Fed will likely be forced to raise rates faster in 2022

*The Fed is farther behind the rise in inflation than at any time since the late 1970s, and combined with super-tight labor markets, it may be forced to raise rates faster than is currently anticipated in financial markets. We forecast six rate hikes in 2022 and four in 2023. But that would still leave the real Fed funds rate negative and may not be sufficient to lower inflation and interrupt the wage-price feedback loop.

*Inflation has accelerated far above the Fed’s forecasts and its comfort zone, and we forecast it will remain elevated. PCE inflation has risen to 5.8%, and 4.8% excluding food and energy. The Fed forecasts that it will fall to 2.6% and 2.7% on its core 2022Q4. That rosy outlook seems highly unlikely. We forecast that yr/yr inflation will rise further in coming months and recede in the second half of 2022, but remain elevated, near 4%. But this requires a substantial easing of supply constraints and bottlenecks.

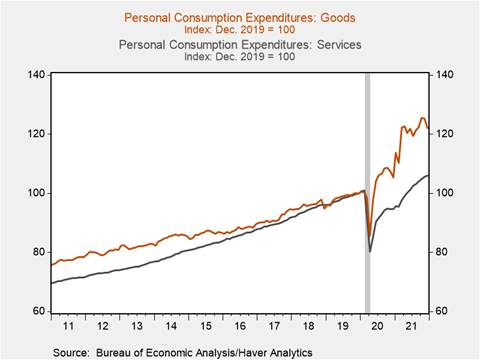

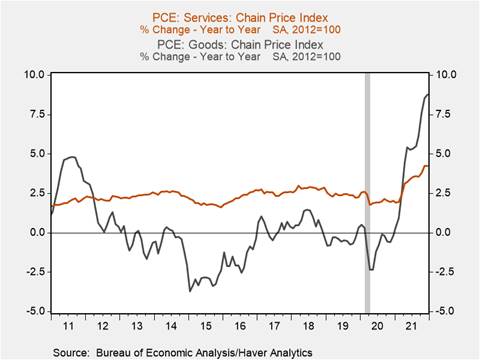

*Inflation has been driven by strong demand, reflecting pent-up consumer demand and very aggressive fiscal and monetary stimulus, and supply shortages (“Strong U.S. growth, inflation, and the Fed’s challenges”, January 28, 2021). The robust growth in goods demand has driven up goods inflation to 8.75% yr/yr while inflation of services has picked up to 4.25%, as the recovery of services sectors have lagged, and the costs of shelter in the inflation measures has also lagged (Charts 1 and 2). Even as services inflation has lagged, inflation has accelerated across a broad array of goods and services (“Inflation Watch Update”, December 10, 2021).

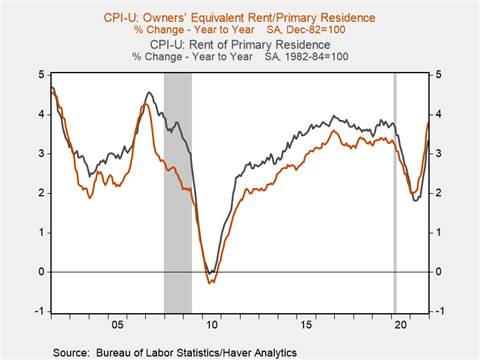

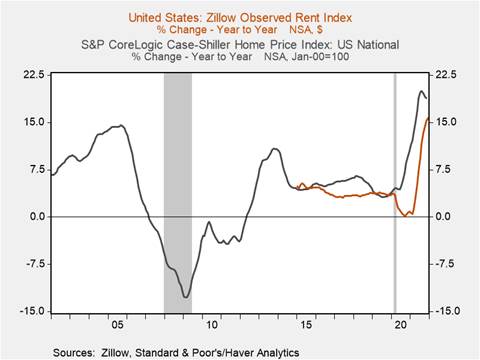

*Our forecast of persistently high inflation involves an acceleration of services inflation and disinflation or even moderate deflation in goods. We forecast shelter costs, the biggest component in inflation, to accelerate to 5.5% and remain elevated through year-end 2023 based on historical lags between home prices and owner-occupied equivalent rent (OER) and rental costs, while other inflation in other services will also accelerate (Charts 3 and 4, “OER, Services Prices and Inflation”, January 18, 2022).

