|

|

AI mania received a boost when Nvidia investors received better than anticipated earnings news this week, driving the S&P 500 higher this week. Sure, Nvidia is a real company and when you look at how rapidly its earnings are accelerating, it’s hard not to get excited about the stocks. On Friday, the company reported revenue for the fourth quarter ended January 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago.

For the quarter, GAAP earnings per diluted share was $4.93, up 33% from the previous quarter and up 765% from a year ago. Non-GAAP earnings per diluted share was $5.16, up 28% from the previous quarter and up 486% from a year ago.

For fiscal 2024, revenue was up 126% to $60.9 billion. GAAP earnings per diluted share was $11.93, up 586% from a year ago. Non-GAAP earnings per diluted share was $12.96, up 288% from a year ago.

But at some point, the estimates can’t keep rising indefinitely. Shares already trade at a PE approaching nearly 96X trailing-year earnings. While Nvidia represents a leader in AI-related semiconductors, it’s not the only player in town. And according to analyst Josh Enomoto, Nvidia is actually losing GPU market share to Intel and AMD.

All I can say is that, from experience, the rapidity with which Nvidia’s earnings and share price has been rising is bound to level off at some point even assuming we avoid higher inflation and higher interest rates, both of which I doubt.

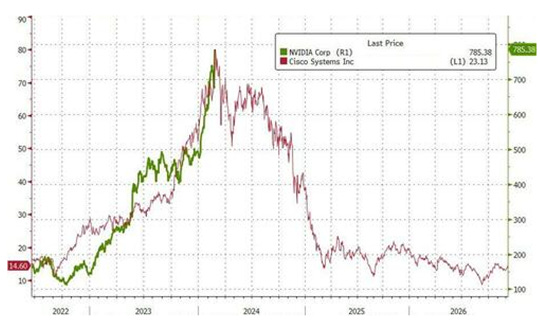

I think the chart above that shows the trajectory of Cisco Systems (red), a tech mania stock at the turn of the century with the share price trajectory of Nvidia is interesting. The point is that when markets rise exponentially, that will end one day. And smart money has already chosen to lighten up on tech stocks at current nosebleed levels and buy undervalued commodity stocks, as famed market analyst Fred Hickey pointed out in the following tweet this past week.

Last week we told you about Druckenmiller selling tech shares including Nvidia and buying gold and gold shares. Now Paul Singer’s Elliott fund is buying across all assets, including base metals and precious metals in addition to commodities in demand for electric vehicles.

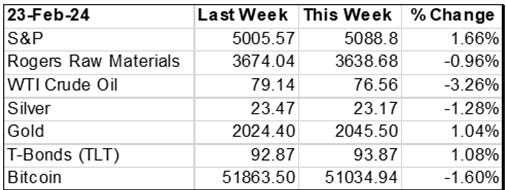

Looking at my Key Market Metrics table shown above, it doesn’t look very bullish to me. Oil and commodities in general were down, including silver which is more of an industrial metal than a monetary metal. And both major safe havens, gold and U.S. Treasuries, were up this week, suggesting not everyone is looking so positively at AI mania momentum although I should point out that an article on Zero Hedge this week noted that hedge funds have never been longer momentum and Magnificent 7. So, Druckenmiller and Singer may be among the first to exit the mania markets. Assuming others join, readers of this letter should be looking forward to happier days ahead at least so far as their portfolios go. By the way, let me suggest you watch Crescat Gets Active video this week. Quinton Hennigh named several gold exploration companies covered in this letter that are prime takeover targets by companies like Barrick and Newmont.

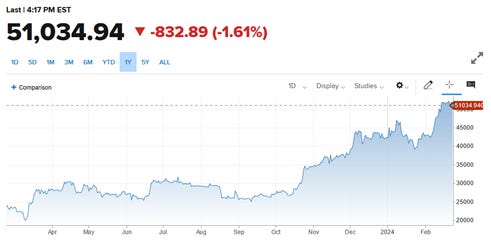

Of course, not only Nvidia, but Bitcoin has also been on a tear. It has more than doubled in the past year. It rose 10.68% during the week ending 2/10 and another 8.95% during the week ending 2/17, but this week it fell back 1.60%.

