|

Today’s letter is brought to you by Sidebar!

Ready to accelerate your career? As we all know, navigating a big career transition is hard to do. It’s one thing to set a lofty goal, and it’s another thing to have the support system for yourself to follow through.

Sidebar is a private, highly vetted leadership program for those who want to do more, do it better, and do it faster.

Sidebar’s approach to helping members level up their careers is focused around small peer groups, a tech-enabled platform, and an expert-led curriculum. Members say it’s like having their own Personal Board of Directors.

93% of members say that Sidebar has made a significant difference in their career trajectory.

"Providing and receiving support from others who play a similar role to you is one of the best ways to grow your capabilities and succeed." - Vice President, Roku

“The facilitation has been great. I love the timer bar, the way the conversation is structured, the commitment and accountability.” - Vice President, Clip

“I've been impressed by Sidebar’s technology platform. The real time agenda tracker at the top of our weekly meetings really helps the group stay on track.” - Senior Director, Microsoft

Nothing will get you further in your career than learning from your peers - it’s a true competitive advantage. Join the growing waitlist of top senior leaders, and apply to become a founding member.

To investors,

Fidelity manages over $11 trillion in assets. They are one of the titans of the traditional financial system. When their team shares an opinion publicly, people around the world pay attention.

This is why it is so interesting to take a look at recent comments by Jurrien Timmer, Director of Global Macro at Fidelity, who has been tracking bitcoin’s rise over the last 3-4 years and periodically updates his perspective.

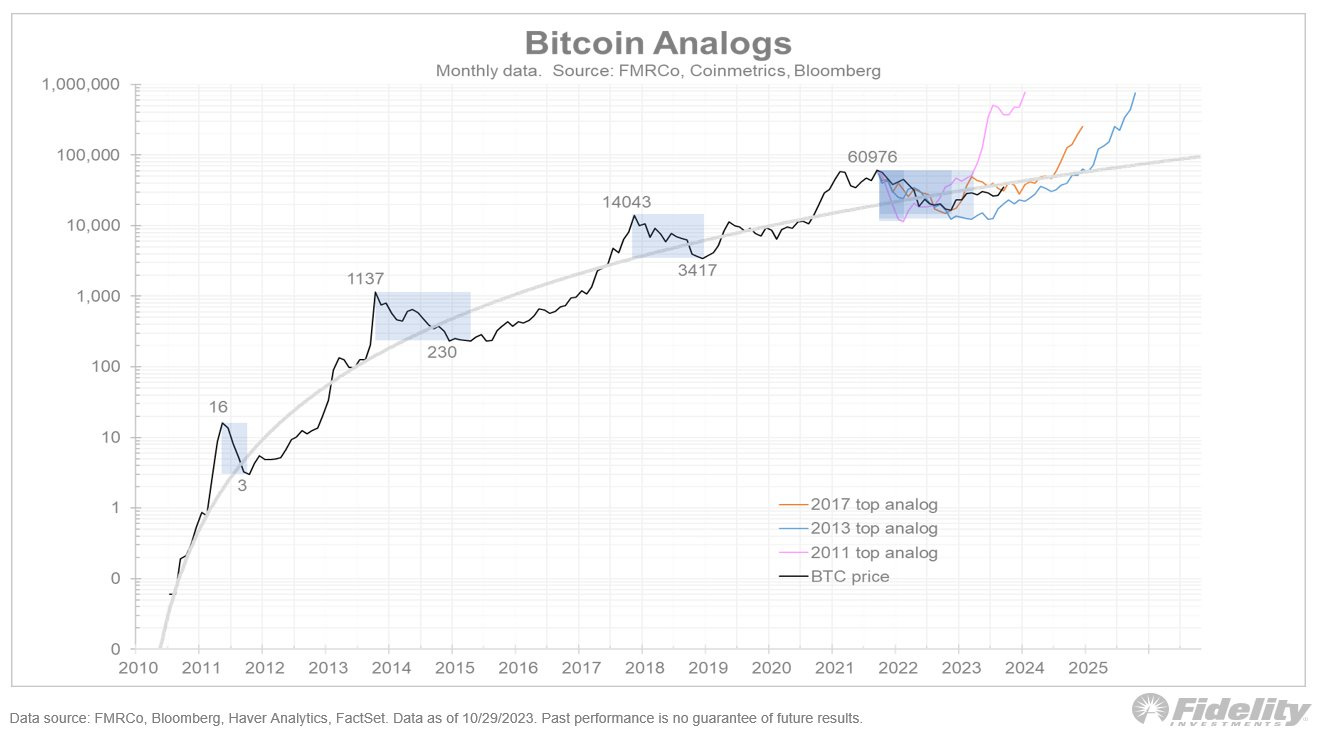

Timmer tweeted that bitcoin’s current price rise is in-line with past bull markets, which is objectively true. But that is not the interesting part of his analysis.