*The services sectors, including leisure and hospitality, transportation and warehousing, personal and business services, and education and health services, have been slow to recover from the pandemic, but they should catch up as the constraining impacts of the pandemic fade. These services sectors tend to be labor intensive. Service providers will face higher wages and operating costs. Healthy demand for services will give them flexibility to raise product prices. With inflation of services, which comprise over two-thirds of the PCE price index, remaining around 5.5%, significant deflation in goods would be necessary to lower inflation to 3%. Even if supply shortages dissipate, that seems to be a stretch.

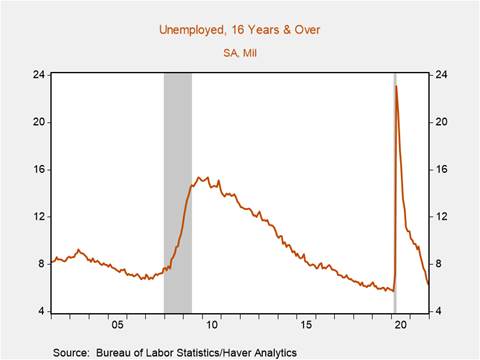

*The Fed has virtually achieved its mandate of maximum inclusive employment, and labor markets are tight and will likely remain tight. Establishment payrolls have regained 84% of their March-April 2020 decline. In the Household Survey, the unemployment rate has fallen to 3.9%, below the Fed’s estimates of the longer-run natural rate, so-called full employment, as the total number of unemployed has fallen to 6.3 million, very close to its pre-pandemic low. Inclusive measures of labor market conditions, including U-6, a broad measure of underemployment and marginally attached workers, has declined to 7.3%, just above its pre-pandemic low (Labor markets update: strong demand + supply shortages + catch up to inflation = accelerating wages, November 18, 2021).

The labor force participation rate stands out as the only variable that has not bounced back: it has recovered only 53% of its pandemic decline. An outsized share of this shortfall has been among people over 55 years old, and several studies indicate this is due to accelerated retirements. If so, this implies even tighter labor markets.

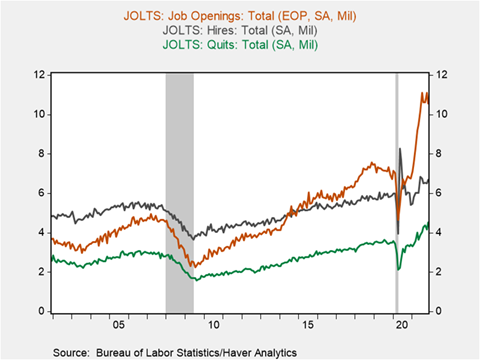

The BLS JOLTS data highlights the large gap between strong labor demand and constrained supply, and the extremely dynamic labor markets and high quit rates that have increased the difficulties businesses have in retaining workers. Through November, there were 10.5 million job openings, 6.7 million new hires, and 4.5 million workers quitting Charts (5 and 6). Strikingly, job openings exceed the total number of unemployed. We forecast that the unemployment rate will fall to 3.3% by year-end 2022.

*Wages have accelerated and will likely rise further, associated with tight labor markets and as wages catch up to inflation and the rise in inflationary expectations. Workers have the upper hand. Amid rising productivity, wages are expected to catch up to recent inflation and wage negotiations are embodying higher inflationary expectations. This feedback loop between wages and inflation will continue as long as aggregate demand remains excessive.

