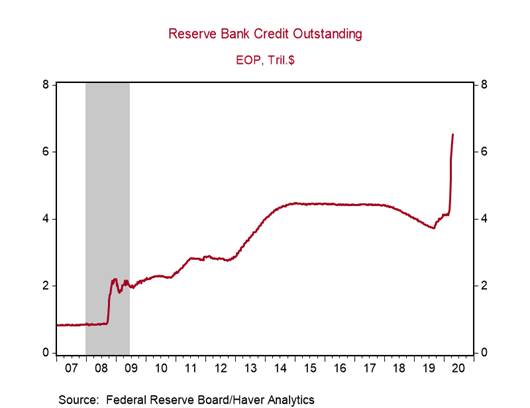

The surge in the Fed’s balance sheet to $6.5tn from $4.1tn pre-COVID crisis reflects the aggressive steps the Fed has taken to smooth financial market functioning. It currently primarily reflects the Fed’s open-ended purchases of U.S. Treasuries and mortgage-backed securities (Chart 1). The Fed has committed to continue with this QE, but it has significantly tapered its UST purchases to around $10bn per day currently from $75bn per day toward the end of March given the improvement in financial markets.

The Fed’s Main Street Lending Facility, Corporate Credit Facilities, Municipal Liquidity Facility, and the Term Asset-Backed Securities Loan Facility that will provide up to $2.3tn in loans to support the economy during this crisis have not yet been launched, but the announcements of these initiatives have been enough to improve sentiment in credit markets and other asset classes.

The CARES Act included an authorization of $454bn to the Treasury to support the Fed’s lending programs, so the Fed has room to either increase the scope of these lending facilities once they are operational or establish new facilities. The size of the Fed’s balance sheet could almost double from its current elevated level.

The Fed expects to maintain its policy rate at the effective lower bound (ELB) “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” We expect the policy rate to remain at the ELB for several years given that economic activity will struggle to return to its pre-crisis level until there is a vaccine for COVID-19 and with the unemployment rate likely to be more than double its pre-crisis level at the end of 2021. Thus far, the Fed seems very reluctant to use negative interest rates as a policy tool.

The Fed mentioned the downward pressures on inflation resulting from the current crisis several times throughout its Official Policy Statement. We expect a temporary bout of moderate deflation in the near term, reflecting the collapse in aggregate demand and oil prices despite the Fed’s aggressive increase in base money and the unprecedented spike in Federal deficit spending (Temporary moderate deflation despite aggressive monetary expansion, April 28, 2020). The Fed will continue to strive to achieve its 2% inflation goal.

Chart 1:

Sources: Federal Reserve Board and Berenberg Capital Markets

Roiana Reid, roiana.reid@berenberg-us.com