He followed this chart with the following paragraph:

“In my view, Bitcoin is a commodity currency that aspires to be a store of value and a hedge against monetary debasement. I think of it as exponential gold.”

This is the first time that I have heard someone use the phrase “exponential gold.” It is a perfect way to describe bitcoin though. The digital currency embodies the sound money principles of gold (outside the system and can not be debased), while benefiting from the asymmetry of new technology adoption.

Downside protection of gold, upside of tech stocks—exponential gold. Truly an unique asset.

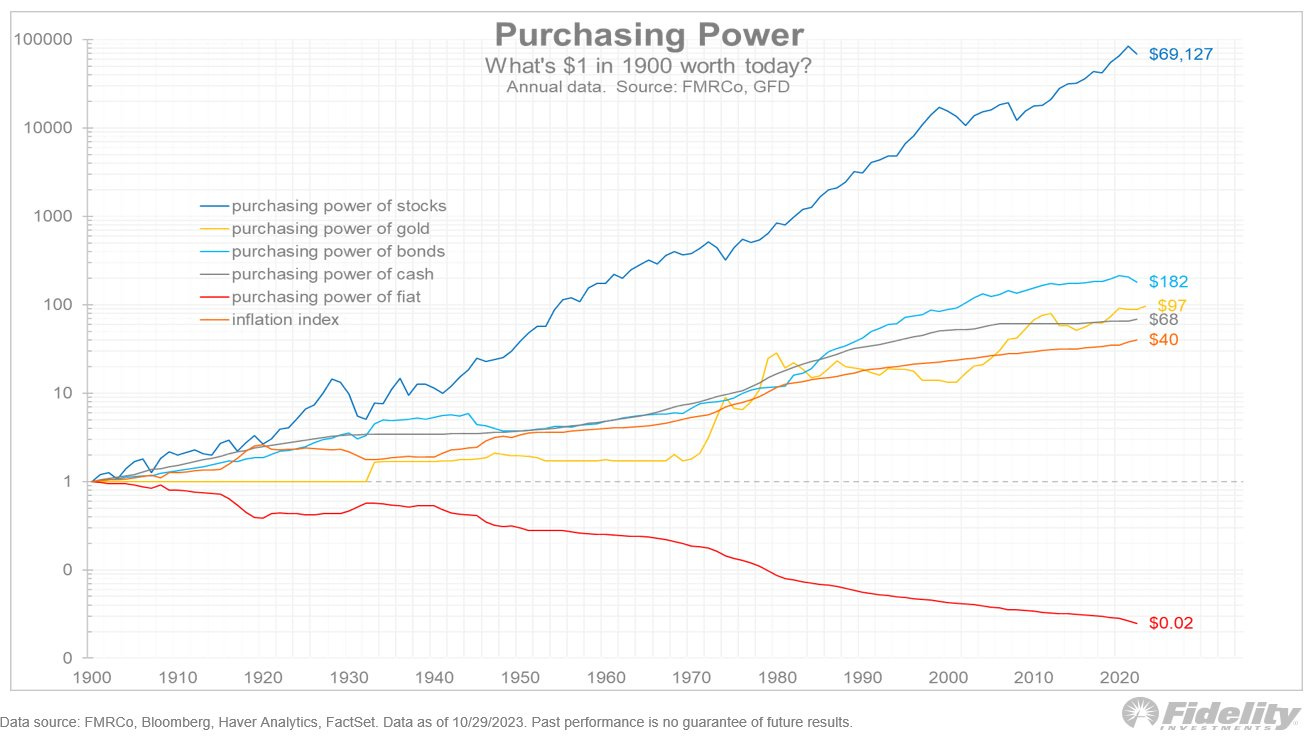

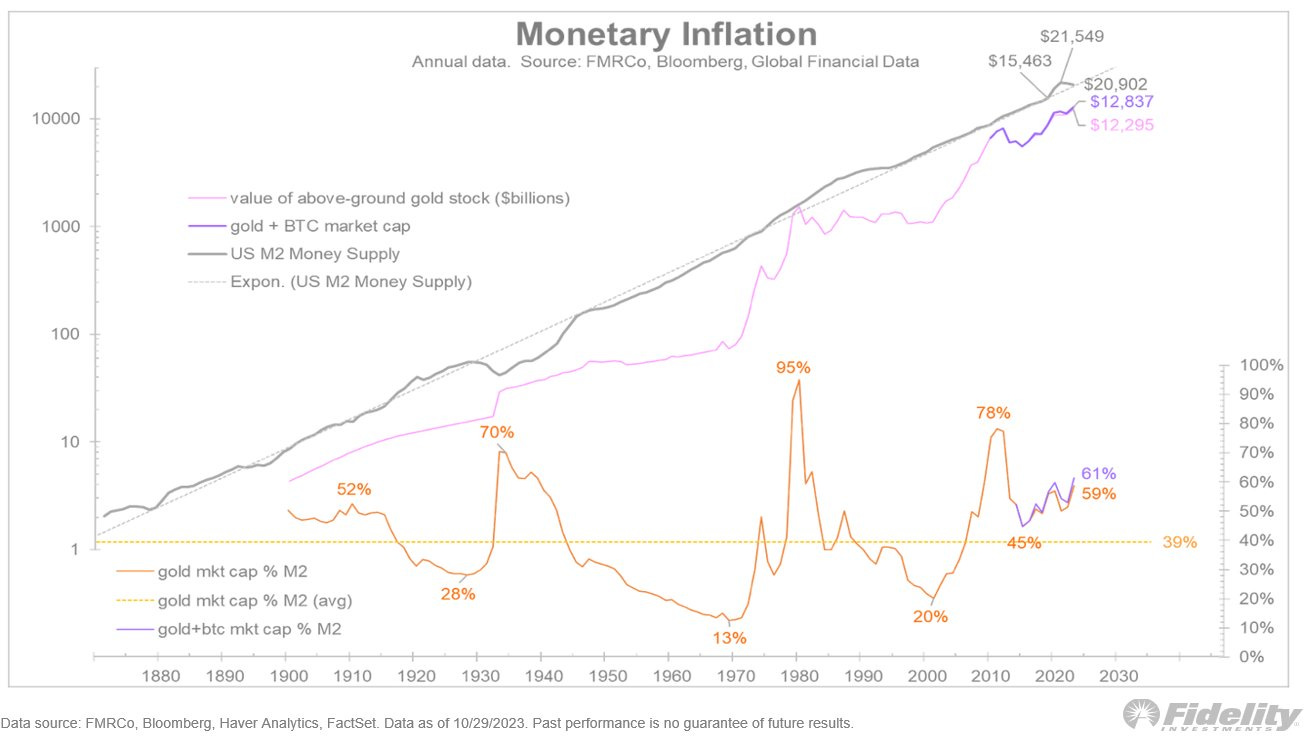

Timmer followed this comment with two more charts. The first shows purchasing power trends for various assets from 1900 till today. He writes “gold is money of course, but it’s too deflationary and clunky to be used as a medium of exchange. Hence, investors own it primarily as a store of value – and one of the many reasons Bitcoin is often compared to gold.”

Then Timmer explains in the past “during structural regimes in which inflation runs hot, real rates are negative, and/or money supply growth is excessive, gold tends to shine and gain market share relative to GDP. Notable examples: the 1970s and 2000s.”

Gold has done a fantastic job of preserving purchasing power over the years. I don’t know many young people who are interested in holding the precious metal though. They look at it as an asset with no upside return, regardless of whether that is right or wrong.

If bitcoin can leverage the sound money principles to benefit from these periods of high-inflation and/or undisciplined monetary policy, just as gold has done for decades, then it would make sense that young people will continue to allocate capital to the digital version.