*By any measure, the Fed must raise rates significantly to get monetary policy back toward neutral. The real Fed funds rate is deeply negative. The Fed must close that gap. The gap between the Fed funds rate and what a Taylor Rule would suggest is necessary to reduce inflation back to the Fed’s 2% target is even larger. The difficult challenge will be to raise rates sufficiently to slow demand sufficiently to interrupt the wage-inflation feedback loop and dampen inflationary expectations, but not too much and generate recession. And it must accomplish this task in a polarized Washington political environment and knowing that raising rates will force an adjustment of valuations in financial markets.

*We have been emphasizing the distinction between what the Fed ought to do and what it is likely to do. Now that the Fed has waited far too long to begin tapering its asset purchases and raising rates, the Fed ought to raise rates aggressively to close the gap between the Fed funds rate and inflation. Even if the Fed assumes inflation will fall to 3%-3.5% as supply bottlenecks dissipate, that would require raising rates quickly to that range. The Fed should also be fairly aggressive in not reinvesting all of its maturing assets and allowing runoff in its balance sheet. Moving more slowly would not slow aggregate demand and may fuel ongoing inflationary expectations.

Note that our aggressiveness on what the Fed ought to do is based on our long-standing assessment that inflation would rise, driven by old-fashioned excess monetary and fiscal stimulus. There are only two levers to reduce inflation: increased supply or slower demand. With monetary policy still aggressively stimulative, the Fed must do its part to slow demand.

The Fed is likely to move more slowly than it ought to. Based on its experiences and economic performance during the past decade, the Fed has reinterpreted “gradual” to mean much slower rate increases than before the financial crisis, when a rate increase at every meeting was considered gradual and the Fed occasionally raised rates in between meetings. The members of the FOMC have a distinct dovish tilt and this will be accentuated when President Biden’s three nominees become Governors. As the Fed raises rates, it will likely face cross currents from the White House and Congress (history suggests that that would be nothing new). Also, the Fed is cognizant of its impacts on financial markets. And the Fed definitely wants to avoid a monetary tightening that would generate recession.

We forecast the Fed to begin raising rates somewhat more aggressively than is currently expected. The Fed’s funds futures markets will continue to build in faster rate increases, giving the Fed the perception that it can raise rates without surprising markets. This may be faster than the “new gradualists” perceive, but it would be slower than the gradual rate increases that occurred prior to the financial crisis. As Fed Chair Powell stated in his press conference following this week’s FOMC meeting:

"We know that the economy is in a very different place than it was when we began raising rates in 2015. Specifically, the economy is now much stronger. The labor market is far stronger. Inflation is running well above our 2 percent target, much higher than it was at that time…we're well aware that this is a different economy than existed during the last tightening cycle, and our policy is going to reflect those differences.”

We note that even if the Fed raises rates six times this year to 1.5%-1.75% by year-end and four more times in 2023 to 2.5%-2.75%, this would still leave real rates negative.

Chart 1.

Chart 2.

Chart 3.

Chart 4.

Chart 5.

Chart 6.

Mickey Levy, mickey.levy@berenberg-us.com

Mahmoud Abu Ghzalah, mahmoud.abughzalah@berenberg-us.com

© 2022 Berenberg Capital Markets, LLC, Member FINRA and SPIC

Remarks regarding foreign investors. The preparation of this document is subject to regulation by US law. The distribution of this document in other jurisdictions may be restricted by law, and persons, into whose possession this document comes, should inform themselves about, and observe, any such restrictions. United Kingdom This document is meant exclusively for institutional investors and market professionals, but not for private customers. It is not for distribution to or the use of private investors or private customers. Copyright BCM is a wholly owned subsidiary of Joh. Berenberg, Gossler & Co. KG (“Berenberg Bank”). BCM reserves all the rights in this document. No part of the document or its content may be rewritten, copied, photocopied or duplicated in any form by any means or redistributed without the BCM’s prior written consent. Berenberg Bank may distribute this commentary on a third party basis to its customers.