Jim Bianco had some very interesting insights into the Bitcoin market and voiced regrets that ETFs were created because they have set up a potential paper scam similar to what takes place in the gold markets—where paper contracts far exceed physical gold behind them. Investors believe they own gold, but with no physical gold behind the contact all they have is a paper asset. Bitcoin actually has no intrinsic value, but it does provide a means of attaining commercial privacy. As with gold, in which bullion banks can within a wide range control the price of gold, major players will be able to do more or less the same thing with paper Bitcoin. Jim pointed out several funds in which investors actually buy to hold for the long term like VOO and Vanguard S&P 500, have seen large net inflows (Blue line). Other funds like SPY and SPDR S&P 500 (Yellow line) are merely trading vehicles that are little more than casino chips. Jim thinks the Bitcoin ETFs have boosted the price of Bitcoin in the short term but in the long term their creation will hurt its price as people get burned and regulators set in to remove one of the important attributes of Bitcoin, namely privacy.

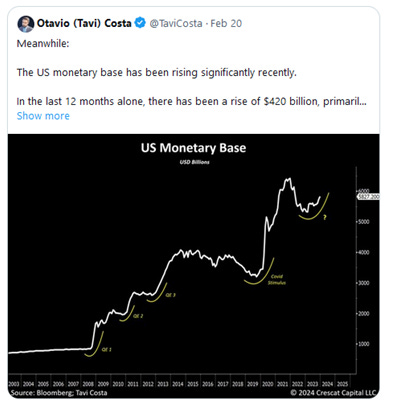

Regarding the bigger market picture, last week Tavi Costa posted the tweet shown above. Its a thousand-word picture explaining why equity markets seem to have defied gravity. It’s pretty simple. The Fed is increasing the monetary base, as it must, to keeping the economy from falling to a slower speed that would trigger a financial collapse.

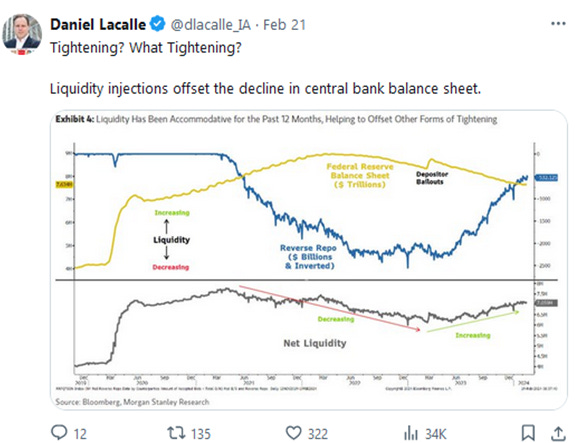

And Daniel Lacalle tweeted the above chart out that adds more information about how the economy has continued to peform better than expected despite the Fed shrinking its balance sheet. Reverse Repos baslically off set declining liquidy by the fed selling securities.

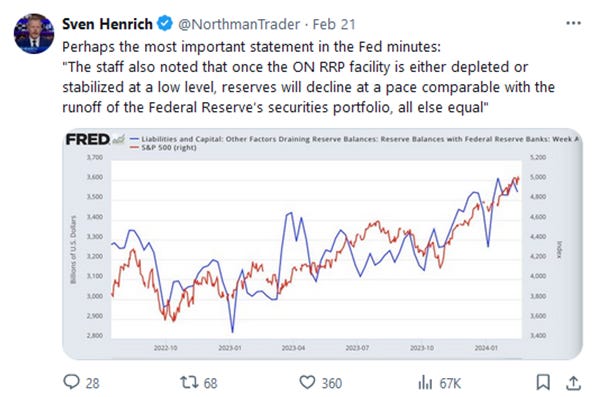

But Sven Henrich highlighted a very important sentence in the latest Fed minutes, namely that once the reverse repo facility (RRP) is either depleted or stabilized at a low level, reserves will decline at a pace comparable with the runoff of the Fed’s security portfolio. In other words, when the RRP runs out in this election year, look for all manner of creative money printing to occur as part of the Biden reelection propaganda operation.

As Alasdair Macleod observed in his article titled “Keynesian credit creation meets its Armageddon,” the inevitable outcome is the demolition of the dollar and other attached fiat currencies. Bottom Line: That’s why owning gold as a portfolio foundation is imperative.

You're currently a free subscriber to J Taylor's Gold Energy & Tech Stocks. For the full experience, upgrade your subscription.