As Balaji Srinivasan once said, by 2040 everyone under the age of 30 will have grown up in a world where bitcoin existed. They will see no difference in the “newness” of bitcoin vs gold. Both assets will have been around forever in their eyes.

So now that Fidelity is publicly calling bitcoin “exponential gold,” we have to assume that Wall Street is waking up to this same idea. If you wanted to design an asset from scratch to benefit in a long-term loose monetary policy regime, it would be the downside protection of gold and the upside opportunity of tech stocks.

More and more it appears this is a good description of bitcoin. Exponential gold.

Let’s see if this phrase catches on.

-Anthony Pompliano

If you enjoyed this letter, you should consider subscribing to the Pomp Letter. I write 3-5x per week and explain in simple language what is happening in the economy, financial markets, and bitcoin.

Praying for Exits is a pseudonymous account that is run by one of the most interesting early stage investors in venture capital.

In this conversation, we talk about aerospace, artificial intelligence, defense technology, current state of venture capital, media, and why being pseudonymous is so advantageous for this specific investor.

Listen on iTunes: Click here

Listen on Spotify: Click here

Earn Bitcoin by listening on Fountain: Click here

Pseudonymous investor talks Space, AI, and Defense Tech

Podcast Sponsors

Trust & Will - Estate planning made easy. They are fast, secure, and simple to use. Get your will or trust created today.

Auradine - A new bitcoin miner powered by the world’s first 4 nanometer silicon chip technology.

Base: Base is shaping the future of the on-chain world with near-zero gas fees and rapid transaction speeds.

ResiClub: Your data-driven gateway to the US housing market.

Bay Area Times: A visual newsletter explaining the latest tech & business news.

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research.

You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription.